While Jacquet Metals SA (EPA:JCQ) might not be the most widely known stock at the moment, it saw a decent share price growth in the teens level on the ENXTPA over the last few months. With many analysts covering the stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. But what if there is still an opportunity to buy? Today I will analyse the most recent data on Jacquet Metals’s outlook and valuation to see if the opportunity still exists.

View our latest analysis for Jacquet Metals

Is Jacquet Metals still cheap?

Good news, investors! Jacquet Metals is still a bargain right now. My valuation model shows that the intrinsic value for the stock is €33.83, but it is currently trading at €23.05 on the share market, meaning that there is still an opportunity to buy now. However, given that Jacquet Metals’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

What kind of growth will Jacquet Metals generate?

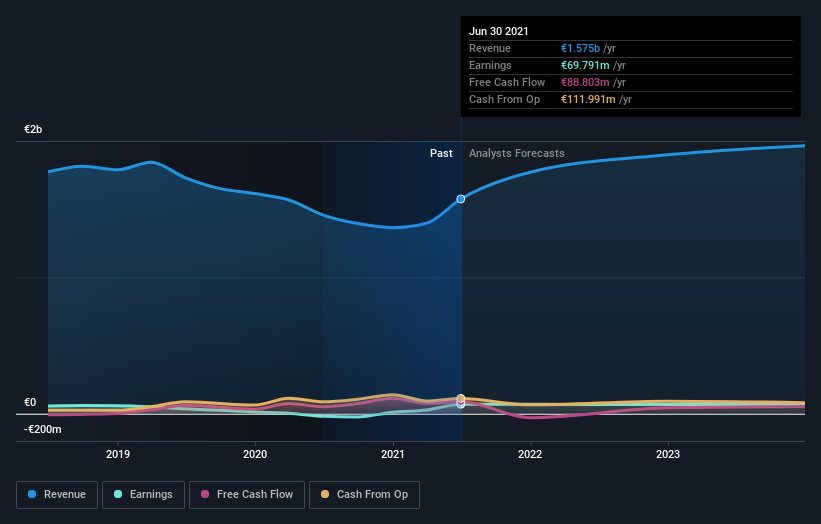

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Though in the case of Jacquet Metals, it is expected to deliver a negative earnings growth of -3.2%, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What this means for you:

Are you a shareholder? Although JCQ is currently undervalued, the adverse prospect of negative growth brings about some degree of risk. I recommend you think about whether you want to increase your portfolio exposure to JCQ, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping tabs on JCQ for some time, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

If you want to dive deeper into Jacquet Metals, you'd also look into what risks it is currently facing. When we did our research, we found 3 warning signs for Jacquet Metals (1 is potentially serious!) that we believe deserve your full attention.

If you are no longer interested in Jacquet Metals, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you're looking to trade Jacquet Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:JCQ

Jacquet Metals

Engages in the buying and trading of special metals in Germany, France, North America, Spain, Italy, the Netherlands, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives