- Italy

- /

- Electric Utilities

- /

- BIT:EVISO

Undiscovered European Gems With Strong Fundamentals In March 2025

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty, the European market has shown resilience, with the pan-European STOXX Europe 600 Index recently snapping a ten-week streak of gains. Despite concerns over U.S. trade policies and inflationary pressures, strategic spending initiatives in defense and infrastructure by Germany and the EU have provided some stability to investor sentiment. In such an environment, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities that can withstand market volatility while offering potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

eVISO (BIT:EVISO)

Simply Wall St Value Rating: ★★★★★★

Overview: eVISO S.p.A. operates a platform utilizing artificial intelligence for the commodities market, focusing mainly on Italy, with a market capitalization of approximately €239.67 million.

Operations: eVISO S.p.A.'s primary revenue stream comes from Light, generating €213.39 million, followed by Services at €6.87 million and Gas Sales at €3.87 million. The company's net profit margin is a key indicator of its financial performance in the commodities market.

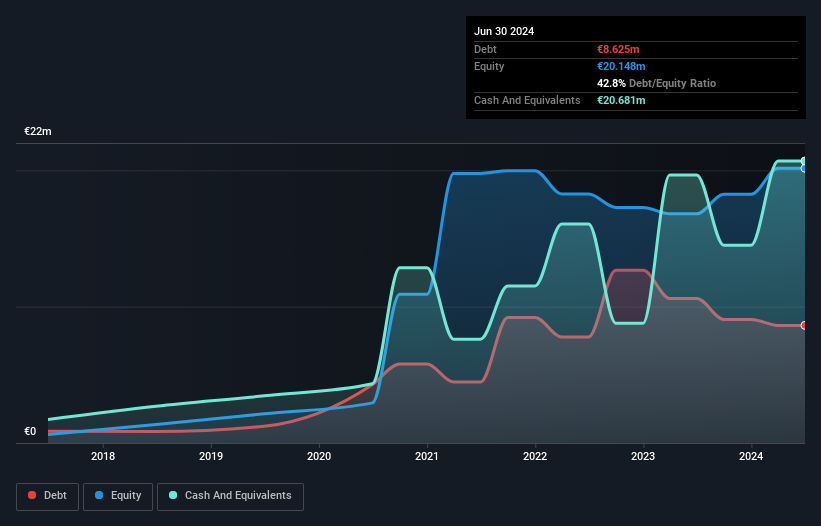

eVISO, a nimble player in the energy sector, has shown promising financial health with its interest payments well covered by EBIT at 12.4x. The company's debt to equity ratio improved significantly from 57.6% to 42.8% over five years, indicating prudent financial management. Trading at a notable 25.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. eVISO recently turned profitable and is expected to grow earnings by an impressive 28.9% annually, positioning it ahead of the industry average of -12%. With high-quality earnings and positive free cash flow, the outlook appears robust for this energetic contender in Europe’s market landscape.

- Click here to discover the nuances of eVISO with our detailed analytical health report.

Examine eVISO's past performance report to understand how it has performed in the past.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: CFM Indosuez Wealth Management SA operates in Monaco and internationally, offering banking and financial solutions to private investors, businesses, institutions, and professionals with a market cap of €704.79 million.

Operations: The company generates revenue primarily from its Wealth Management segment, which accounts for €196.38 million.

With total assets of €7.7 billion and equity at €404.3 million, CFM Indosuez Wealth Management stands out with a robust financial position. The firm's earnings surged by 40% over the past year, significantly outpacing the industry average of 5.3%, highlighting its strong performance. An allowance for bad loans is low at 34%, and non-performing loans are well-managed at 0.8%. Its price-to-earnings ratio of 11.6x offers value compared to the French market's 15.1x, while customer deposits form a substantial portion (85%) of its low-risk funding structure, ensuring financial stability amidst market fluctuations.

- Unlock comprehensive insights into our analysis of CFM Indosuez Wealth Management stock in this health report.

Learn about CFM Indosuez Wealth Management's historical performance.

Meko (OM:MEKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Meko AB (publ) is engaged in the automotive aftermarket industry across Sweden, Norway, Denmark, Poland, Estonia, Latvia, Lithuania, and Finland with a market capitalization of approximately SEK7.05 billion.

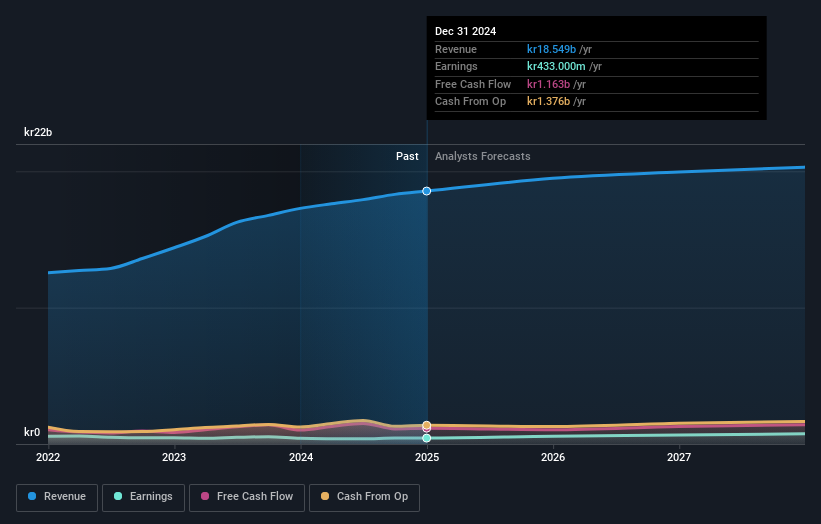

Operations: Meko generates revenue primarily from its operations in Sweden/Norway (SEK6.83 billion), Denmark (SEK4.36 billion), and Poland/The Baltics (SEK4.35 billion). The company also has a presence in Finland and Sørensen Og Balchen in Norway, contributing SEK1.49 billion and SEK1.01 billion respectively to its revenue streams.

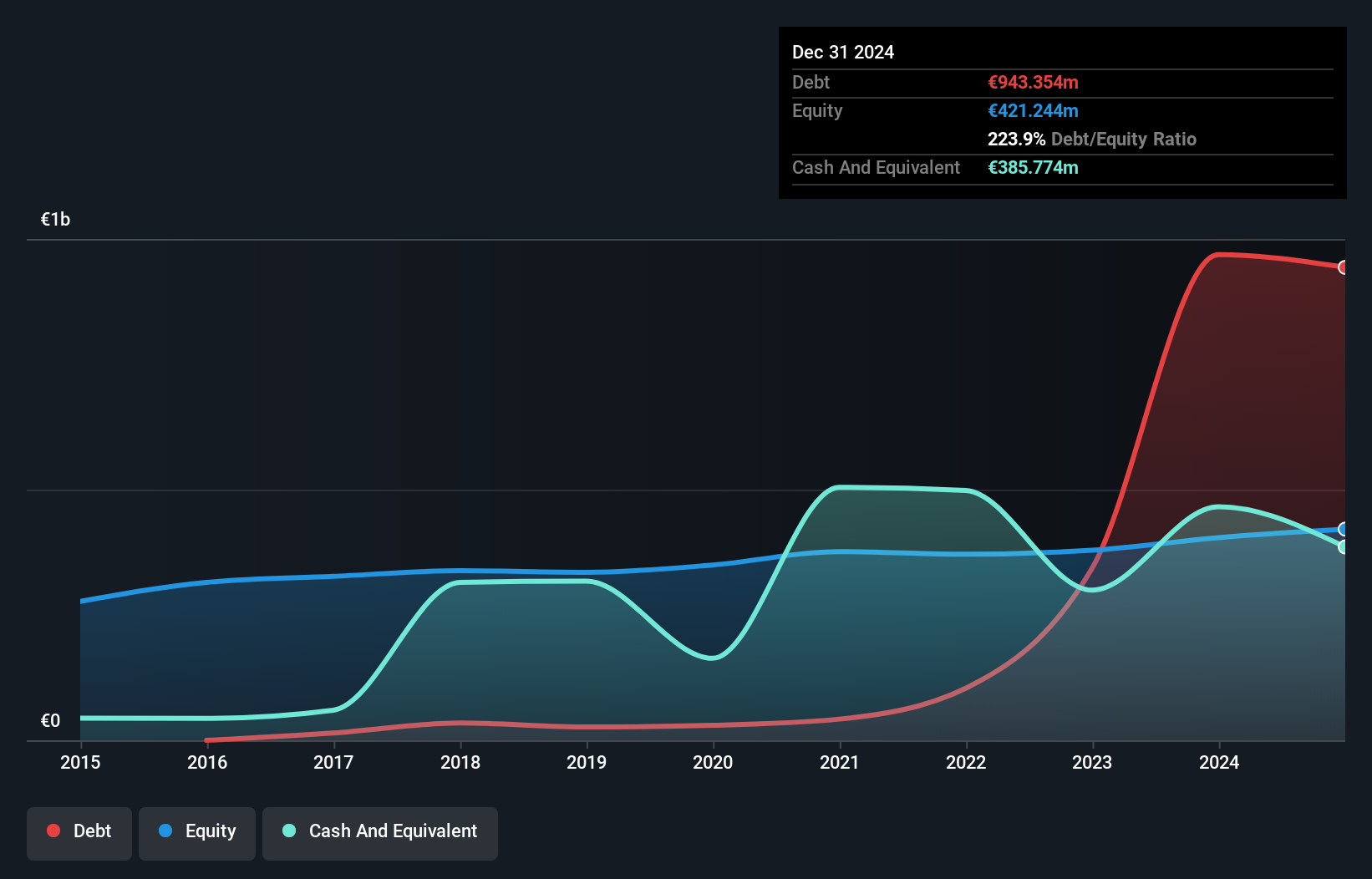

Meko, a player in the Nordic and Baltic automotive aftermarket, is eyeing growth through automated warehouses in Denmark, Norway, and Finland. These initiatives are likely to boost efficiency and cut costs, potentially improving net margins from 2.3% to 3.7%. The company's debt to equity ratio has impressively decreased from 94% to 49.2% over five years, yet remains high at 40.1%. Despite reporting a net loss of SEK 4 million for Q4 2024 with sales of SEK 4.65 billion, Meko's strategic focus could enhance profitability as analysts foresee earnings reaching SEK 754 million by February 2028 with a price target of SEK150 per share.

Where To Now?

- Get an in-depth perspective on all 372 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:EVISO

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)