The European stock market has been buoyed by strong corporate earnings and optimism surrounding the potential resolution of geopolitical tensions, with major indices such as the STOXX Europe 600 and Germany's DAX posting notable gains. Amidst these developments, dividend stocks have garnered attention for their ability to provide a steady income stream, making them an attractive option for investors seeking stability in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 3.97% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.11% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.55% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.07% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.65% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.66% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.99% | ★★★★★☆ |

Click here to see the full list of 219 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manitou BF SA, with a market cap of €780.66 million, develops, manufactures, and distributes equipment and services across various regions including France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East.

Operations: Manitou BF generates its revenue primarily from its Products Division, which accounts for €2.11 billion, and the Services & Solutions Division, contributing €416.52 million.

Dividend Yield: 6.1%

Manitou BF's dividend yield is among the top 25% in the French market, though its dividend history has been volatile over the past decade. Despite recent earnings declines, dividends remain covered by both earnings and cash flows with payout ratios of 65.9% and 37.2%, respectively. The company trades at a favorable price-to-earnings ratio of 10.7x compared to the French market average of 16.2x, indicating good relative value for investors seeking dividends in Europe.

- Navigate through the intricacies of Manitou BF with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Manitou BF is trading behind its estimated value.

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles and motorcycles, along with spare parts and accessories globally, with a market cap of €53.47 billion.

Operations: Bayerische Motoren Werke's revenue is primarily derived from its Automotive segment at €120.56 billion, with additional contributions from Motorcycles at €3.13 billion and Financial Services at €39.40 billion.

Dividend Yield: 4.9%

BMW's dividend yield of 4.92% ranks in the top 25% of German payers, but its history is marked by volatility and lack of free cash flow coverage. Despite trading at a good value, recent earnings have declined with Q2 sales at €23.95 billion from €27.20 billion last year. The company announced a €1.65 billion share buyback program to enhance shareholder value while navigating financial challenges from decreased net income and profit margins compared to the previous year.

- Take a closer look at Bayerische Motoren Werke's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Bayerische Motoren Werke is priced lower than what may be justified by its financials.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and sells chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market cap of €739.93 million.

Operations: SAF-Holland SE's revenue is derived from three main segments: Americas (€726.21 million), Asia/Pacific (APAC)/China/India (€236.90 million), and Europe, The Middle East, Africa (EMEA) (€857.36 million).

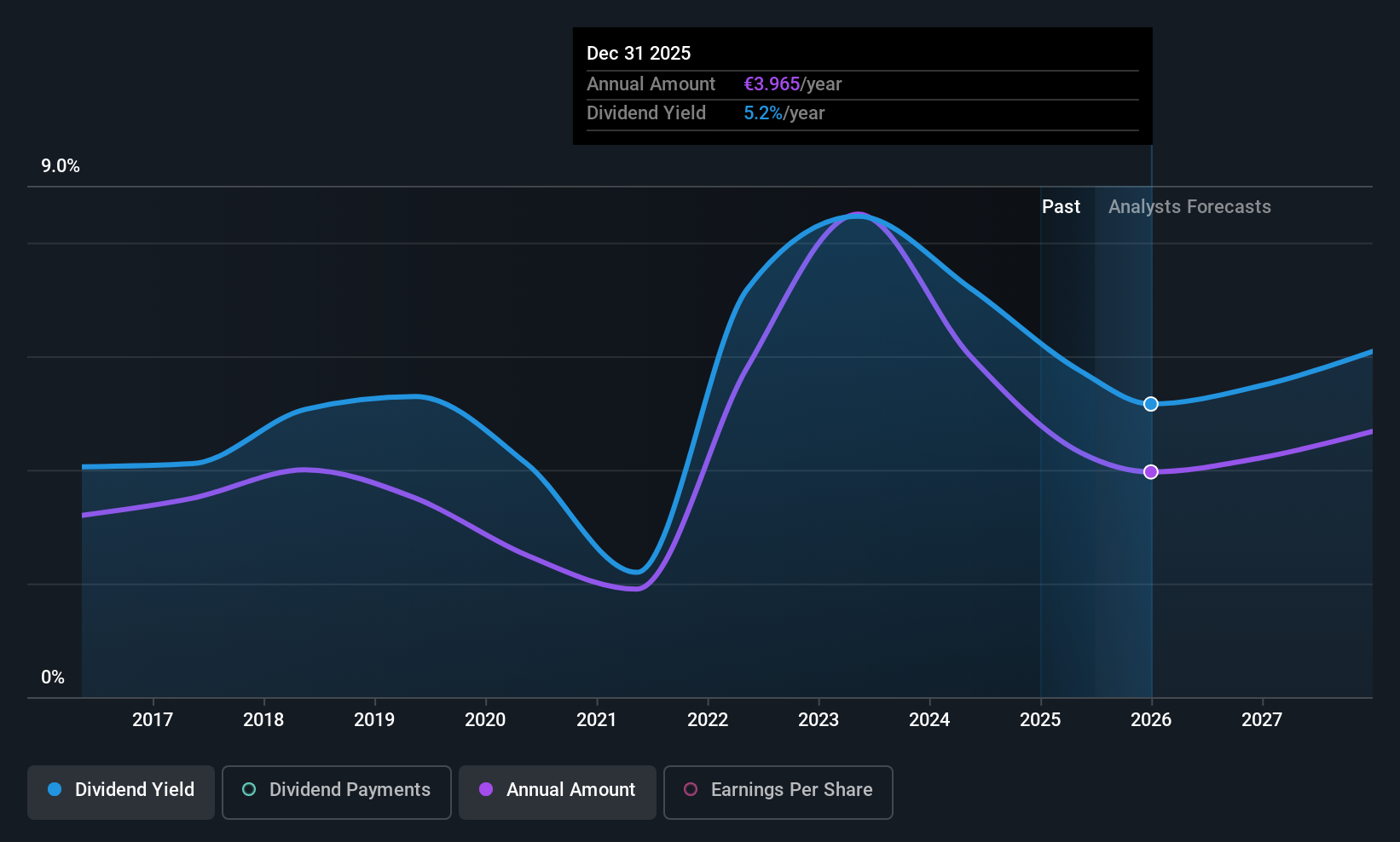

Dividend Yield: 5.2%

SAF-Holland's dividend yield of 5.21% is among the top 25% in Germany, though its payment history shows volatility over the past decade. Despite a solid earnings coverage with a payout ratio of 60.1%, high debt levels and recent lowered sales guidance to €1.8 billion for 2025 due to market challenges in North America may impact future payouts. A major US military order underscores strategic growth initiatives, potentially supporting long-term profitability and dividend sustainability.

- Unlock comprehensive insights into our analysis of SAF-Holland stock in this dividend report.

- Upon reviewing our latest valuation report, SAF-Holland's share price might be too pessimistic.

Next Steps

- Gain an insight into the universe of 219 Top European Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MTU

Manitou BF

Engages in the development, manufacture, and distribution of equipment and services in the France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives