As global markets navigate mixed signals with U.S. stocks closing out a strong year despite recent profit-taking, and European indices experiencing varied performances, investors are increasingly seeking stability amidst economic fluctuations. In this context, dividend stocks present an appealing option for those looking to balance potential growth with reliable income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SIMONA (DB:SIM0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SIMONA Aktiengesellschaft is engaged in the development, manufacturing, and marketing of semi-finished thermoplastics, pipes, fittings, and profiles on a global scale with a market cap of €336 million.

Operations: SIMONA's revenue is primarily generated from its segment of semi-finished plastics, pipes, fittings, and finished parts, totaling €578.85 million.

Dividend Yield: 3.1%

SIMONA's dividend payments have been volatile and unreliable over the past decade, with an annual drop of over 20% at times. However, the dividends are well covered by both earnings and cash flows, with payout ratios around 35%. While the dividend yield is lower than top-tier German payers, recent earnings growth of 9.6% suggests potential for future stability. The stock trades at a significant discount to its estimated fair value.

- Get an in-depth perspective on SIMONA's performance by reading our dividend report here.

- The valuation report we've compiled suggests that SIMONA's current price could be quite moderate.

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manitou BF SA, along with its subsidiaries, develops, manufactures, and provides equipment and services globally, with a market cap of €701.03 million.

Operations: Manitou BF SA generates revenue through its Products Division, which accounts for €2.47 billion, and its Services & Solutions (S&S) Division, contributing €395.12 million.

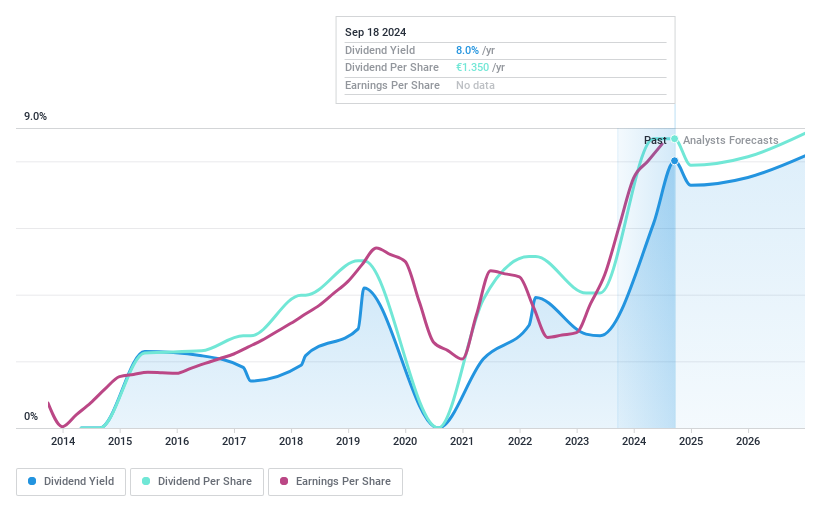

Dividend Yield: 7.4%

Manitou BF's dividend payments have been volatile and unreliable over the past decade, experiencing significant drops. Despite this, dividends are well covered by earnings with a payout ratio of 31.7% and cash flows at 65.5%. The dividend yield is competitive, ranking in the top 25% of French payers. Trading below estimated fair value suggests potential for capital appreciation, though high debt levels may pose risks to financial stability.

- Click here to discover the nuances of Manitou BF with our detailed analytical dividend report.

- Our valuation report unveils the possibility Manitou BF's shares may be trading at a discount.

Rexel (ENXTPA:RXL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. is a company that, along with its subsidiaries, distributes low and ultra-low voltage electrical products and services across residential, commercial, and industrial markets in France, Europe, North America, and Asia-Pacific with a market cap of €7.54 billion.

Operations: Rexel S.A.'s revenue is primarily derived from its Wholesale - Electronics segment, which generated €19.02 billion.

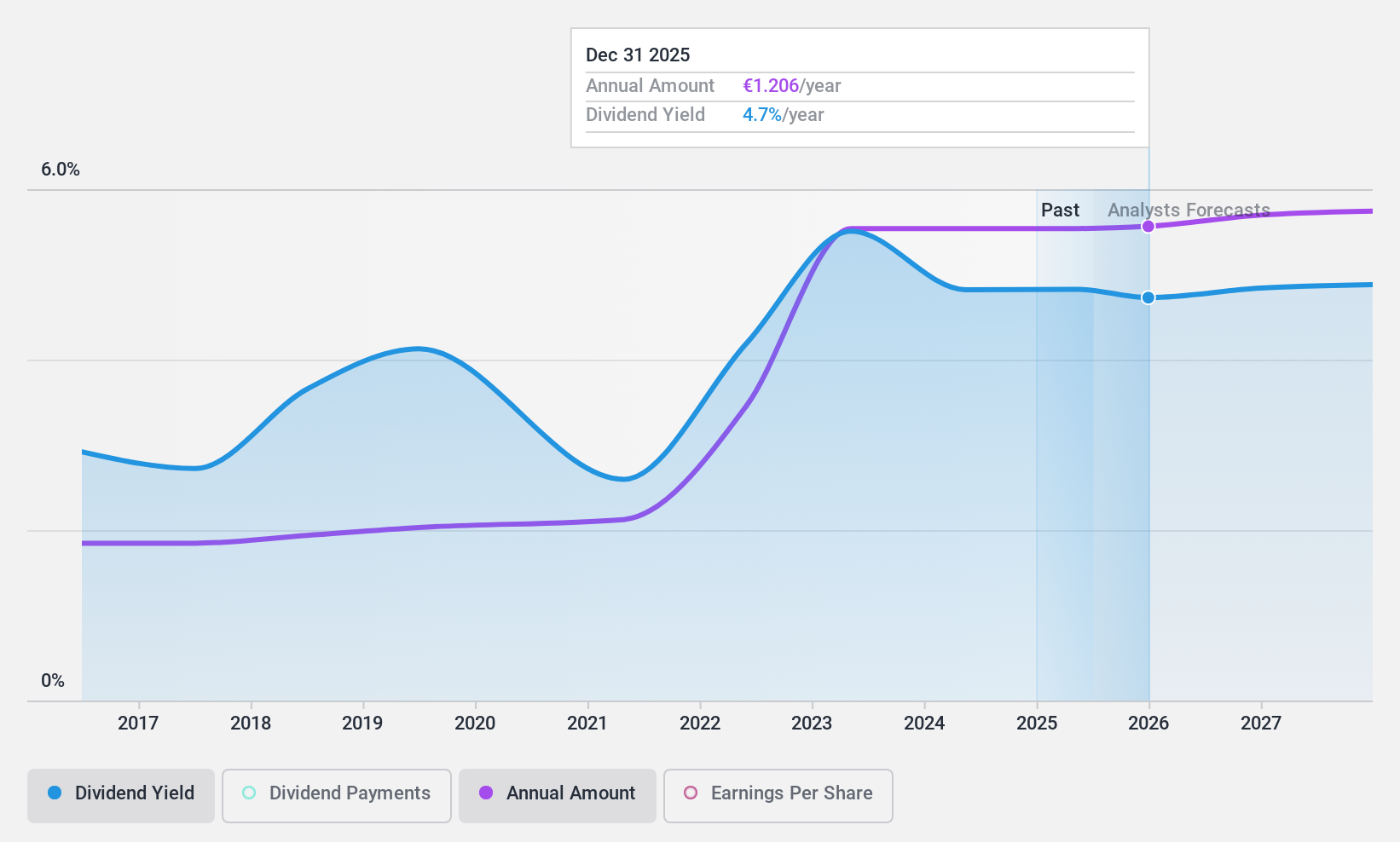

Dividend Yield: 4.7%

Rexel's dividend payments have been unstable and unreliable over the past decade, with significant volatility. However, dividends are well covered by earnings (51.6% payout ratio) and cash flows (39.9% cash payout ratio), indicating sustainability despite a high debt level. Trading 22% below estimated fair value suggests potential for capital appreciation, but the dividend yield of 4.75% is lower than the French market's top quartile payers at 5.81%.

- Take a closer look at Rexel's potential here in our dividend report.

- Upon reviewing our latest valuation report, Rexel's share price might be too pessimistic.

Make It Happen

- Click here to access our complete index of 1981 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Manitou BF, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MTU

Manitou BF

Engages in the development, manufacture, and distribution of equipment and services in the France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives