- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXENS

Exosens (ENXTPA:EXENS): Assessing Valuation After Recent 19% Share Price Upswing

Reviewed by Kshitija Bhandaru

Exosens (ENXTPA:EXENS) has seen its stock chart a steady path over the last month, gaining 19%. Investors may wonder what is driving the momentum behind the share price, particularly as markets continue to weigh company fundamentals.

See our latest analysis for Exosens.

The recent 19% surge in Exosens’ share price over the past month reflects renewed momentum, especially when viewed alongside its 1.2% total shareholder return for the year. After a mostly steady performance earlier in the year, this uptick could signal changing sentiment from investors who are weighing its growth potential and improving fundamentals.

If Exosens’ momentum has you thinking bigger, now is an ideal moment to expand your search and discover fast growing stocks with high insider ownership

The recent swing raises the key question: Is Exosens now trading below its true value, or have investors already factored in the company’s future growth into the share price, leaving little upside for new buyers?

Most Popular Narrative: 4.1% Undervalued

Exosens’s most-followed valuation narrative places fair value at €45.50, a bit above the last close of €43.65. This spread has shaped upbeat investor sentiment, as attention shifts to what might drive further upside from here.

The significant increases in global defense spending, especially the raised NATO target to 3.5% of GDP, combined with Exosens' leadership in night-vision and amplification technologies, position the company to benefit from a multi-year surge in demand for high-end defense sensing equipment, likely driving sustained high revenue growth and improved order visibility.

How exactly does Exosens aim to justify its premium? The fair value hinges on a bold growth path, with earnings forecasts and profit margins more typical of industry standouts. The full narrative reveals the market-moving metrics that fuel this high conviction outlook. Will they surprise you?

Result: Fair Value of €45.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain bottlenecks or integration challenges from recent acquisitions could quickly impact margins and stall Exosens’s current growth momentum.

Find out about the key risks to this Exosens narrative.

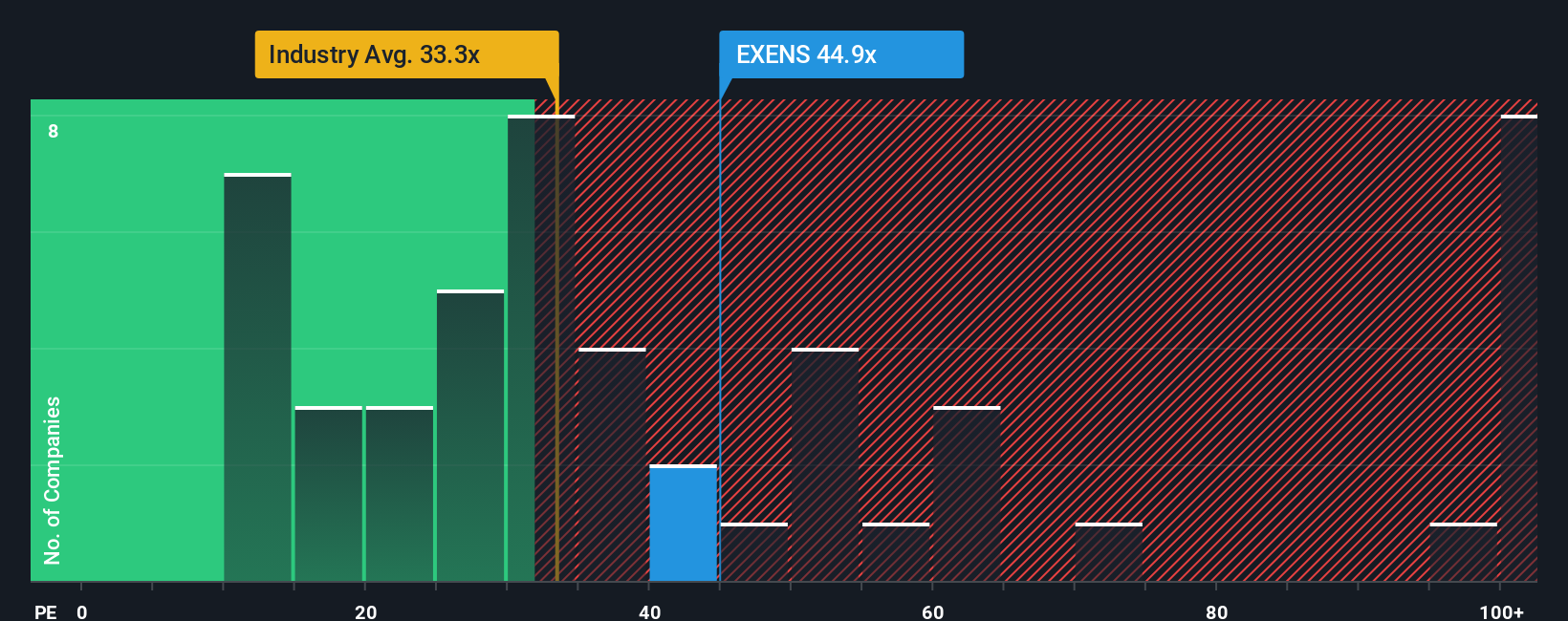

Another View: Valuation by Industry Ratios

The market’s going rate puts Exosens at a price-to-earnings ratio of 39.8x, which is noticeably higher than both the European Aerospace & Defense average of 34.3x and its own fair ratio of 26.9x. This means investors are paying a notable premium, which could limit upside if growth does not deliver. Are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exosens Narrative

If you see the story differently or want to dive deep on your own terms, you can craft your personal take using the available data in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exosens.

Looking for More Investment Ideas?

Level up your investing strategy by spotting opportunities others miss before it’s too late. Here are smart ways to start your next search:

- Boost your portfolio's stability with reliable yields by checking out these 19 dividend stocks with yields > 3% offering attractive income streams above 3%.

- Get ahead of tech’s next big wave by targeting AI innovators through these 24 AI penny stocks, which are poised to transform industries and create lasting value.

- Benefit from significant potential upside when you act on these 896 undervalued stocks based on cash flows, identified as trading below intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exosens might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXENS

Exosens

Engages in the development, manufacture, and sale of electro-optical technologies in the fields of amplification, and detection and imaging in France, rest of Europe, North America, Asia, Oceania, Africa, and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives