3 Euronext Paris Stocks Estimated To Be Trading Below Intrinsic Value By Up To 40.2%

Reviewed by Simply Wall St

As tensions in the Middle East escalate and global markets react, European indices, including France's CAC 40, have experienced notable declines. Amidst this cautious investor sentiment and potential shifts in monetary policy by the European Central Bank, opportunities may arise for discerning investors to identify stocks trading below their intrinsic value. In such a climate, focusing on companies with strong fundamentals and resilience can be key to finding undervalued stocks that might offer potential upside as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €29.30 | €57.57 | 49.1% |

| Vivendi (ENXTPA:VIV) | €10.23 | €18.03 | 43.3% |

| Lectra (ENXTPA:LSS) | €28.85 | €53.33 | 45.9% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.11 | 40.1% |

| EKINOPS (ENXTPA:EKI) | €3.75 | €6.64 | 43.5% |

| Solutions 30 (ENXTPA:S30) | €1.322 | €2.45 | 46% |

| Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €22.50 | €39.61 | 43.2% |

| Exail Technologies (ENXTPA:EXA) | €17.96 | €30.02 | 40.2% |

| Vogo (ENXTPA:ALVGO) | €3.22 | €6.36 | 49.4% |

| OVH Groupe (ENXTPA:OVH) | €6.61 | €11.89 | 44.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies offers robotics, maritime, navigation, aerospace, and photonics technology solutions both in France and internationally with a market cap of €305.21 million.

Operations: Exail Technologies generates its revenue through its robotics, maritime, navigation, aerospace, and photonics technology solutions in both domestic and international markets.

Estimated Discount To Fair Value: 40.2%

Exail Technologies is trading at €17.96, significantly below its estimated fair value of €30.02, indicating it may be undervalued based on cash flows. Despite recent earnings showing a net loss of €3.71 million for the half year ended June 2024, revenue growth is forecasted at 13.8% annually, outpacing the French market's average. Analysts expect profitability within three years and anticipate a 29.7% stock price increase from current levels.

- The growth report we've compiled suggests that Exail Technologies' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Exail Technologies.

Exclusive Networks (ENXTPA:EXN)

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue segments are comprised of €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

