- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

European Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience an upswing, buoyed by improved sentiment following the de-escalation of trade tensions between the U.S. and China, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In this context, identifying stocks with strong fundamentals and potential for growth can be particularly appealing as they may offer attractive investment prospects amidst a recovering economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lectra (ENXTPA:LSS) | €24.10 | €47.47 | 49.2% |

| Absolent Air Care Group (OM:ABSO) | SEK218.00 | SEK417.99 | 47.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK110.30 | DKK215.07 | 48.7% |

| Arcure (ENXTPA:ALCUR) | €4.765 | €9.20 | 48.2% |

| Claranova (ENXTPA:CLA) | €2.84 | €5.48 | 48.2% |

| MilDef Group (OM:MILDEF) | SEK229.00 | SEK437.52 | 47.7% |

| illimity Bank (BIT:ILTY) | €3.684 | €7.28 | 49.4% |

| 3U Holding (XTRA:UUU) | €1.59 | €3.12 | 49.1% |

| Expert.ai (BIT:EXAI) | €1.332 | €2.59 | 48.5% |

| HBX Group International (BME:HBX) | €10.26 | €19.68 | 47.9% |

Let's dive into some prime choices out of the screener.

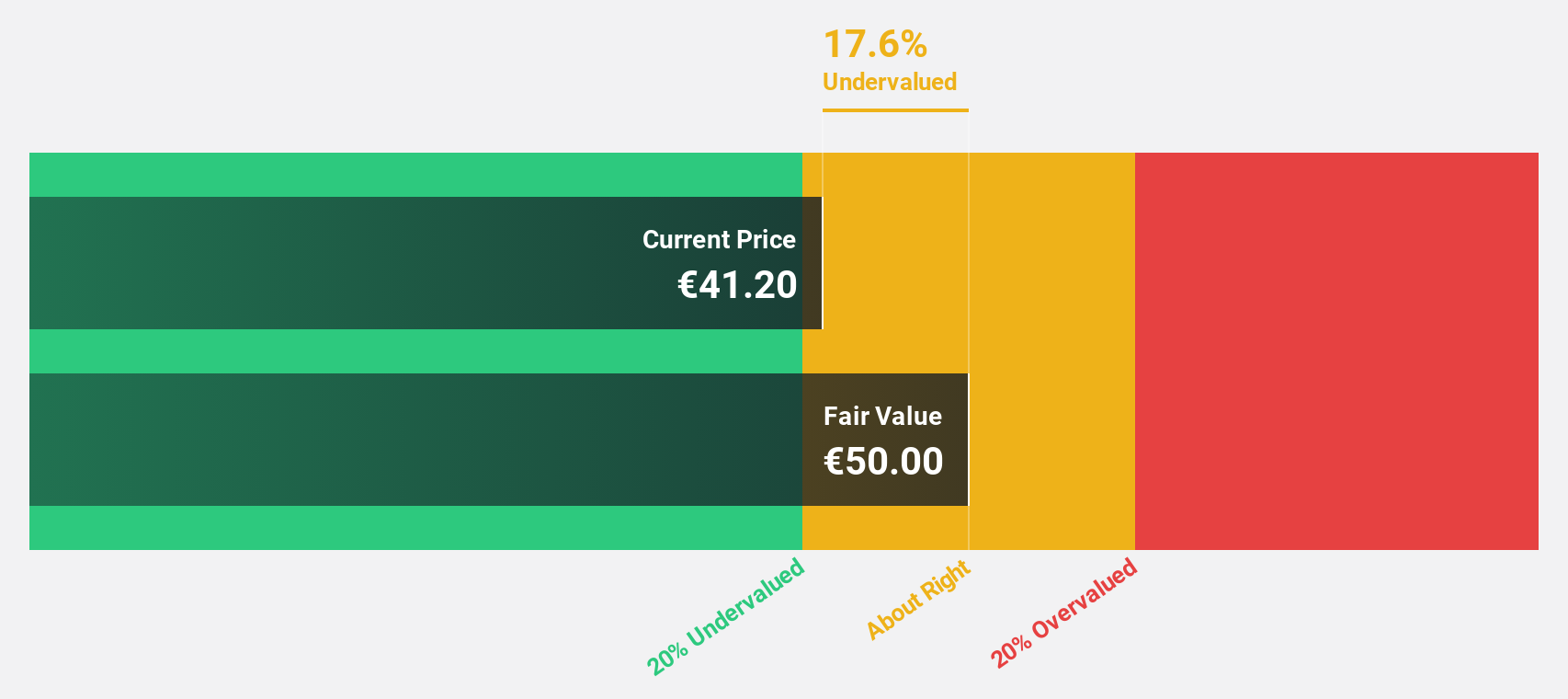

RENK Group (DB:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally, with a market cap of €6.03 billion.

Operations: The company's revenue segments comprise €126.77 million from Slide Bearings, €324.40 million from Marine & Industry, and €736.77 million from Vehicle Mobility Solutions.

Estimated Discount To Fair Value: 27.1%

RENK Group is trading at €60.28, significantly below its estimated fair value of €82.73, making it undervalued based on cash flows. The company reported strong earnings growth of 80.3% over the past year and is expected to continue with a projected annual profit growth of 29.1%, outpacing the German market average. Despite high debt levels and recent share price volatility, RENK's robust financial performance underscores its potential as an undervalued investment opportunity in Europe.

- Our expertly prepared growth report on RENK Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in RENK Group's balance sheet health report.

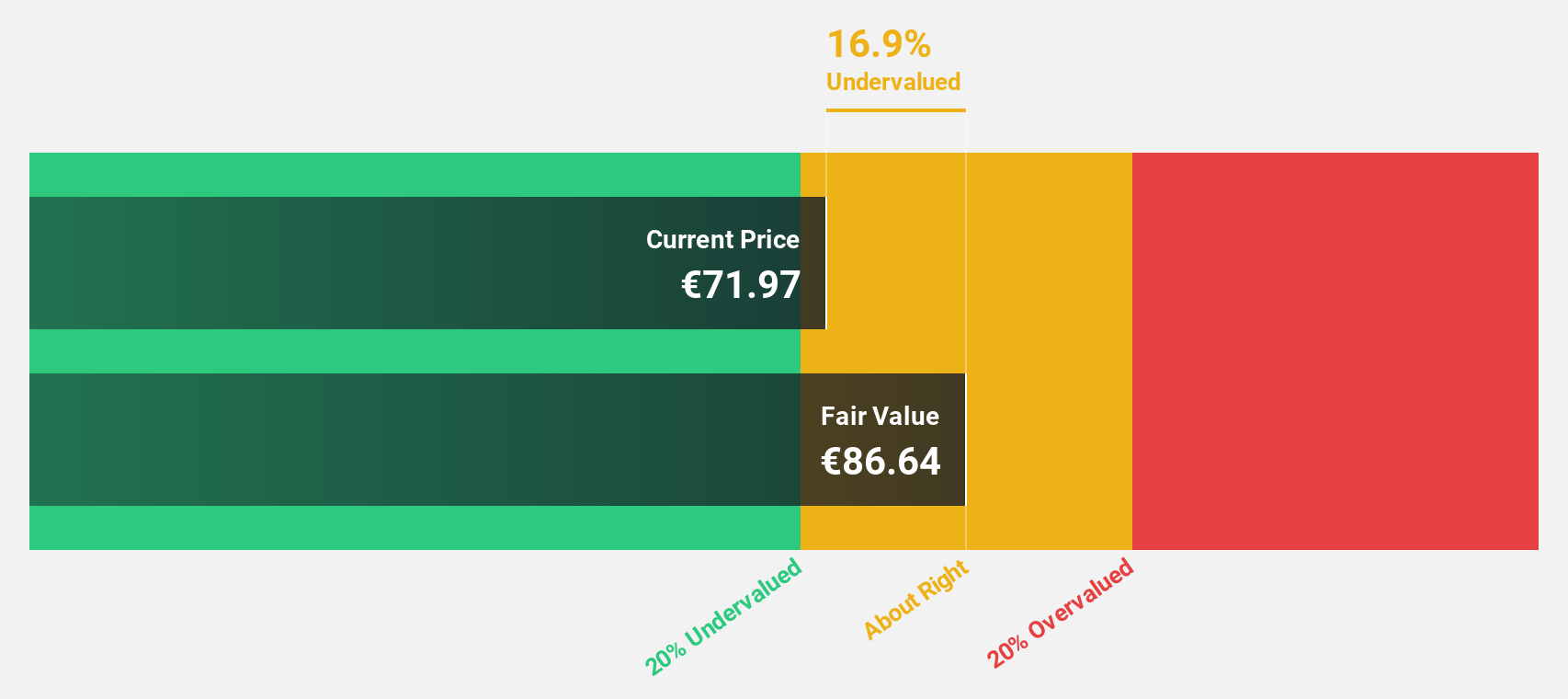

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies for amplification, detection, and imaging across various regions including France, Europe, North America, Asia, Oceania, Africa and internationally with a market cap of €1.97 billion.

Operations: The company generates revenue primarily from its amplification segment, contributing €280.20 million, and its detection and imaging segment, adding €117.50 million.

Estimated Discount To Fair Value: 22.7%

Exosens is trading at €38.8, below its estimated fair value of €50.2, highlighting its undervaluation based on cash flows. The company reported a significant earnings increase to €30.7 million in 2024 from the previous year and anticipates continued robust profit growth of 25.3% annually, surpassing the French market average. Despite recent share price volatility and moderate revenue growth forecasts, Exosens' strategic expansions and strong market position bolster its investment appeal in Europe.

- Our comprehensive growth report raises the possibility that Exosens is poised for substantial financial growth.

- Dive into the specifics of Exosens here with our thorough financial health report.

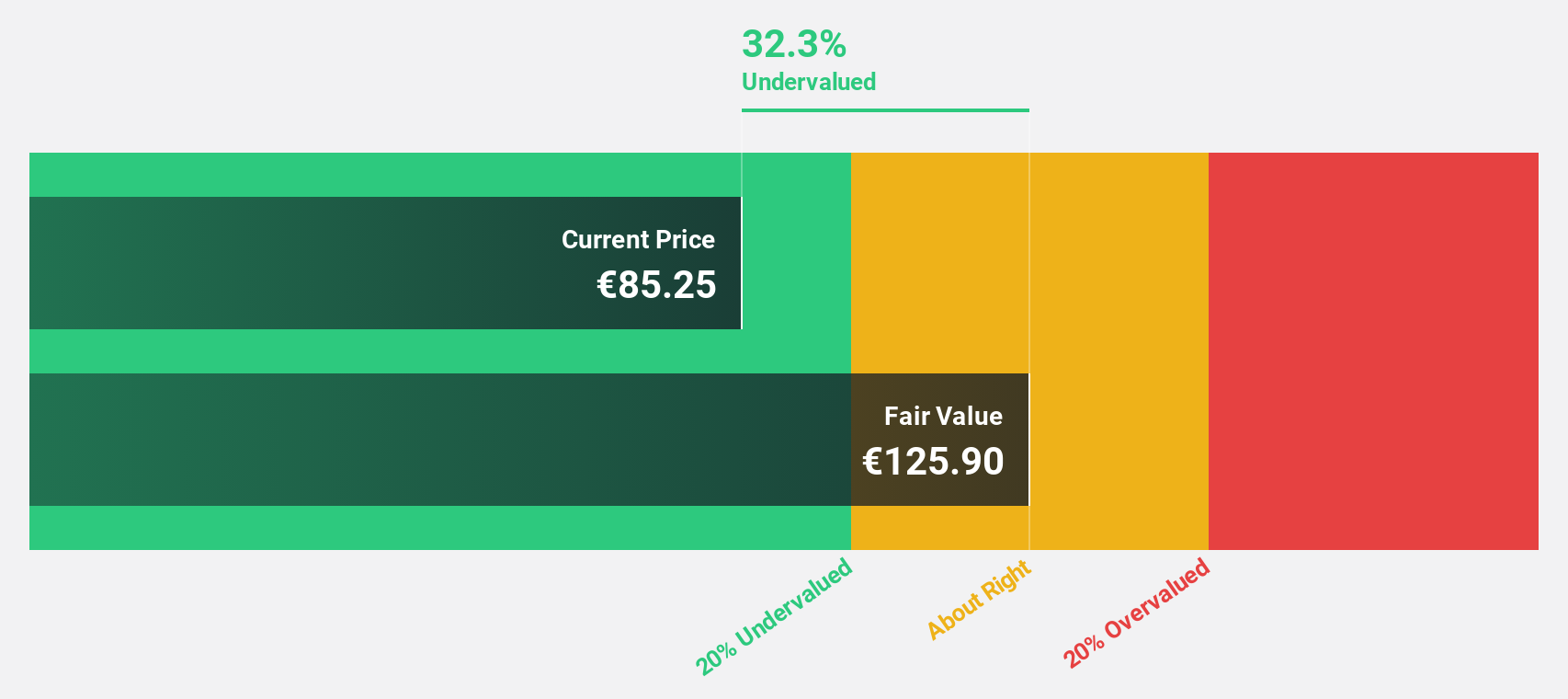

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, along with its subsidiaries, offers sensor solutions for defense and security applications globally and has a market cap of €8.44 billion.

Operations: The company's revenue is primarily generated from its Sensors segment, which accounts for €1.96 billion, followed by the Optronics segment at €363 million.

Estimated Discount To Fair Value: 12%

Hensoldt is trading at €73.1, below its estimated fair value of €83.09, indicating undervaluation based on cash flows. The company reported a net loss of €30 million for Q1 2025 despite increased sales to €395 million from the previous year. Forecasted annual earnings growth of 28.3% surpasses the German market average, yet interest payments remain poorly covered by earnings. Hensoldt's revenue and profit growth projections suggest potential for improved financial performance amidst recent volatility.

- Upon reviewing our latest growth report, Hensoldt's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Hensoldt with our detailed financial health report.

Key Takeaways

- Click this link to deep-dive into the 174 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives