- France

- /

- Construction

- /

- ENXTPA:FGR

Azimut Holding Leads These 3 Dividend Stocks To Consider

Reviewed by Simply Wall St

In the wake of recent global market fluctuations, driven by U.S. election outcomes and central bank rate adjustments, investors are keenly observing shifts in economic policies that could impact growth and inflation. Amidst these developments, dividend stocks like Azimut Holding have garnered attention for their potential to provide steady income streams in uncertain times. When considering dividend stocks, it's crucial to focus on companies with a strong track record of earnings stability and a commitment to returning value to shareholders through consistent payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

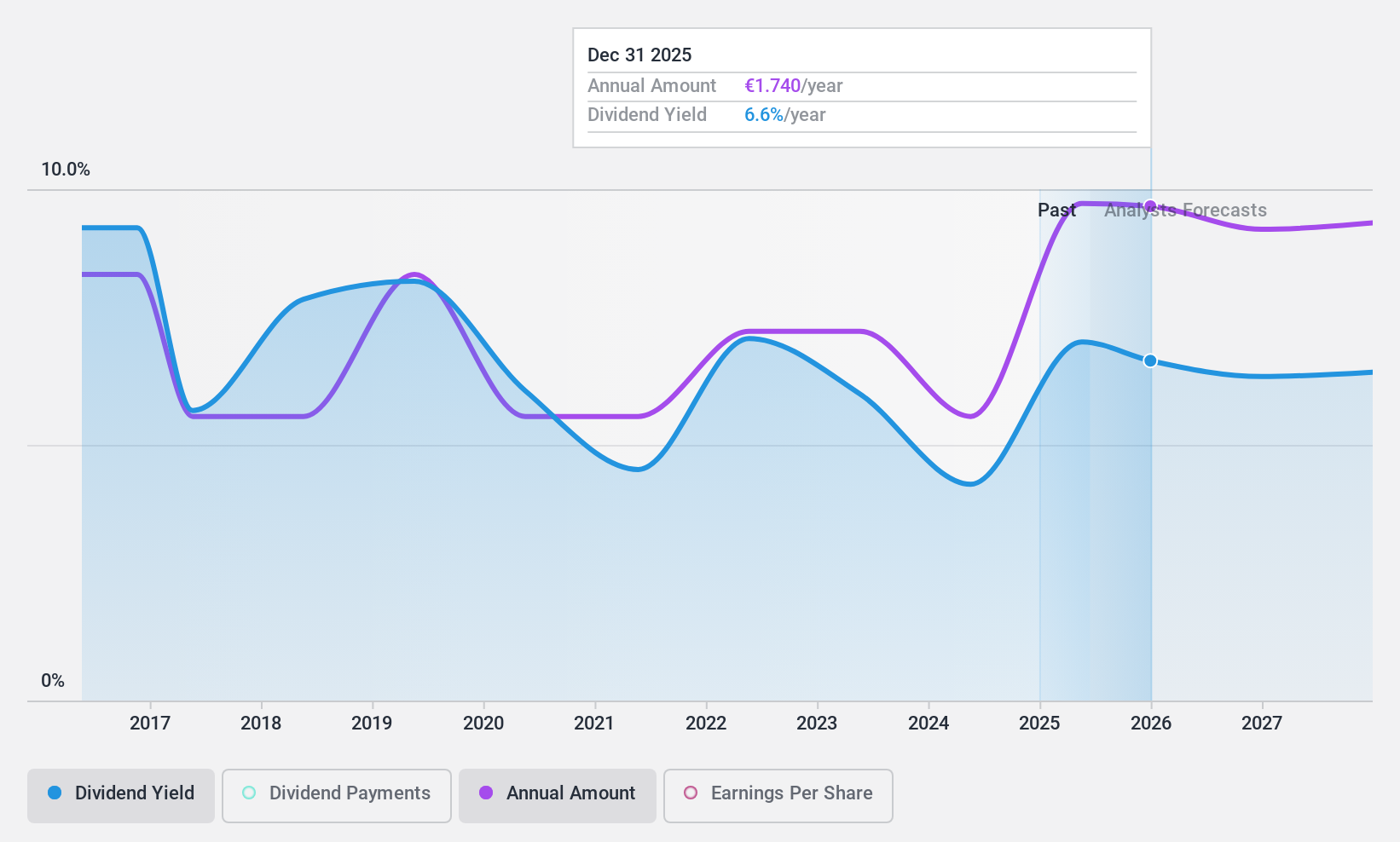

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market capitalization of approximately €3.30 billion.

Operations: Azimut Holding S.p.A. generates its revenue primarily from the asset management segment, which accounts for €1.44 billion.

Dividend Yield: 4.3%

Azimut Holding's dividend payments have been volatile and unreliable over the past decade, despite a recent increase. The dividends are well covered by earnings and cash flows, with payout ratios of 26.6% and 29.1%, respectively. Recent earnings showed a slight year-over-year decline in Q3 net income but an increase over nine months, suggesting some financial resilience. However, the dividend yield is below top-tier levels in Italy, reflecting its unstable track record.

- Click to explore a detailed breakdown of our findings in Azimut Holding's dividend report.

- Upon reviewing our latest valuation report, Azimut Holding's share price might be too pessimistic.

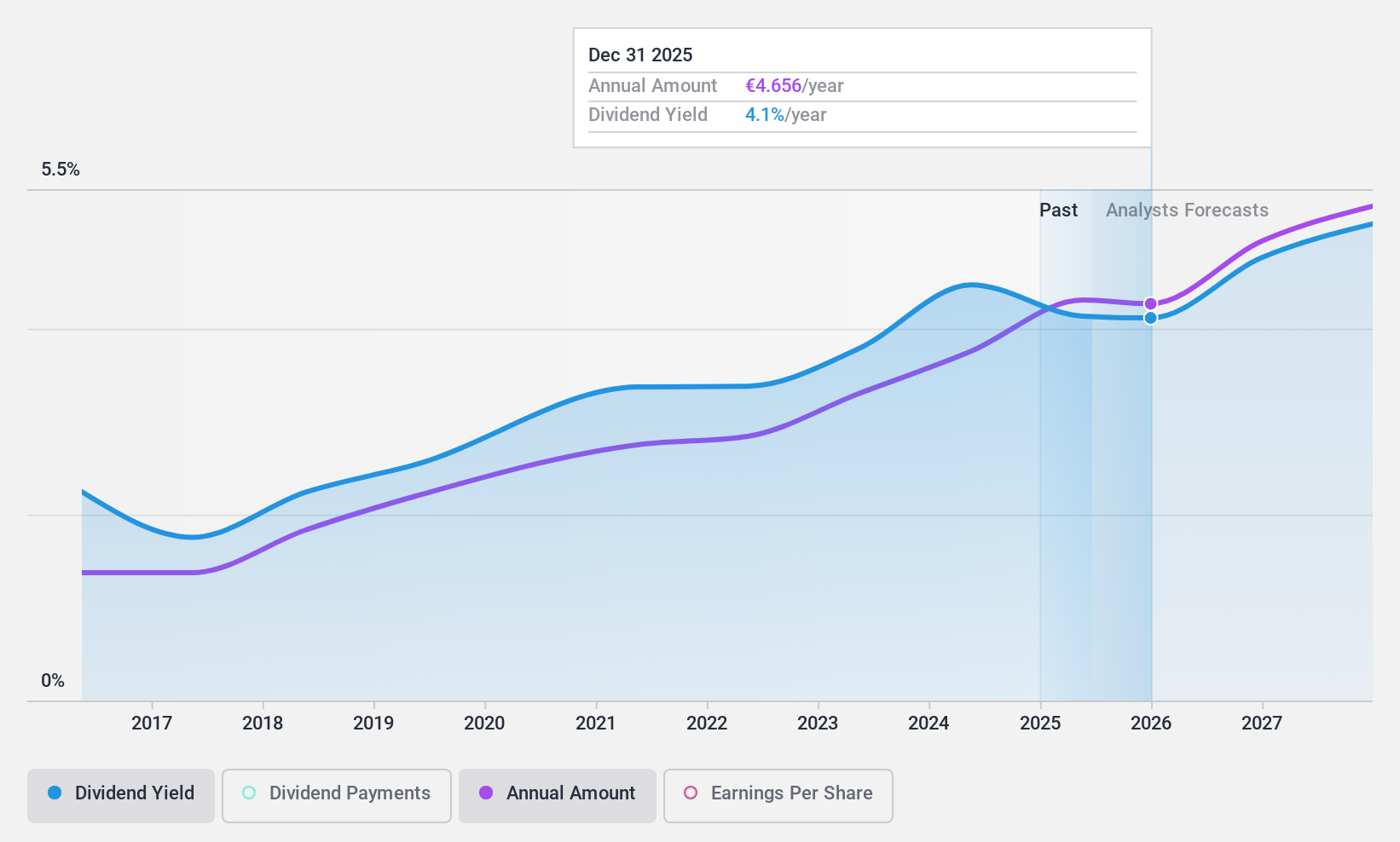

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and internationally with a market cap of €8.12 billion.

Operations: Eiffage SA's revenue segments include Concessions (€4.04 billion), Construction (€4.01 billion), Energy Systems (€6.49 billion), and Infrastructures (€8.78 billion).

Dividend Yield: 4.7%

Eiffage's dividend history is unstable and unreliable, with past volatility exceeding 20% annual drops. Despite this, dividends are well covered by earnings and cash flows, with payout ratios of 38.6% and 16.4%, respectively. Recent half-year results showed sales growth to €11.41 billion but a slight net income decline to €382 million. The dividend yield of 4.72% lags behind France's top payers, reflecting its inconsistent track record amidst high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Eiffage.

- Our valuation report unveils the possibility Eiffage's shares may be trading at a discount.

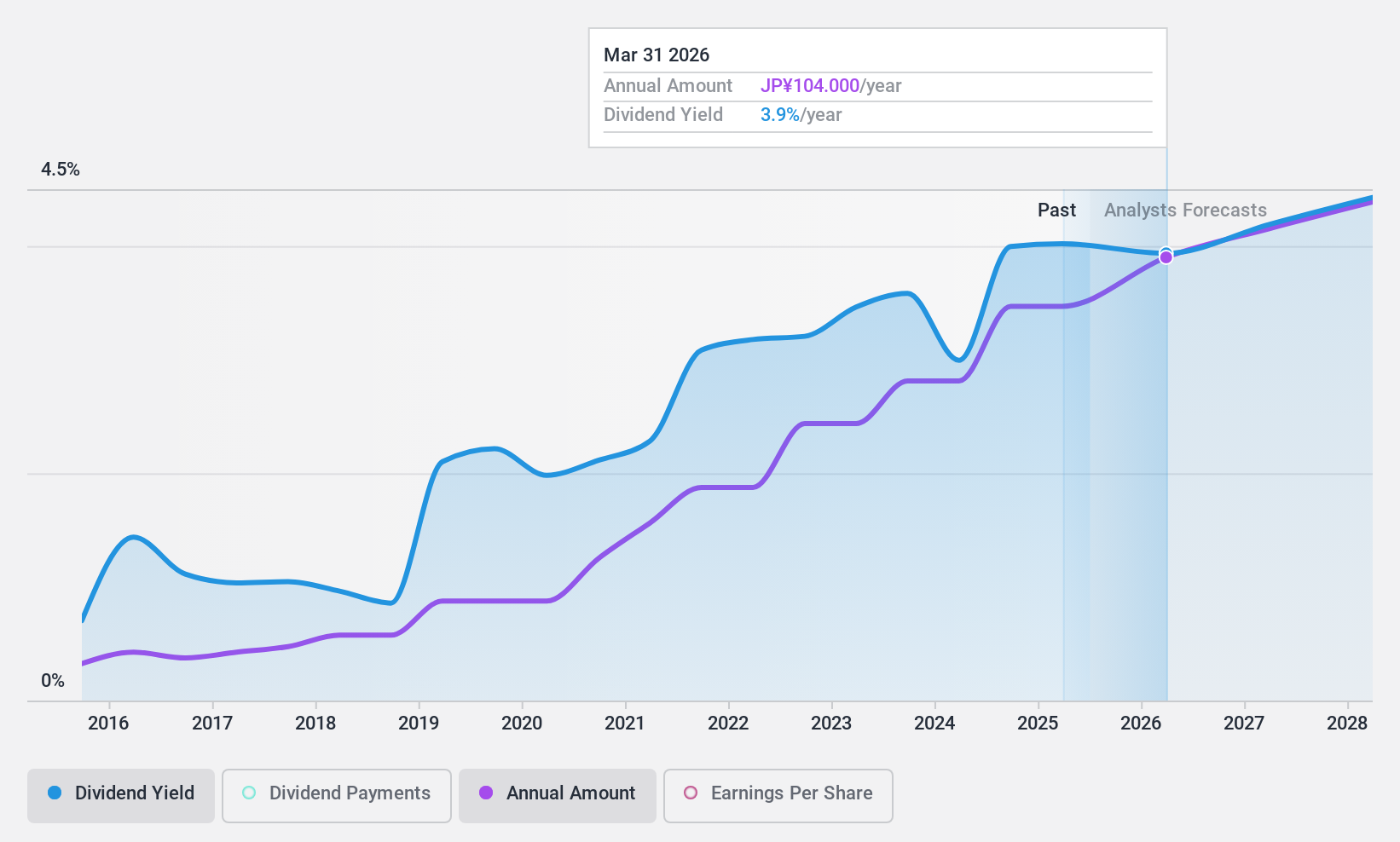

Nippon Gas (TSE:8174)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Gas Co., Ltd. operates in Japan, focusing on the supply and sale of LP gas and natural gas, with a market cap of ¥234.53 billion.

Operations: Nippon Gas Co., Ltd. generates revenue through its LP Gas Business at ¥87.23 billion, City Gas Business at ¥63.78 billion, and Electricity Business at ¥43.91 billion.

Dividend Yield: 4.4%

Nippon Gas's recent dividend increase to JPY 46.25 per share marks a positive shift, yet its payout ratio of 102.4% suggests dividends aren't fully covered by earnings, raising sustainability concerns. Despite this, the cash payout ratio stands at a more reasonable 73.3%, indicating coverage by cash flows. Trading significantly below fair value and offering a yield in Japan's top quartile, Nippon Gas remains attractive but with caution due to past volatility and coverage issues.

- Dive into the specifics of Nippon Gas here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Nippon Gas is trading behind its estimated value.

Summing It All Up

- Delve into our full catalog of 1955 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eiffage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGR

Eiffage

Engages in the construction, property development, urban development, civil engineering, metallic construction, roads, energy systems, and concessions businesses in France, rest of Europe, and internationally.

Very undervalued with adequate balance sheet and pays a dividend.