- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR) Is Down 5.6% After Global A320 Recall Over Solar Radiation Software Risk – What's Changed

Reviewed by Sasha Jovanovic

- In November 2025, Airbus undertook an unprecedented global recall and urgent software updates for around 6,000 A320-family aircraft after discovering that intense solar radiation could disrupt flight control data, resulting in worldwide operational disruptions and mandatory regulatory action.

- The rapid pace of fixes highlights the aviation sector’s vulnerability to emerging technological and environmental risks, as well as the critical role of real-time software management in modern aircraft safety.

- We'll assess how the global safety recall and grounding of A320 jets could affect Airbus’s future earnings outlook and operational execution.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Airbus Investment Narrative Recap

Airbus’s investment appeal centers on its ability to capitalize on rising global air travel demand and fleet renewal cycles. The recent worldwide A320 recall highlights the aviation sector’s sensitivity to technology and regulatory shocks, but does not appear to structurally alter the most important short-term catalyst, ramping up production to satisfy a record order book. The biggest risk remains persistent vulnerabilities across the supply chain and critical suppliers, which could delay deliveries or hinder margin improvement efforts if left unresolved. Of the company’s recent announcements, the revised delivery agreement with Wizz Air stands out as most relevant to the recall event. Order deferrals and fleet mix adjustments by key clients reinforce the need for operational reliability and supplier coordination at a time when rapid, unforeseen technical issues can disrupt both Airbus’s delivery schedule and its customers’ confidence. Yet, investors should also be aware that ongoing supply chain volatility remains a significant watchpoint for Airbus...

Read the full narrative on Airbus (it's free!)

Airbus' narrative projects €98.7 billion revenue and €7.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and a €3.0 billion earnings increase from €4.9 billion today.

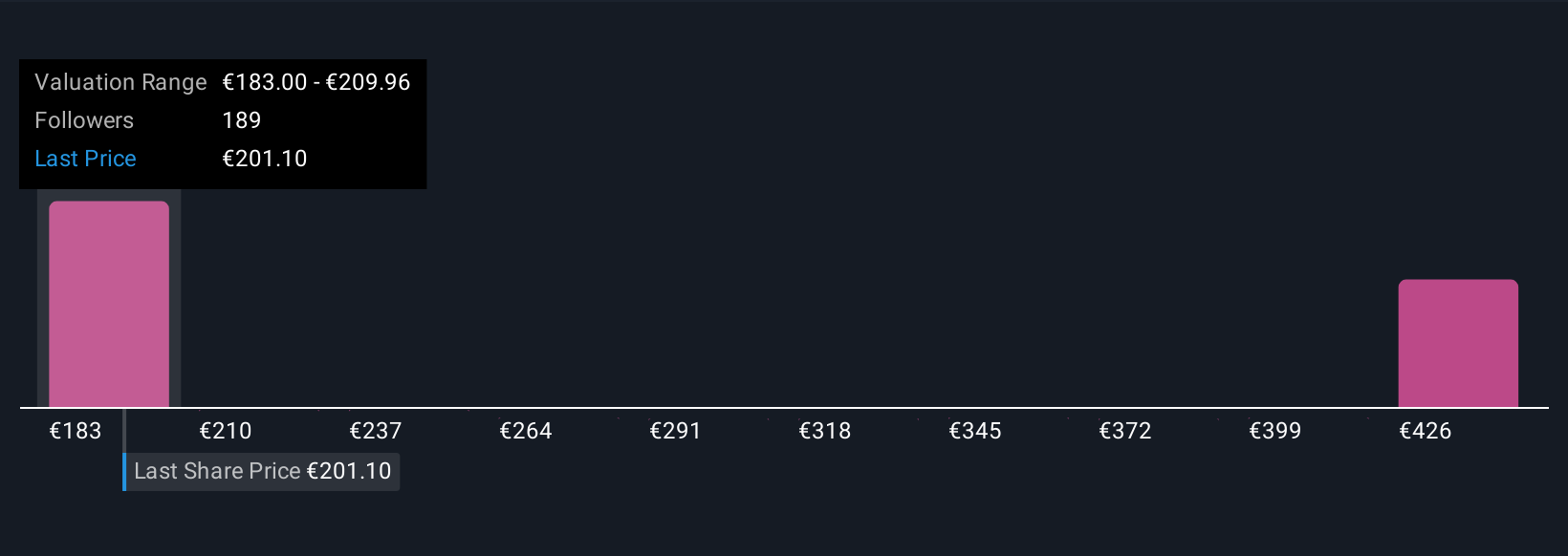

Uncover how Airbus' forecasts yield a €224.40 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Twenty-one private investors in the Simply Wall St Community estimated Airbus’s fair value between €145 and €313 per share, highlighting divergent views. Alongside these varied outlooks, persistent supply chain bottlenecks may hold important implications for Airbus’s future earnings trajectory.

Explore 21 other fair value estimates on Airbus - why the stock might be worth as much as 64% more than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026