- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Positive Sentiment Still Eludes Figeac Aero Société Anonyme (EPA:FGA) Following 31% Share Price Slump

Figeac Aero Société Anonyme (EPA:FGA) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 20%.

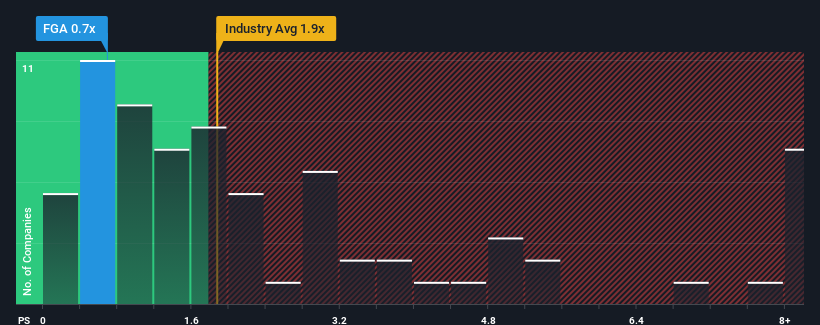

Since its price has dipped substantially, Figeac Aero Société Anonyme may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Aerospace & Defense industry in France have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Figeac Aero Société Anonyme

What Does Figeac Aero Société Anonyme's P/S Mean For Shareholders?

Recent revenue growth for Figeac Aero Société Anonyme has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Figeac Aero Société Anonyme will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Figeac Aero Société Anonyme .How Is Figeac Aero Société Anonyme's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Figeac Aero Société Anonyme's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 83% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 10% each year over the next three years. That's shaping up to be similar to the 11% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Figeac Aero Société Anonyme's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Figeac Aero Société Anonyme's P/S

The southerly movements of Figeac Aero Société Anonyme's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Figeac Aero Société Anonyme remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 1 warning sign for Figeac Aero Société Anonyme that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential with acceptable track record.

Market Insights

Community Narratives