Forsee Power Société anonyme (EPA:FORSE) Stock's 32% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Forsee Power Société anonyme (EPA:FORSE) share price has dived 32% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

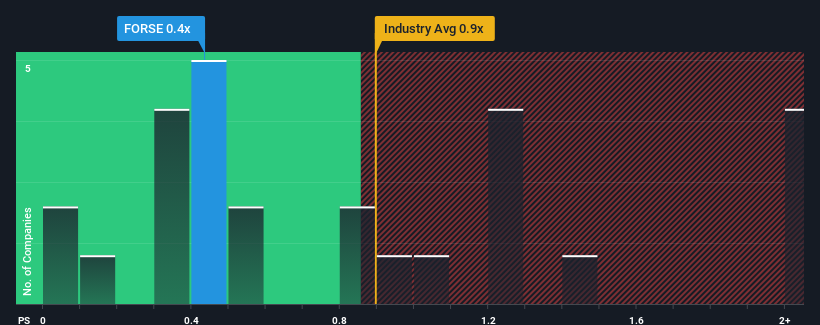

Even after such a large drop in price, it's still not a stretch to say that Forsee Power Société anonyme's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Machinery industry in France, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Forsee Power Société anonyme

How Has Forsee Power Société anonyme Performed Recently?

Forsee Power Société anonyme certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Forsee Power Société anonyme.How Is Forsee Power Société anonyme's Revenue Growth Trending?

In order to justify its P/S ratio, Forsee Power Société anonyme would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. The latest three year period has also seen an excellent 176% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 9.9% per year over the next three years. That's shaping up to be materially higher than the 6.8% per annum growth forecast for the broader industry.

With this information, we find it interesting that Forsee Power Société anonyme is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Forsee Power Société anonyme's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Forsee Power Société anonyme looks to be in line with the rest of the Machinery industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Forsee Power Société anonyme's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Forsee Power Société anonyme.

If you're unsure about the strength of Forsee Power Société anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FORSE

Forsee Power Société anonyme

Engages in the design, manufactures, and integration of battery systems for electromobility in France, res of Europe, Asia, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.