Société Générale Société anonyme's (EPA:GLE) Shareholders Will Receive A Smaller Dividend Than Last Year

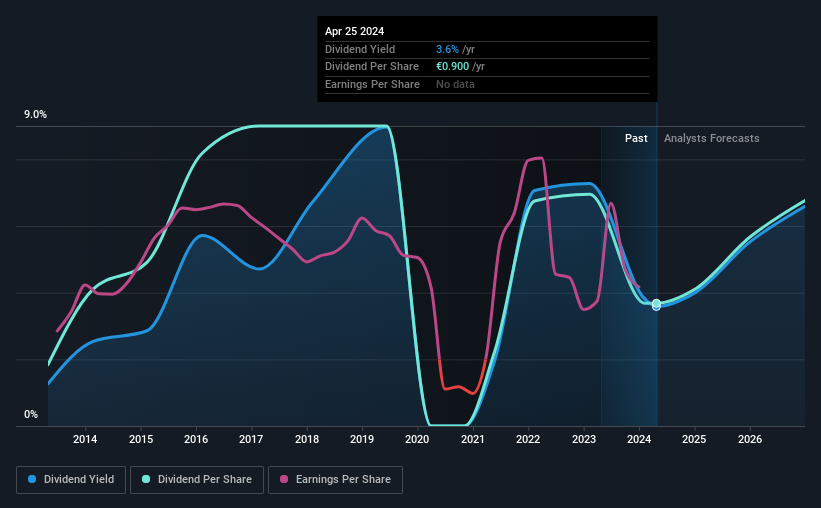

Société Générale Société anonyme's (EPA:GLE) dividend is being reduced from last year's payment covering the same period to €0.90 on the 29th of May. This payment takes the dividend yield to 3.6%, which only provides a modest boost to overall returns.

Check out our latest analysis for Société Générale Société anonyme

Société Générale Société anonyme's Earnings Will Easily Cover The Distributions

Even a low dividend yield can be attractive if it is sustained for years on end.

Société Générale Société anonyme has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions do not necessarily guarantee future ones, but Société Générale Société anonyme's payout ratio of 41% is a good sign as this means that earnings decently cover dividends.

Looking forward, EPS is forecast to rise by 175.7% over the next 3 years. Analysts forecast the future payout ratio could be 27% over the same time horizon, which is a number we think the company can maintain.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the dividend has gone from €0.45 total annually to €0.90. This means that it has been growing its distributions at 7.2% per annum over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Société Générale Société anonyme's EPS has fallen by approximately 13% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While Société Générale Société anonyme is earning enough to cover the dividend, we are generally unimpressed with its future prospects. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Société Générale Société anonyme that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GLE

Société Générale Société anonyme

Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.