Emmanuel Viellard has been the CEO of Lisi S.A. (EPA:FII) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Lisi.

See our latest analysis for Lisi

Comparing Lisi S.A.'s CEO Compensation With the industry

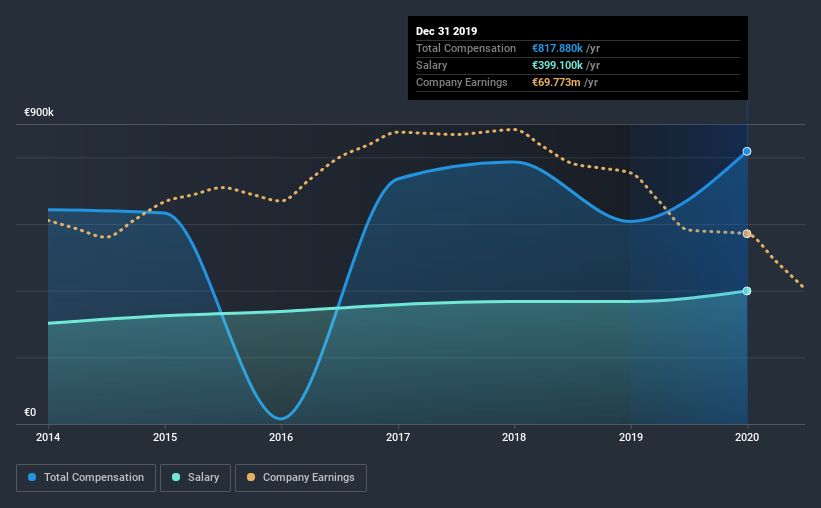

At the time of writing, our data shows that Lisi S.A. has a market capitalization of €1.1b, and reported total annual CEO compensation of €818k for the year to December 2019. That's a notable increase of 35% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €399k.

On examining similar-sized companies in the industry with market capitalizations between €843m and €2.7b, we discovered that the median CEO total compensation of that group was €3.4m. Accordingly, Lisi pays its CEO under the industry median. Furthermore, Emmanuel Viellard directly owns €812k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €399k | €367k | 49% |

| Other | €419k | €240k | 51% |

| Total Compensation | €818k | €607k | 100% |

On an industry level, around 41% of total compensation represents salary and 59% is other remuneration. Lisi is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Lisi S.A.'s Growth Numbers

Over the last three years, Lisi S.A. has shrunk its earnings per share by 22% per year. It saw its revenue drop 12% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Lisi S.A. Been A Good Investment?

With a three year total loss of 41% for the shareholders, Lisi S.A. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, Lisi S.A. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. EPS growth has failed to impress us, and the same can be said about shareholder returns. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Lisi that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Lisi, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:FII

Lisi

Designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives