Slammed 25% Cerinnov Group SA (EPA:ALPCV) Screens Well Here But There Might Be A Catch

The Cerinnov Group SA (EPA:ALPCV) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 120% in the last twelve months.

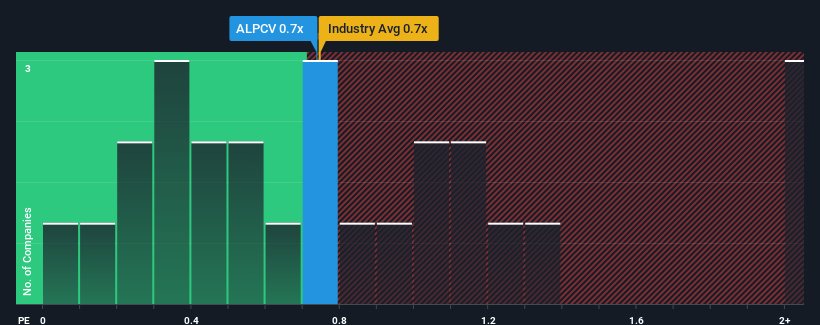

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Cerinnov Group's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in France is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Cerinnov Group

What Does Cerinnov Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Cerinnov Group has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Cerinnov Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cerinnov Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Revenue has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 17% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Cerinnov Group's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Cerinnov Group's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Cerinnov Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Cerinnov Group has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPCV

Cerinnov Group

Designs, manufactures, and markets of machines and equipment for the ceramics, heat treatment, and glass industries in France, rest of Europe, the Americas, Asia, Oceania, and the Middle East.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives