- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Does Exail Technologies’ SBF 120 Inclusion Signal a Turning Point for ENXTPA:EXA’s Investment Narrative?

Reviewed by Sasha Jovanovic

- Exail Technologies was recently added to the SBF 120 Index following the release of its half-year results, which showed sales of €230.79 million and net income of €1.31 million for the period ended June 30, 2025.

- This combination of strong operational performance and index inclusion reflects growing recognition of the company’s improved financial standing and market presence.

- We’ll explore what Exail Technologies’ sales growth and return to profitability mean for its evolving investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Exail Technologies' Investment Narrative?

To be a shareholder in Exail Technologies right now is to buy into a story of turnaround and expanding market recognition. The company’s recent addition to the SBF 120 Index is timely, coming on the heels of stronger than expected half-year results and major contract wins in both civil and defense technology. Inclusion in this widely tracked benchmark could support investor sentiment and trading liquidity, affecting short-term catalysts such as analyst coverage and fund flows. At the same time, rising revenue and a move to profitability may reduce concerns about execution risk, at least in the near term. Yet, pricing remains high relative to sales and peers, and the share price has experienced meaningful volatility despite this momentum. Investors should watch closely to see if these positive developments can convert into sustained earnings while keeping an eye on valuation and volatility risk. On the flipside, that premium valuation could expose investors to sharper shifts in sentiment if growth stalls.

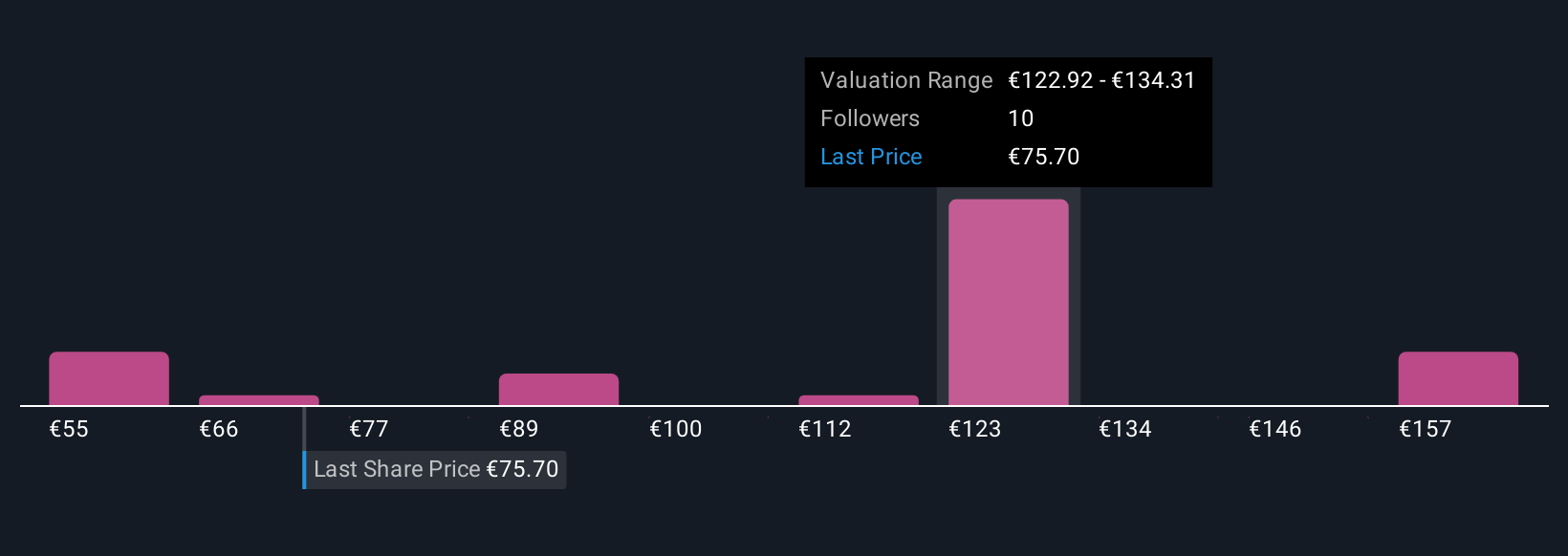

Exail Technologies' share price has been on the slide but might be up to 9% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 9 other fair value estimates on Exail Technologies - why the stock might be worth as much as 29% more than the current price!

Build Your Own Exail Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exail Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Exail Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exail Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in