Euronext Paris: 3 Stocks Trading At Up To 41.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the French stock market shows resilience amid global economic fluctuations, evidenced by the CAC 40 Index's recent climb of 3.89%, investors are increasingly looking for undervalued opportunities. In this environment, identifying stocks trading below their intrinsic value can provide a strategic edge, particularly when supported by robust fundamentals and favorable macroeconomic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €29.80 | €57.54 | 48.2% |

| Vivendi (ENXTPA:VIV) | €10.615 | €18.20 | 41.7% |

| Lectra (ENXTPA:LSS) | €29.85 | €53.63 | 44.3% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.08 | 39.8% |

| Exail Technologies (ENXTPA:EXA) | €17.80 | €34.52 | 48.4% |

| Vogo (ENXTPA:ALVGO) | €3.32 | €6.40 | 48.1% |

| VusionGroup (ENXTPA:VU) | €152.10 | €257.38 | 40.9% |

| Solutions 30 (ENXTPA:S30) | €1.547 | €2.61 | 40.6% |

| Aurea (ENXTPA:AURE) | €5.76 | €8.81 | 34.6% |

| Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €22.70 | €39.57 | 42.6% |

Here's a peek at a few of the choices from the screener.

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.26 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

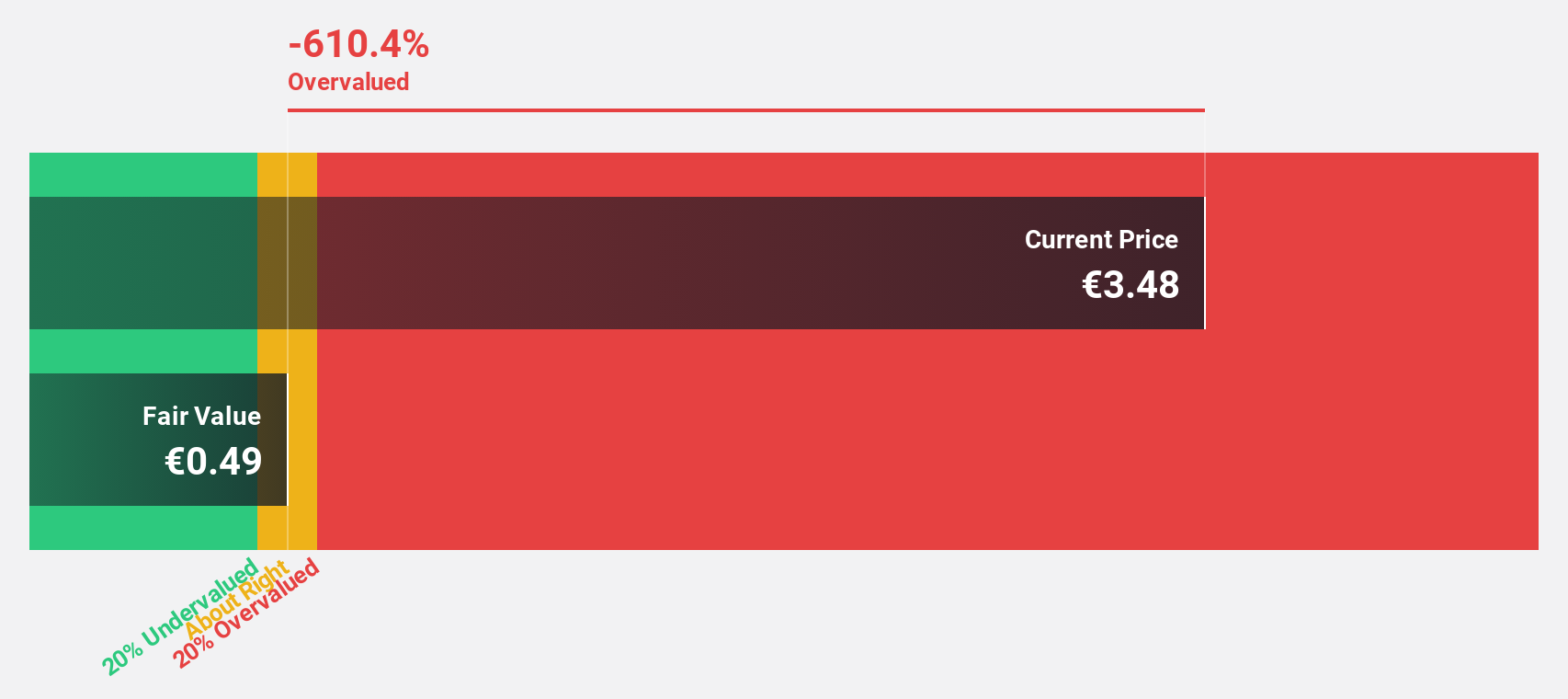

Estimated Discount To Fair Value: 26.3%

OVH Groupe is trading at €6.64, which is 26.3% below its estimated fair value of €9.01, indicating it may be undervalued based on cash flows. The company’s revenue is forecast to grow at 9.7% per year, outpacing the French market's average growth of 5.7%. However, it has experienced high share price volatility in the past three months and its Return on Equity is projected to remain low at 1.7% over the next three years.

- Insights from our recent growth report point to a promising forecast for OVH Groupe's business outlook.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this financial health report.

Safran (ENXTPA:SAF)

Overview: Safran SA, with a market cap of €89.71 billion, operates globally in the aerospace and defense sectors through its subsidiaries.

Operations: Safran generates revenue primarily from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

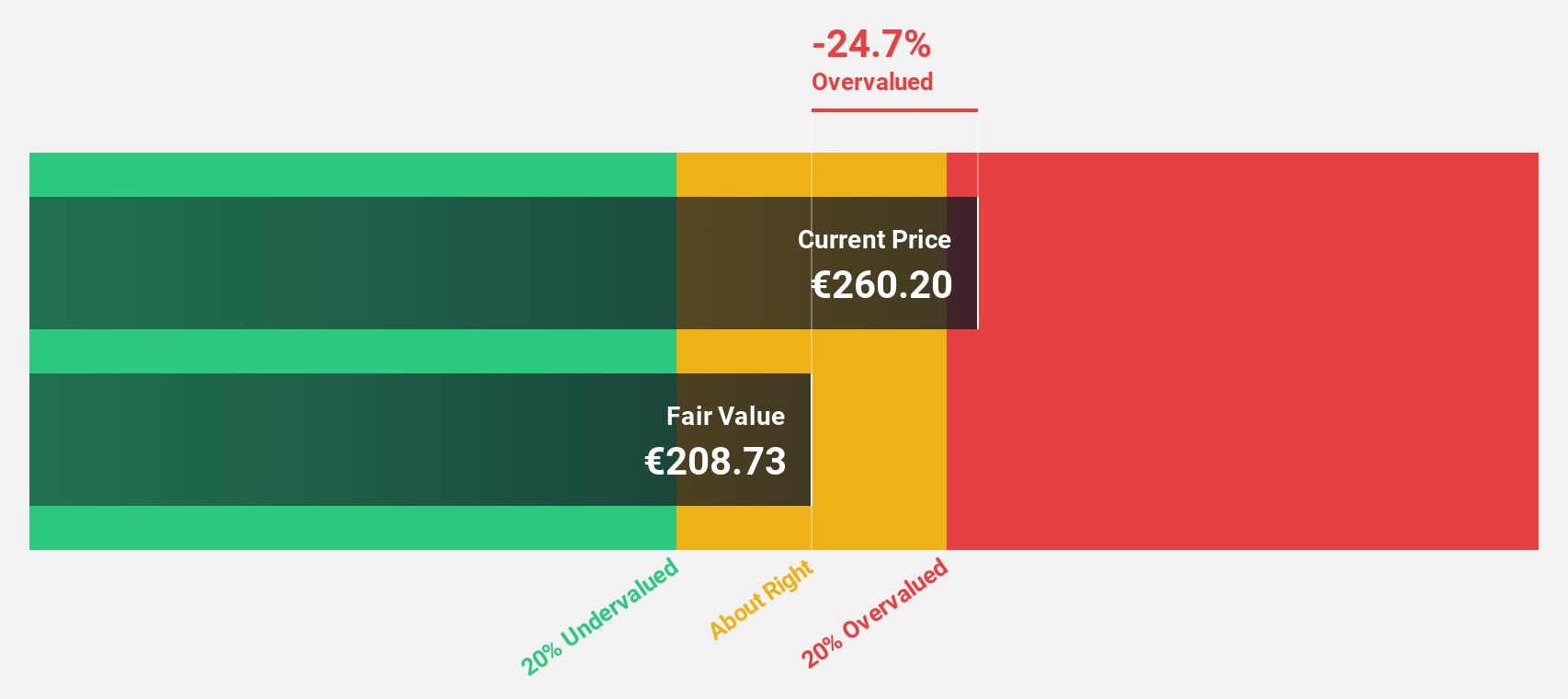

Estimated Discount To Fair Value: 25%

Safran SA is trading at €213.4, significantly below its estimated fair value of €284.7, suggesting it is undervalued based on cash flows. Despite a recent dip in net income to €57 million for H1 2024 from €1.86 billion a year ago, earnings are forecast to grow over 20% annually over the next three years, outpacing the French market's average growth rate. Revenue is also expected to increase by 10.4% per year, and Return on Equity is projected to reach 23.5%.

- Upon reviewing our latest growth report, Safran's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Safran's balance sheet health report.

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa, and has a market cap of approximately €10.70 billion.

Operations: Vivendi SE generates revenue from various segments, including Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), Gameloft (€304 million), Prisma Media (€303 million), New Initiatives (€176 million), and Vivendi Village (€151 million).

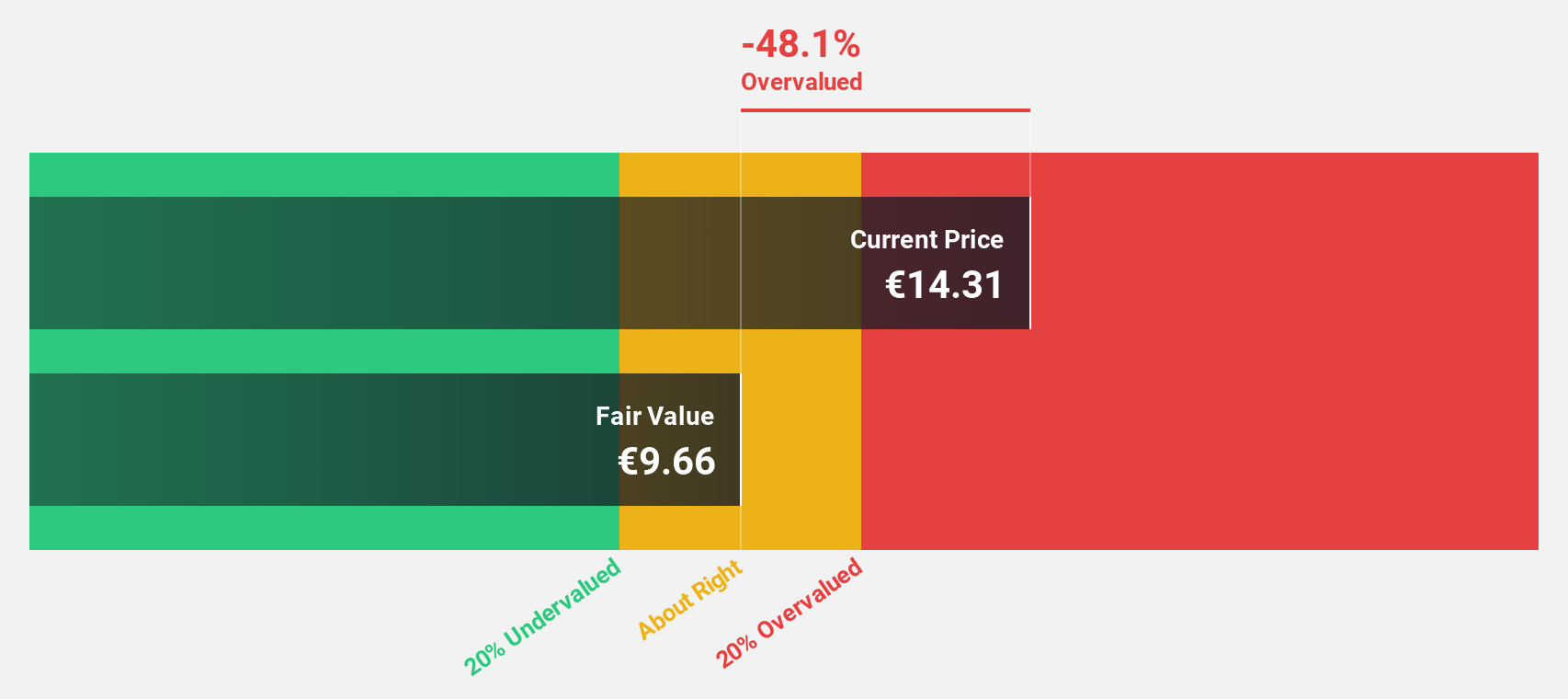

Estimated Discount To Fair Value: 41.7%

Vivendi SE is trading at €10.62, significantly below its estimated fair value of €18.2, indicating it is undervalued based on cash flows. Despite a slight decline in net income to €159 million for H1 2024 from €174 million a year ago, earnings are forecast to grow 30.6% annually over the next three years, outpacing the French market's average growth rate. Revenue is expected to increase by 9.4% per year, though Return on Equity remains low at 5.7%.

- Our expertly prepared growth report on Vivendi implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Vivendi with our detailed financial health report.

Taking Advantage

- Reveal the 22 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.