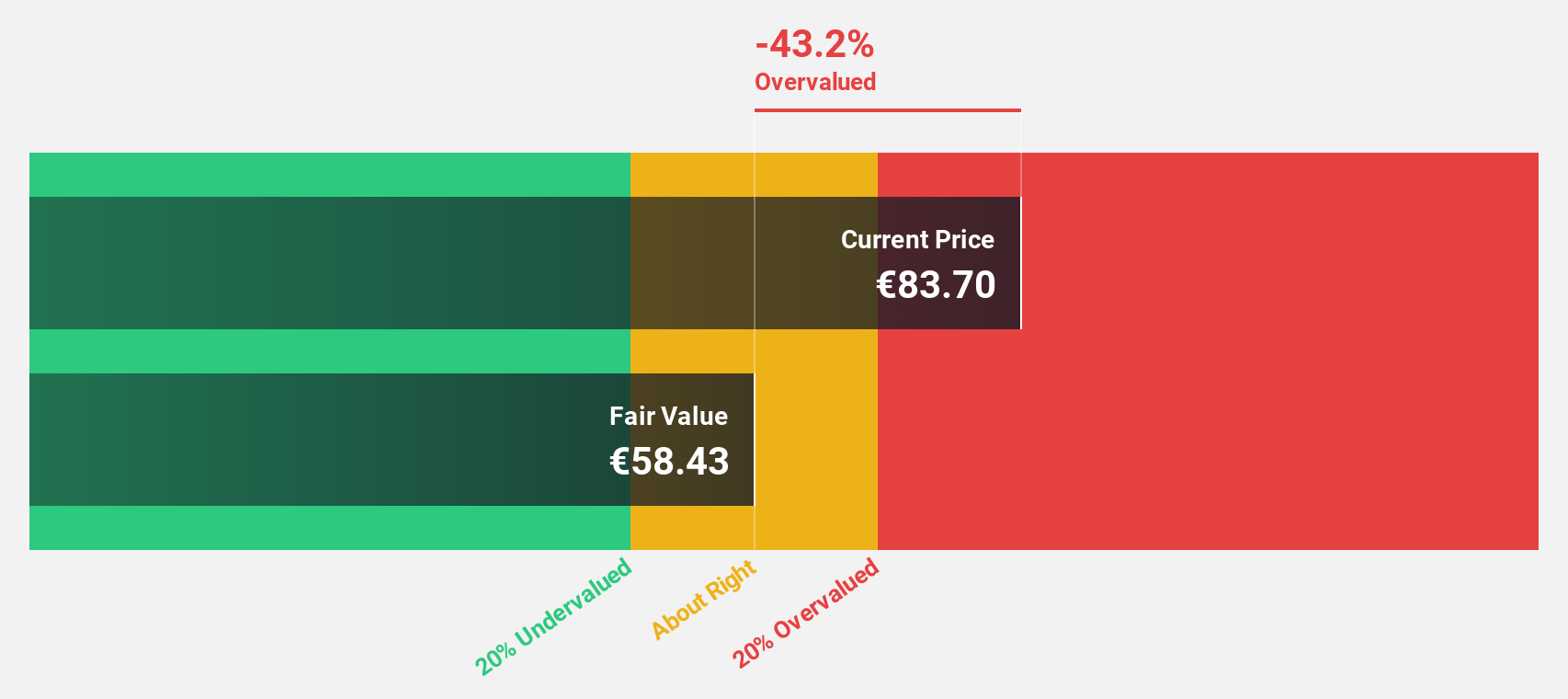

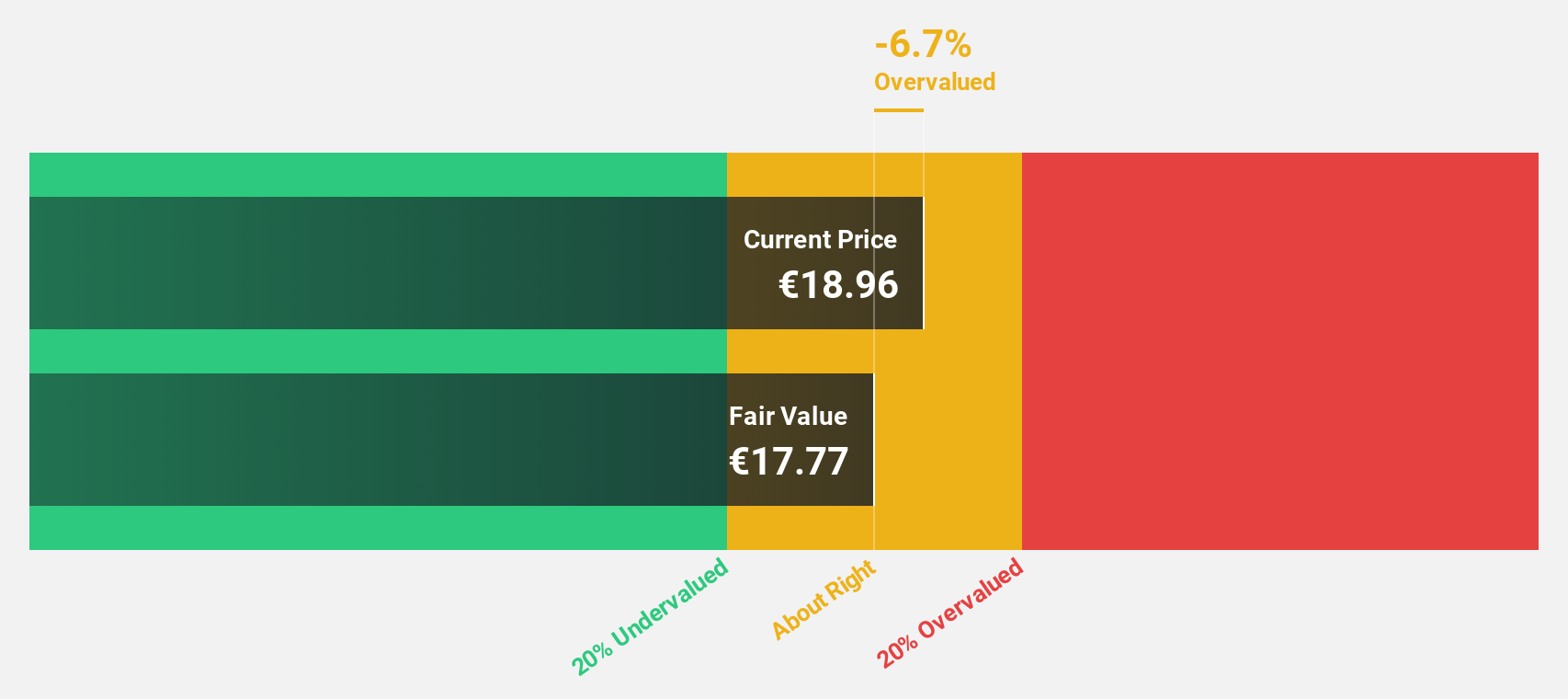

Estimated Discount To Fair Value: 14.6%

Exclusive Networks is trading at €23.65, slightly below its estimated fair value of €27.7, suggesting it could be undervalued based on cash flows. Earnings are projected to grow significantly at 33.5% annually, outpacing the French market's average growth rate of 12.1%. However, recent earnings reports show a decline in net income and profit margins compared to the previous year. A proposed acquisition by CD&R and Permira values the company at €2.2 billion with a premium offer per share.

- According our earnings growth report, there's an indication that Exclusive Networks might be ready to expand.

- Take a closer look at Exclusive Networks' balance sheet health here in our report.

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of €5.75 billion.

Operations: The company's revenue segments include North-Western Europe at €1.89 billion and Global Services Energy at €684.90 million.

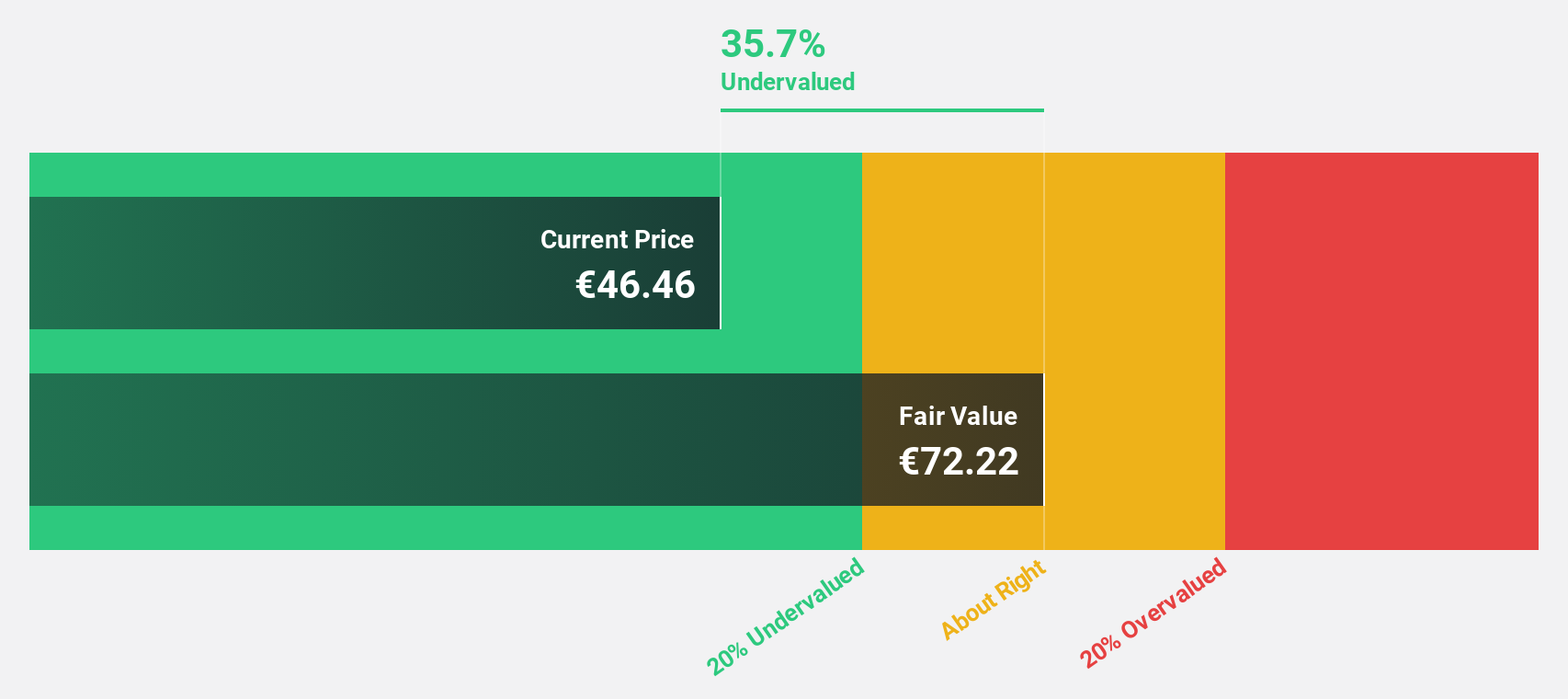

Estimated Discount To Fair Value: 35.7%

SPIE is trading at €34.46, well below its estimated fair value of €53.61, indicating it is undervalued based on cash flows. Earnings are expected to grow significantly at 20.1% annually, surpassing the French market's growth rate of 12.1%. However, SPIE faces challenges with a high level of debt and an unstable dividend track record despite recent increases in interim dividends to €0.25 per share for September 2024.

- Our comprehensive growth report raises the possibility that SPIE is poised for substantial financial growth.

- Get an in-depth perspective on SPIE's balance sheet by reading our health report here.

Next Steps

- Reveal the 22 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives