- France

- /

- Electrical

- /

- ENXTPA:SU

Is Schneider Electric Fairly Priced After AI-Focused Siemens Partnership Shakes Up Sector?

Reviewed by Simply Wall St

Thinking about what to do with your Schneider Electric stock? You are definitely not alone. With the shares closing at 230.55 and racking up a 0.7% gain over the last week and 7.0% in the past month, there is plenty of action to keep investors talking. Despite these recent upticks, the stock is still down 4.6% year-to-date and 2.2% over the past year, making it a bit of a mixed bag for those tracking shorter-term results. However, if you zoom out to the bigger picture, Schneider Electric’s performance stands out. The company has delivered a 114.8% return over three years and 132.8% over five years, rewarding patient shareholders handsomely.

Some of the story behind these price moves ties back to broader market developments. Investors have become increasingly focused on automation and energy management solutions, sectors where Schneider Electric is an established leader. This renewed interest may have played a role in recent momentum, but changing risk perceptions and macroeconomic shifts are also in play.

So, what about valuation? If you are wondering whether the recent performance means Schneider Electric is a bargain or overhyped, the company’s value score is just 1 out of 6, suggesting it is only considered undervalued by one major method. In the next sections, we will break down exactly how that valuation is assessed across different approaches and explain why the numbers alone might not tell the full story. There is also an intriguing angle on valuation you will not want to miss before making your next move.

Schneider Electric scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Schneider Electric Discounted Cash Flow (DCF) Analysis

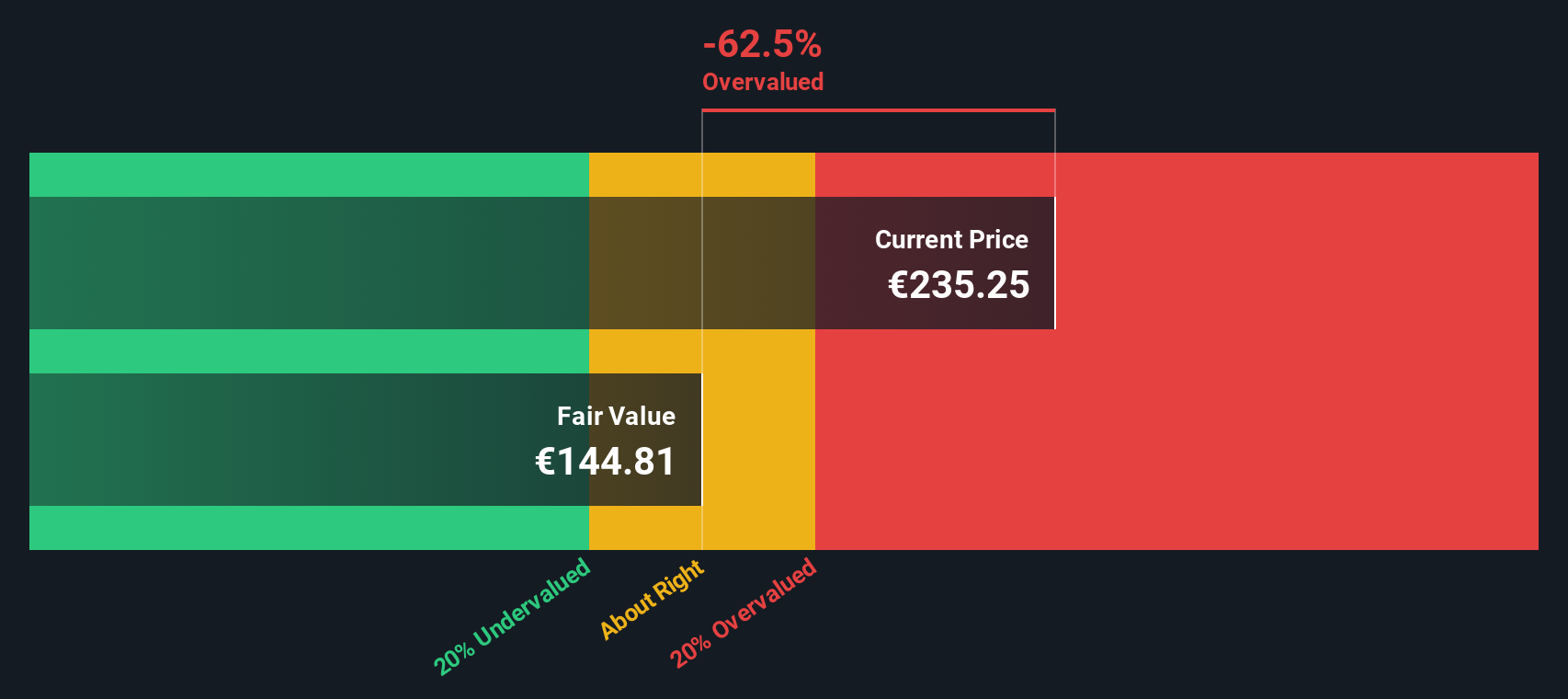

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future free cash flows and discounting them back to today’s terms. This approach tries to answer the basic question: what are all of Schneider Electric’s expected future cash flows actually worth right now?

