- France

- /

- Industrials

- /

- ENXTPA:CRI

Earnings Tell The Story For Chargeurs SA (EPA:CRI) As Its Stock Soars 34%

Despite an already strong run, Chargeurs SA (EPA:CRI) shares have been powering on, with a gain of 34% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.4% over the last year.

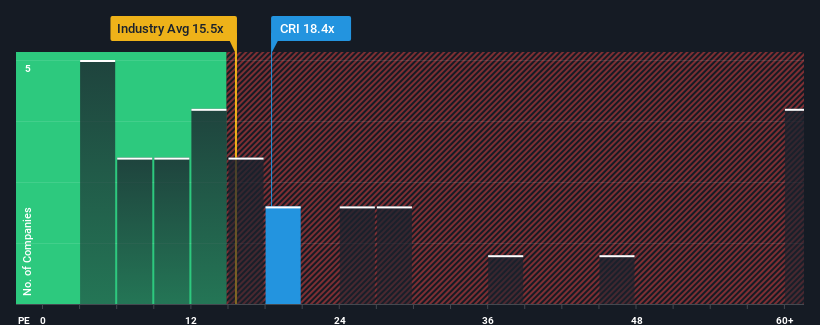

Since its price has surged higher, Chargeurs' price-to-earnings (or "P/E") ratio of 18.4x might make it look like a sell right now compared to the market in France, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Chargeurs' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chargeurs

How Is Chargeurs' Growth Trending?

Chargeurs' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 6.4% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 60% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per annum, which is noticeably less attractive.

In light of this, it's understandable that Chargeurs' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Chargeurs' shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Chargeurs maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Chargeurs (2 are a bit concerning!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CRI

Chargeurs

Operates as an industrial and services company in France, Europe, China, the Middle East, North Africa, Italy, China, the Americas, Asia, and internationally.

Very undervalued with reasonable growth potential.