- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU): Assessing Valuation After a Period of Steady Share Price Performance

Reviewed by Kshitija Bhandaru

Schneider Electric (ENXTPA:SU) shares have shifted only slightly in recent trading, and investors are watching for signals after a relatively calm period. The company’s solid performance lately provides some context for its current valuation.

See our latest analysis for Schneider Electric.

While the share price has held steady lately, Schneider Electric’s one-year total shareholder return sits at a modest 8.3% and its five-year return is well over 150%. This suggests that momentum has cooled somewhat after a strong multi-year run, with investors watching closely for signs of the next phase.

If you’re looking to expand your horizons beyond industrial names like Schneider, now is a great time to discover fast growing stocks with high insider ownership

But after sustained gains and steady fundamentals, is Schneider Electric trading below its true value? Or has the market already accounted for future growth in its current price, leaving little room for upside?

Most Popular Narrative: 3% Undervalued

With Schneider Electric’s estimated fair value at €257.55 and shares closing at €249.70, the narrative suggests a modest upside that has investors weighing just how much growth is already anticipated in the stock price.

The company's transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double-digit rates, is expected to drive higher margins and recurring earnings. There is further upside potential as AVEVA's SaaS conversion completes by 2027.

Want to know what’s powering this outlook? The most influential narrative hinges on ambitious growth from digital services, expanding revenue streams, and plump margins. What crucial forecasts set this price target above the current share price? Click through for the detailed assumptions and expectations that drive this valuation.

Result: Fair Value of €257.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures and persistent weakness in Industrial Automation could still challenge Schneider Electric’s positive growth outlook in the near term.

Find out about the key risks to this Schneider Electric narrative.

Another View: What Do the Multiples Suggest?

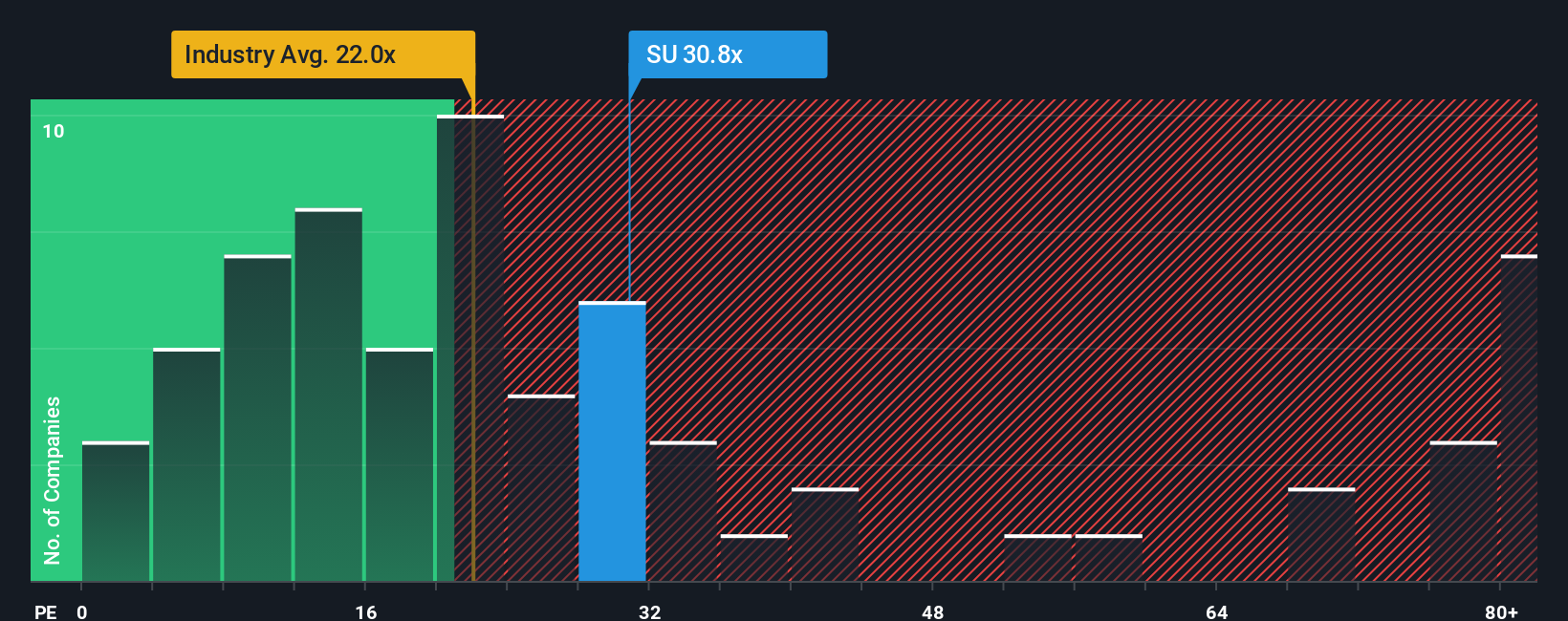

Looking at valuation from a different angle, Schneider Electric’s current price-to-earnings ratio stands at 32.7x, which is higher than both the European Electrical sector average of 23.5x and the peer group average of 26.2x. While this premium hints at strong growth expectations, it also introduces valuation risk if those expectations are not met. Interestingly, the fair ratio for Schneider Electric is estimated at 35.1x, indicating the market could move even higher. The question remains: will it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider Electric Narrative

If you find yourself seeking a different perspective, or simply want to dive into the numbers personally, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the edge comes from spotting fresh opportunities before the crowd. Skip the waiting game and take charge. These lists spotlight stocks primed for today’s market and tomorrow’s breakthroughs.

- Tap into market momentum with these 903 undervalued stocks based on cash flows that are trading below their estimated value, offering room for growth if trends shift upward.

- Capitalize on innovation by checking out these 24 AI penny stocks, where companies are pushing boundaries in automation, data intelligence, and next-gen computing.

- Boost your income stream by browsing these 19 dividend stocks with yields > 3% known for solid financials and consistently attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives