- France

- /

- Construction

- /

- ENXTPA:EN

Most Shareholders Will Probably Agree With Bouygues SA's (EPA:EN) CEO Compensation

Key Insights

- Bouygues' Annual General Meeting to take place on 25th of April

- Total pay for CEO Olivier Roussat includes €1.50m salary

- The overall pay is comparable to the industry average

- Bouygues' total shareholder return over the past three years was 23% while its EPS grew by 15% over the past three years

Performance at Bouygues SA (EPA:EN) has been reasonably good and CEO Olivier Roussat has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 25th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Bouygues

How Does Total Compensation For Olivier Roussat Compare With Other Companies In The Industry?

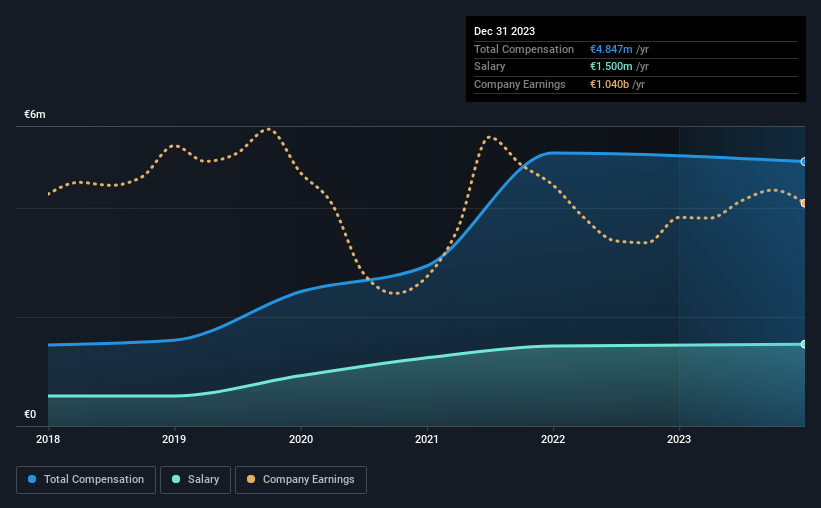

According to our data, Bouygues SA has a market capitalization of €14b, and paid its CEO total annual compensation worth €4.8m over the year to December 2023. That's slightly lower by 3.2% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at €1.5m.

In comparison with other companies in the France Construction industry with market capitalizations over €7.5b, the reported median total CEO compensation was €4.3m. From this we gather that Olivier Roussat is paid around the median for CEOs in the industry.

| Component | 2023 | 2021 | Proportion (2023) |

| Salary | €1.5m | €1.5m | 31% |

| Other | €3.3m | €3.5m | 69% |

| Total Compensation | €4.8m | €5.0m | 100% |

On an industry level, around 49% of total compensation represents salary and 51% is other remuneration. In Bouygues' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Bouygues SA's Growth Numbers

Bouygues SA has seen its earnings per share (EPS) increase by 15% a year over the past three years. It achieved revenue growth of 26% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bouygues SA Been A Good Investment?

With a total shareholder return of 23% over three years, Bouygues SA shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Bouygues that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Bouygues might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives