- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR): Valuation Spotlight as Fuel Cell Innovation Reaches Major Milestone

Reviewed by Simply Wall St

If you have Airbus (ENXTPA:AIR) in your sights, recent news from its partnership with Advent Technologies just turned up the heat, literally. The duo reached a major milestone in developing next-generation High-Temperature Proton Exchange Membrane (HT-PEM) fuel cell technology, boosting both power density and efficiency for high-performance aviation applications. It is another sign that Airbus is pushing forward with clean energy solutions that could eventually transform not only its fleet, but also sectors like defense and heavy-duty mobility.

This collaboration breakthrough comes at a time when Airbus’s stock is already showing strong momentum. Over the past year, shares have climbed 52%, with close to 20% gains since the start of the year and an impressive 19% increase in the past 3 months. These moves suggest the market is keeping a close eye on Airbus’s innovation pipeline, and it is not just patent filings. Investors appear to be rewarding tangible advances. Last year’s double-digit revenue and net income growth further paint a picture of a company benefiting from broad industry tailwinds and operational progress.

With this much innovation in play and shares at multi-year highs, the question becomes clear: is Airbus still undervalued after this rally, or are buyers paying up for tomorrow’s growth today?

Most Popular Narrative: 2.7% Undervalued

According to the most widely followed narrative, Airbus is seen as slightly undervalued, with its current share price sitting just below the consensus analyst target. The focus is on robust drivers of demand, and the company’s strong financial outlook has many watchers wondering what could fuel the next leg up.

Rising global demand, sustainability focus, and airline fleet modernization drive strong aircraft sales, margin expansion, and long-term backlog growth. Diversified growth in defense, space, and aftermarket services enhances earnings potential and operational efficiency through ongoing strategic investments.

Curious what assumptions power this bullish view? Momentum is high, but the expected boom in earnings and margins may surprise you. Do you want to know how future industry shifts and Airbus's own aggressive growth bets could play out in key financial metrics? The full breakdown reveals which projections shape the target, as well as the gaps no one is talking about yet.

Result: Fair Value of €197.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain snags and integration obstacles for key suppliers still loom. These challenges threaten Airbus’s ability to meet delivery targets and sustain growth.

Find out about the key risks to this Airbus narrative.Another View: SWS DCF Model Suggests Even Greater Discount

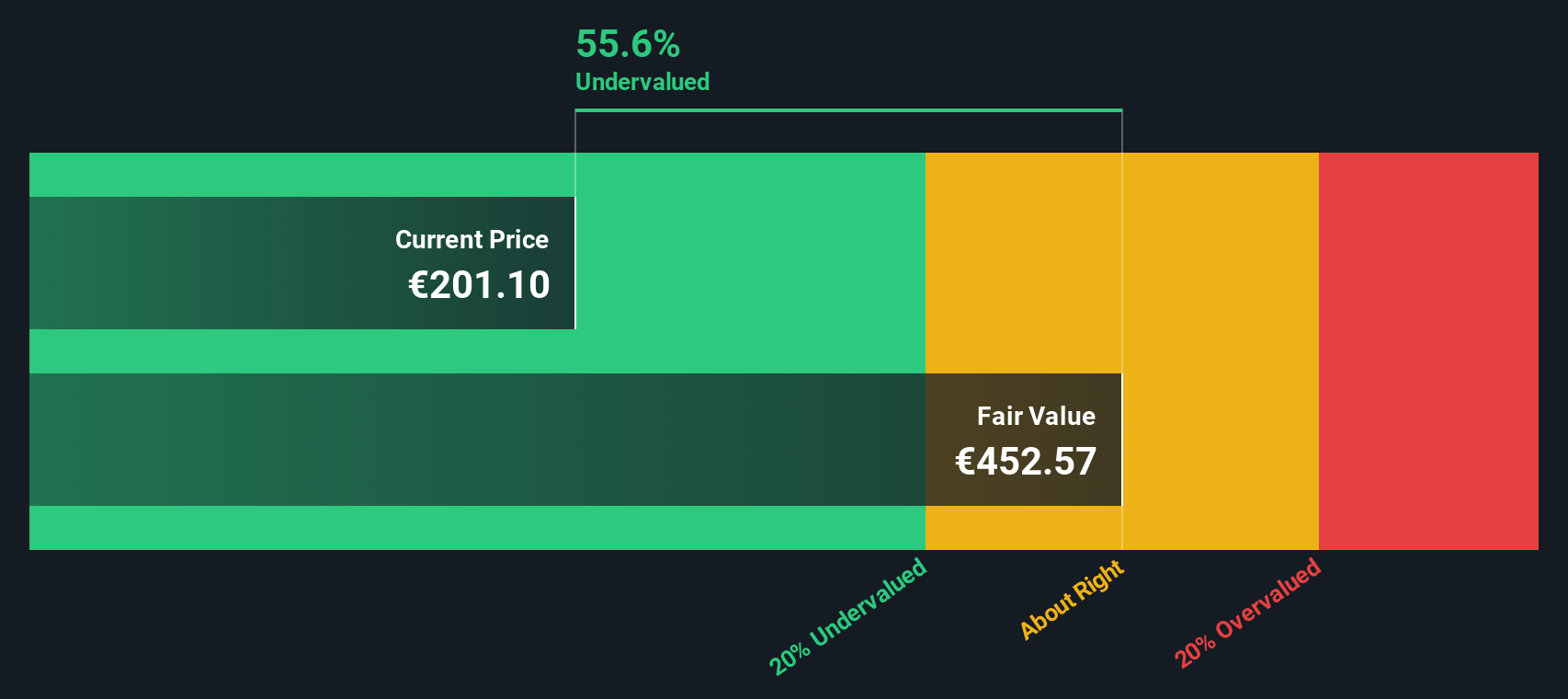

While analysts see Airbus as only slightly undervalued based on market expectations, our SWS DCF model tells a different story and highlights a much deeper discount. Could this gap mean the market is missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Airbus Narrative

If the consensus does not match your perspective or you would rather chart your own course, all the tools are available to let you build a custom outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Airbus.

Looking for More Smart Investment Opportunities?

Don't let your next winning idea pass you by. Unlock fresh investment angles and tap into markets others overlook using these powerful screeners. Your next standout stock could be one click away.

- Spot income gems that deliver reliable cash flow by running your eye over dividend stocks with yields > 3%.

- Catch the latest breakthroughs powering healthcare innovation by searching among healthcare AI stocks.

- Unleash your portfolio's potential by tracking companies that the market hasn't caught up to yet with the power of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives