- Germany

- /

- Industrials

- /

- XTRA:UUU

3 European Penny Stocks With Market Caps Below €70M

Reviewed by Simply Wall St

The European market recently experienced a slight downturn, with the pan-European STOXX Europe 600 Index snapping a 10-week streak of gains due to trade policy uncertainties. Despite this backdrop, investors continue to explore opportunities within smaller companies that might offer potential value and growth. Penny stocks, though an older term, remain relevant as they often represent smaller or less-established companies that can present unique investment opportunities when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.79 | SEK284.19M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.14 | SEK207.11M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.68M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.02 | SEK244.57M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.195 | €303.78M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.992 | SEK1.91B | ★★★★☆☆ |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ★★★★☆☆ |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.725 | RON844.44M | ★★★★★★ |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pearl Gold (DB:02P)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pearl Gold AG is a holding company that invests in gold mining projects in Africa, with a market cap of €12.75 million.

Operations: Pearl Gold AG does not report any specific revenue segments.

Market Cap: €12.75M

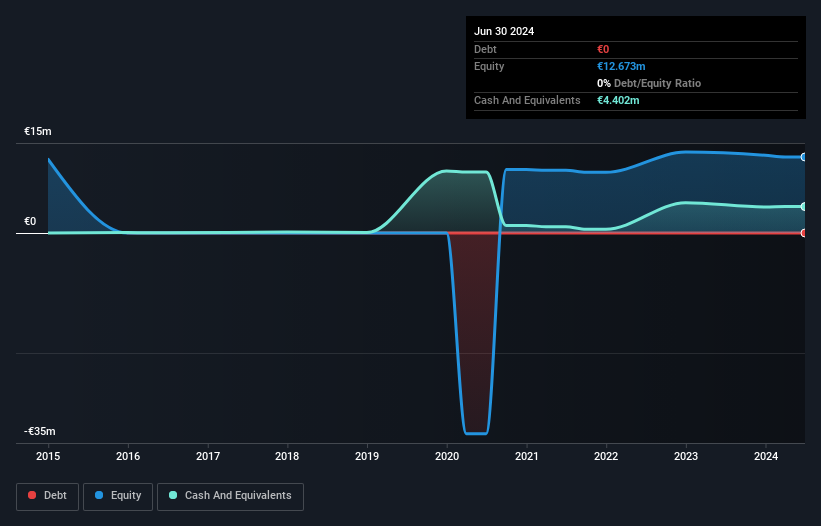

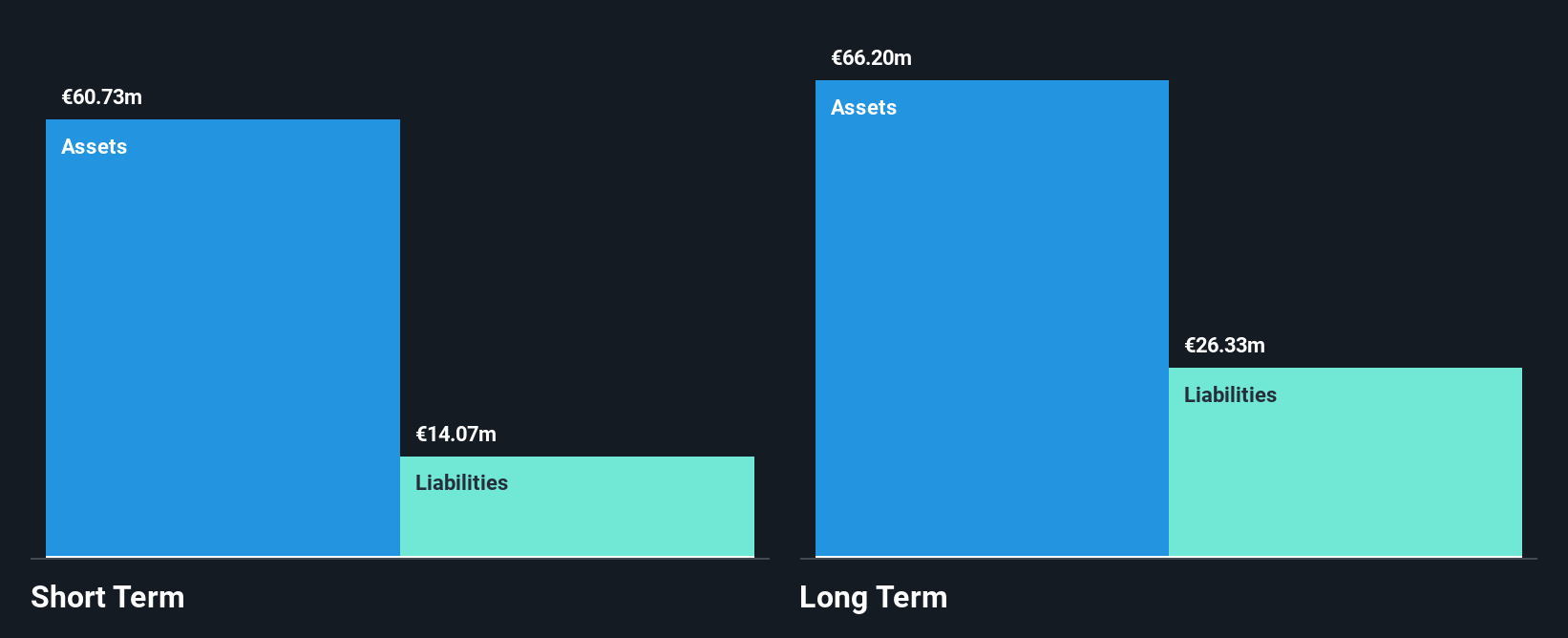

Pearl Gold AG, with a market cap of €12.75 million, is a pre-revenue company investing in African gold mining projects. It has no debt and its short-term assets of €13.4 million comfortably cover both short-term and long-term liabilities. Despite the absence of meaningful revenue, Pearl Gold's financial structure is stable with no shareholder dilution over the past year. However, it remains unprofitable with losses increasing by 25% annually over five years and exhibits high share price volatility. The board is experienced with an average tenure of 7.2 years but management experience details are unavailable.

- Get an in-depth perspective on Pearl Gold's performance by reading our balance sheet health report here.

- Gain insights into Pearl Gold's historical outcomes by reviewing our past performance report.

Forsee Power Société anonyme (ENXTPA:FORSE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Forsee Power Société anonyme, with a market cap of €65.82 million, designs, manufactures, and integrates battery systems for electromobility across France, the rest of Europe, Asia, the United States, and internationally.

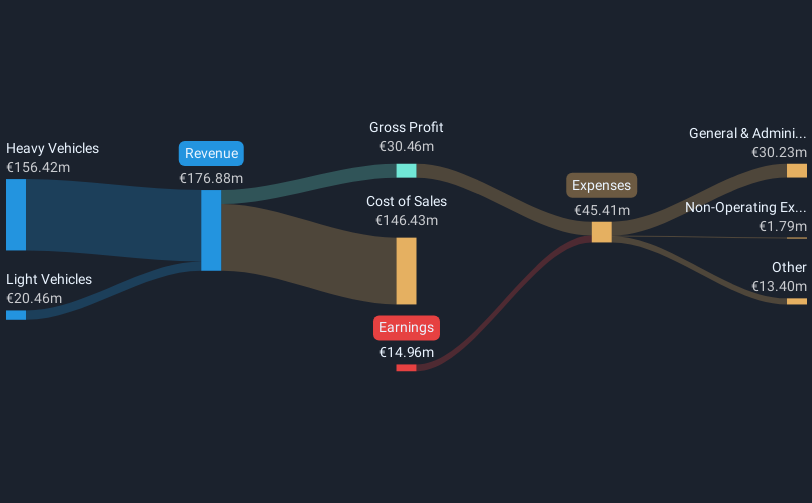

Operations: The company generates revenue primarily from its Heavy Vehicles segment, which accounts for €156.42 million, and its Light Vehicles segment, contributing €20.46 million.

Market Cap: €65.82M

Forsee Power Société anonyme, with a market cap of €65.82 million, is navigating the penny stock landscape with a focus on battery systems for electromobility. Despite being unprofitable and having a high net debt to equity ratio of 40.7%, the company shows promise through strategic partnerships and product launches. Recent collaborations include supplying battery systems for Bozankaya's trolleybuses in Prague and retrofitting locomotives in the US with Innovative Rail Technologies. The company's robust short-term assets (€103M) exceed its liabilities, supporting its cash runway beyond three years despite volatility in share price and management transitions.

- Click here and access our complete financial health analysis report to understand the dynamics of Forsee Power Société anonyme.

- Gain insights into Forsee Power Société anonyme's outlook and expected performance with our report on the company's earnings estimates.

3U Holding (XTRA:UUU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3U Holding AG, with a market cap of €60.44 million, operates in the telecommunications and information technology sectors both in Germany and internationally through its subsidiaries.

Operations: The company's revenue is primarily generated from its Sanitary, Heating and Air Conditioning (SHAC) segment at €48.66 million, followed by the Information and Telecommunications Technology (ITC) segment at €20.49 million, and Renewable Energies Excl. SHAC at €5.81 million.

Market Cap: €60.44M

3U Holding AG, with a market cap of €60.44 million, is positioned in the telecommunications and IT sectors. The company generates significant revenue from its SHAC segment (€48.66 million), indicating a stable income stream despite recent negative earnings growth (-5.4%). Its debt level is appropriate as it holds more cash than total debt, although operating cash flow does not adequately cover debt obligations (4.7%). The board and management are experienced, providing stability amid low return on equity (2.2%) and unsustainable dividend coverage (2.78%). Analysts suggest potential upside with stock trading below estimated fair value by 67.9%.

- Navigate through the intricacies of 3U Holding with our comprehensive balance sheet health report here.

- Explore 3U Holding's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 434 European Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade 3U Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if 3U Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:UUU

3U Holding

Provides telecommunication and information technology services in Germany and internationally.

Excellent balance sheet with reasonable growth potential.