Schneider Electric’s latest reported Free Cash Flow stands at approximately €3.79 billion. Analysts forecast a steady increase, expecting cash flow to reach about €5.73 billion by 2029. Beyond analyst estimates, Simply Wall St extrapolates further, projecting Free Cash Flow to rise to over €6.3 billion by 2035. All these figures reflect the company’s potential to grow its cash-generating ability over time, though it is important to note that projections become less certain the further out they extend.

When these cash flows are discounted back to their present value, the DCF model calculates Schneider Electric’s intrinsic value at €143.01 per share. With shares currently trading at €230.55, the model implies the stock is around 61% overvalued according to this method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Schneider Electric.

Approach 2: Schneider Electric Price vs Earnings

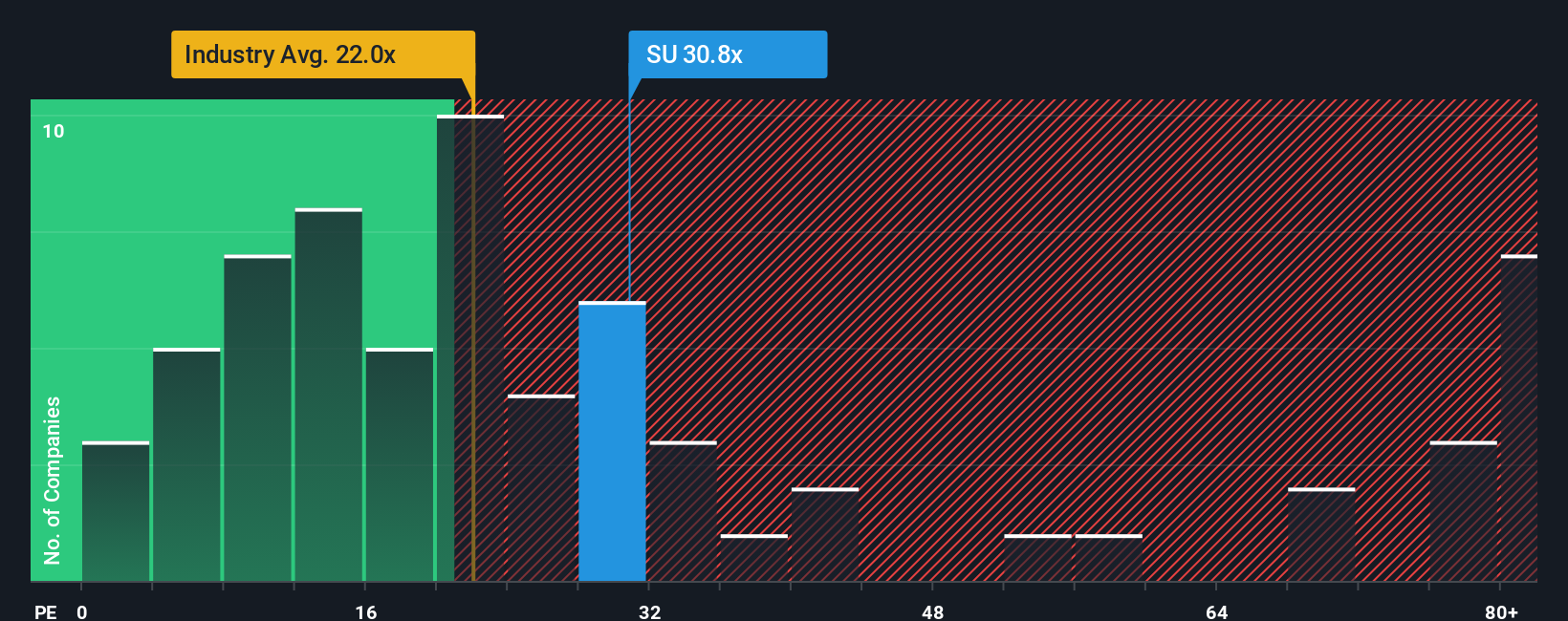

The Price-to-Earnings (PE) ratio is the most popular metric for valuing profitable companies because it connects a company’s share price with its earnings, reflecting what investors are willing to pay for each euro of profit. For established businesses like Schneider Electric, which consistently generate positive earnings, the PE ratio offers a clear and direct way to gauge how the market views its profitability and prospects.

The “right” PE ratio for any company depends on expectations for future earnings growth and perceived risk. Fast-growing or lower-risk businesses typically command higher PE multiples, while companies with uncertain outlooks or lower growth rates usually see lower ratios. Investors compare a company’s PE with industry averages and similar peers, but these numbers do not always account for unique characteristics that can set a company apart.

Schneider Electric currently trades at a PE ratio of 30.2x, slightly below the Electrical industry average of 31.3x but higher than the average of its direct peers, which stands at 25.5x. Simply Wall St provides a “Fair Ratio” calculation based on an in-depth model that factors in growth forecasts, profitability, industry trends, risk, and the company’s market capitalization. For Schneider Electric, the Fair PE Ratio is estimated at 31.0x. This means the stock’s valuation lines up almost exactly with what would be expected given its fundamentals, making it neither notably expensive nor cheap at today’s price.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Schneider Electric Narrative

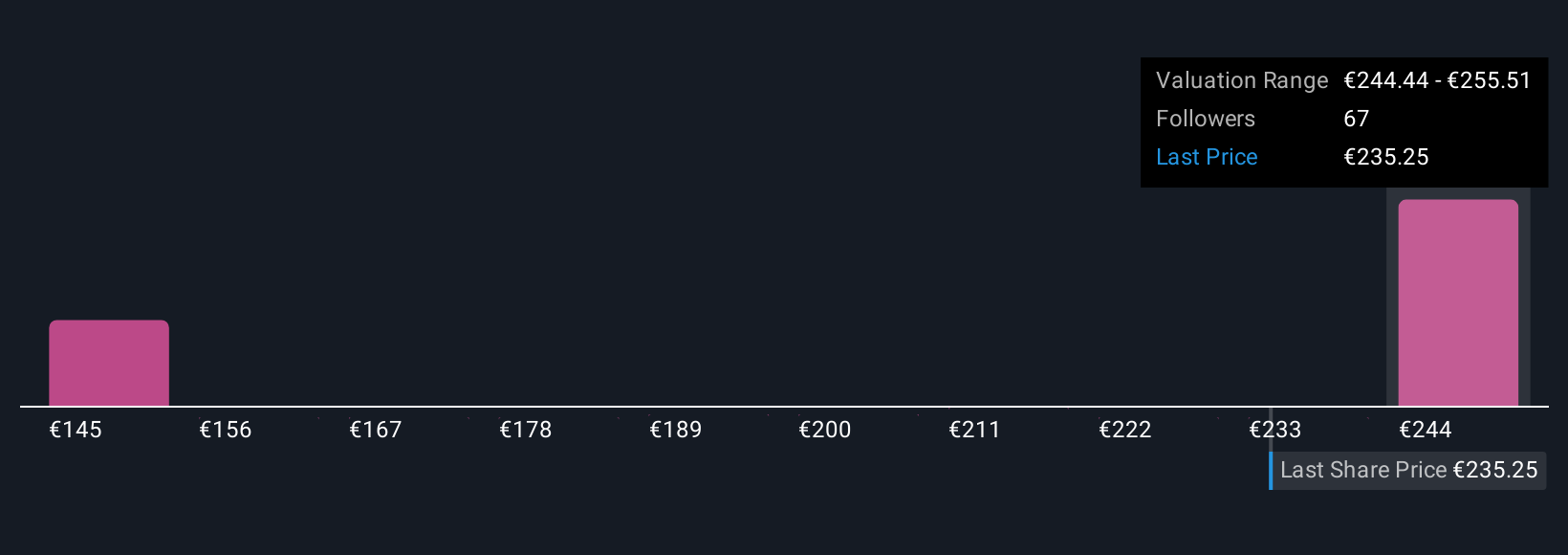

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is essentially your story, your unique perspective on a company’s future, that connects what you believe about a business with your financial forecasts (like future revenue, earnings, and margins) and ultimately, your own estimate of fair value. Rather than relying solely on raw numbers, Narratives help you interpret the data in a way that reflects your own research, expectations, and risk tolerance.

On Simply Wall St’s Community page, where millions of investors share their views, Narratives become a practical and intuitive tool that brings together a company’s big-picture story with its numbers. Narratives help you decide whether to buy, hold, or sell by comparing your Fair Value to the current Price. They are updated automatically whenever new news or earnings arrive, so your view evolves in real time.

For Schneider Electric, for example, one investor’s Narrative might highlight powerful long-term growth opportunities from AI and electrification (resulting in a fair value of €289), while another may focus more on near-term risks like regional weakness or margin pressures (implying a fair value closer to €220). Narratives let you see all these possible outlooks in one place and even create your own, so you can make investment decisions aligned with your own story and insights.

Do you think there's more to the story for Schneider Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives