Compagnie de Saint-Gobain S.A. (EPA:SGO) Not Flying Under The Radar

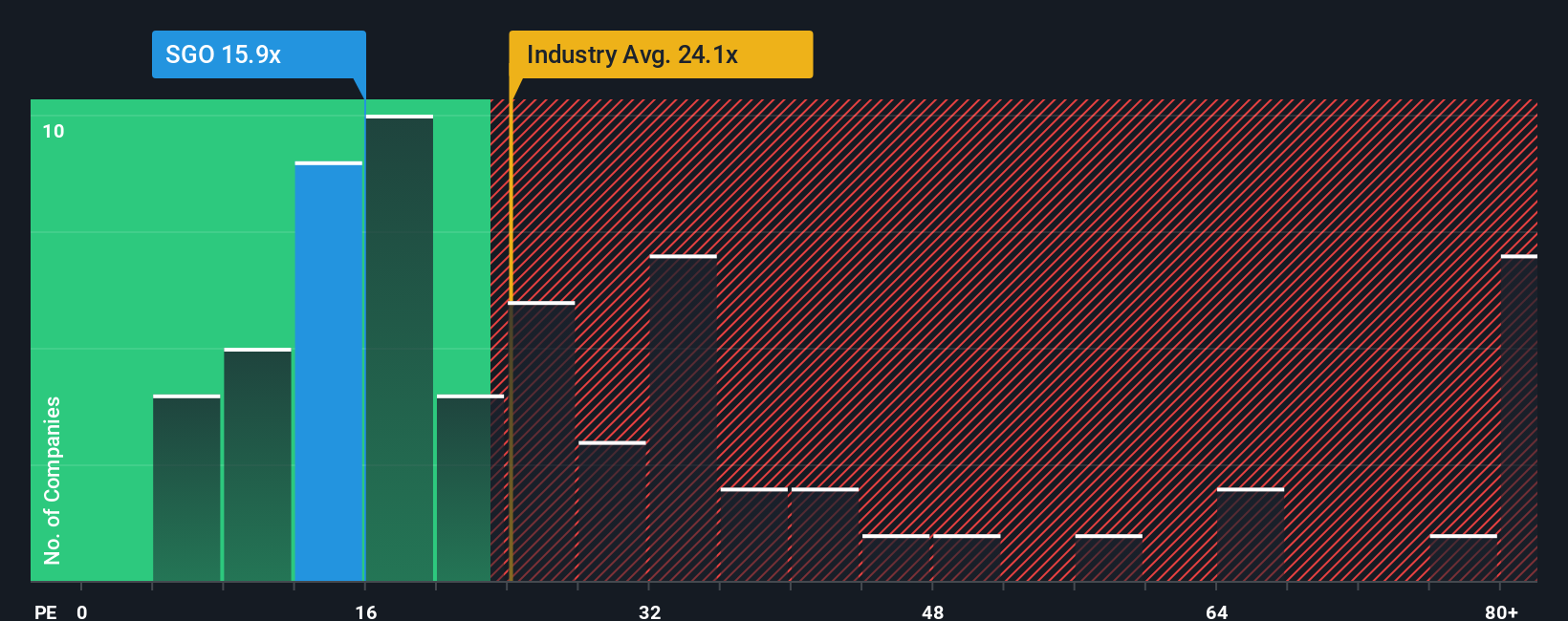

It's not a stretch to say that Compagnie de Saint-Gobain S.A.'s (EPA:SGO) price-to-earnings (or "P/E") ratio of 15.9x right now seems quite "middle-of-the-road" compared to the market in France, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Compagnie de Saint-Gobain's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Compagnie de Saint-Gobain

How Is Compagnie de Saint-Gobain's Growth Trending?

Compagnie de Saint-Gobain's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 12% per annum over the next three years. With the market predicted to deliver 13% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Compagnie de Saint-Gobain's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Compagnie de Saint-Gobain's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Compagnie de Saint-Gobain.

If you're unsure about the strength of Compagnie de Saint-Gobain's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives