Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a week marked by U.S. stock indexes nearing record highs and inflation data fueling expectations for prolonged higher interest rates, small-cap stocks have lagged behind their larger counterparts, as evidenced by the Russell 2000 Index trailing the S&P 500. Amid these conditions, identifying promising small-cap stocks requires a keen eye for companies with robust fundamentals and growth potential that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 20.39% | 14.25% | 10.66% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Luxchem Corporation Berhad | 12.60% | -1.14% | -3.40% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market capitalization of €557.79 million.

Operations: CRTO generates revenue primarily from its Proximity Bank segment, which accounts for €254.46 million, alongside Management for Own Account and Miscellaneous activities contributing €94.09 million.

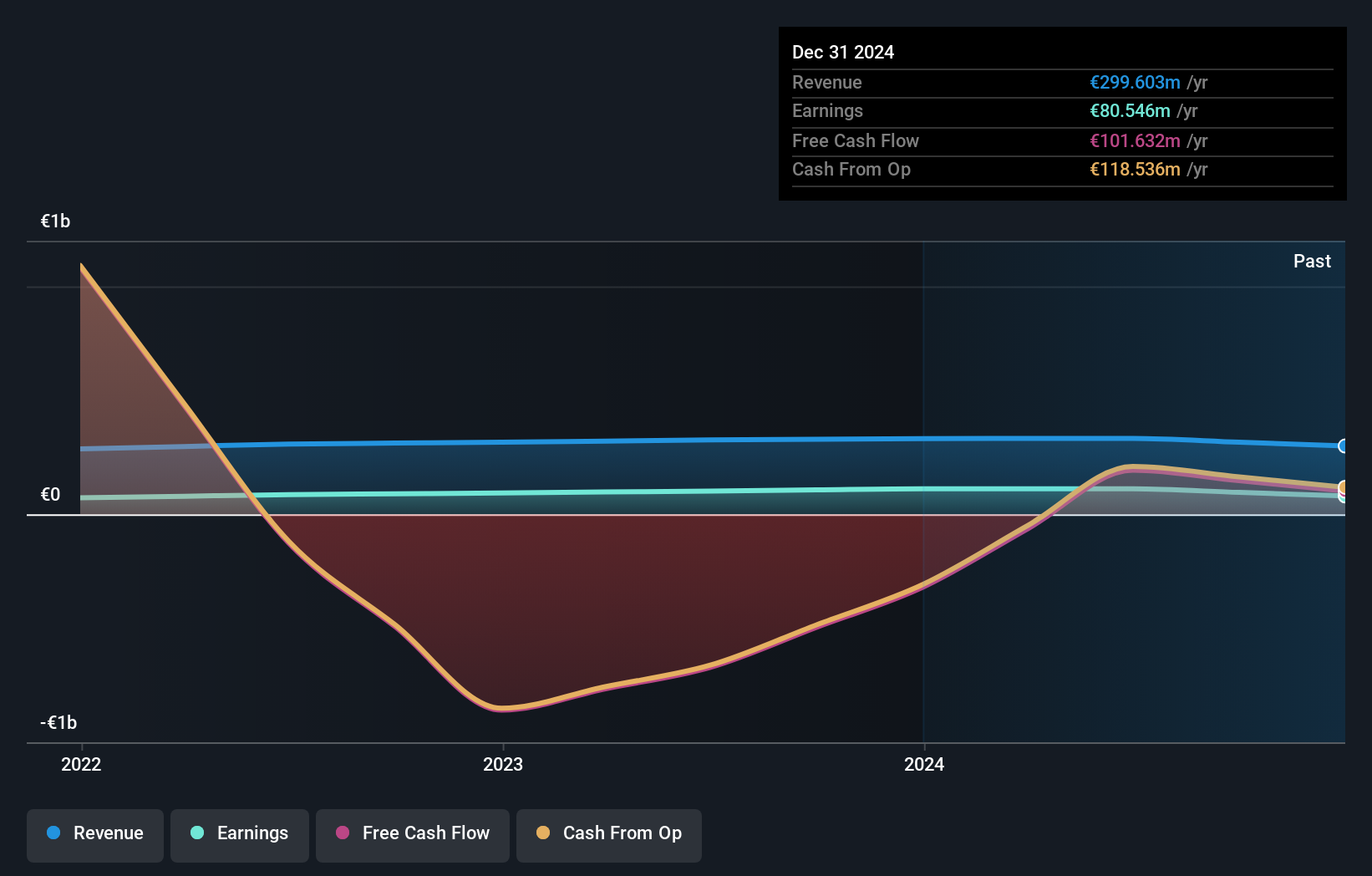

Crédit Agricole Touraine Poitou, with total assets of €16.9B and equity of €2.7B, stands out for its robust financial health. The bank's liabilities are primarily low-risk due to customer deposits making up 95% of the funding sources, which is less risky than external borrowing. It trades at 41.7% below estimated fair value, suggesting potential undervaluation in the market. With a non-performing loans ratio at an appropriate 1.3%, and a sufficient allowance for bad loans at 132%, it manages credit risk effectively while boasting earnings growth of 9.3% over the past year, surpassing industry averages.

Yindu Kitchen Equipment (SHSE:603277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yindu Kitchen Equipment Co., Ltd focuses on the research, development, production, sale, and service of commercial catering equipment both in China and internationally, with a market cap of CN¥11.50 billion.

Operations: Yindu Kitchen Equipment generates revenue primarily from the sale of commercial catering equipment. The company's financials highlight a net profit margin trend worth noting, as it provides insight into its profitability relative to total revenue.

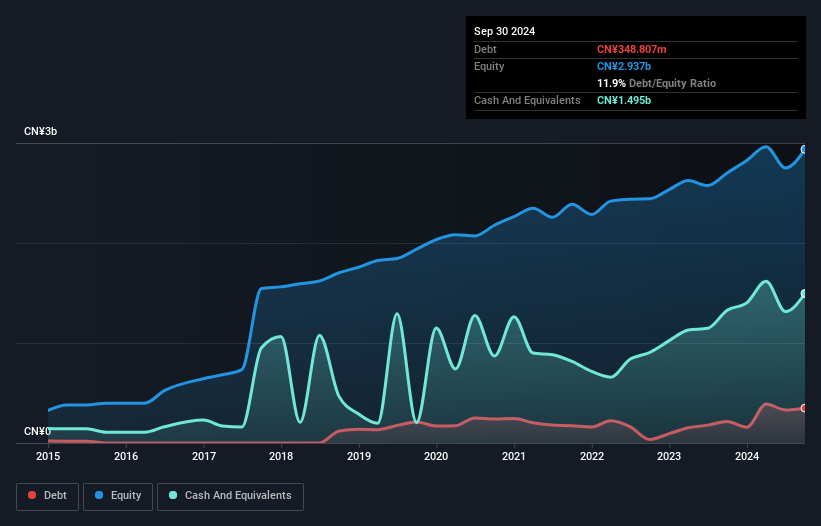

In the bustling world of kitchen equipment, Yindu stands out with its robust financial performance and promising prospects. Over the past year, its earnings surged by 20%, outpacing the broader Machinery industry which saw a -0.06% change. Yindu's debt to equity ratio has slightly risen from 10.9% to 11.9% over five years, yet it holds more cash than total debt, indicating solid financial health. Trading at a price-to-earnings ratio of 19.7x compared to the CN market's 36.5x suggests it's valued attractively against peers and industry standards, hinting at potential value for investors seeking growth opportunities in this niche sector.

- Click to explore a detailed breakdown of our findings in Yindu Kitchen Equipment's health report.

Assess Yindu Kitchen Equipment's past performance with our detailed historical performance reports.

Sinotherapeutics (SHSE:688247)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinotherapeutics Inc. is a specialty pharmaceutical company that focuses on developing generic and formulation products in China, with a market cap of CN¥4.86 billion.

Operations: The company generates revenue primarily from its pharmaceutical manufacturing segment, amounting to CN¥449.12 million.

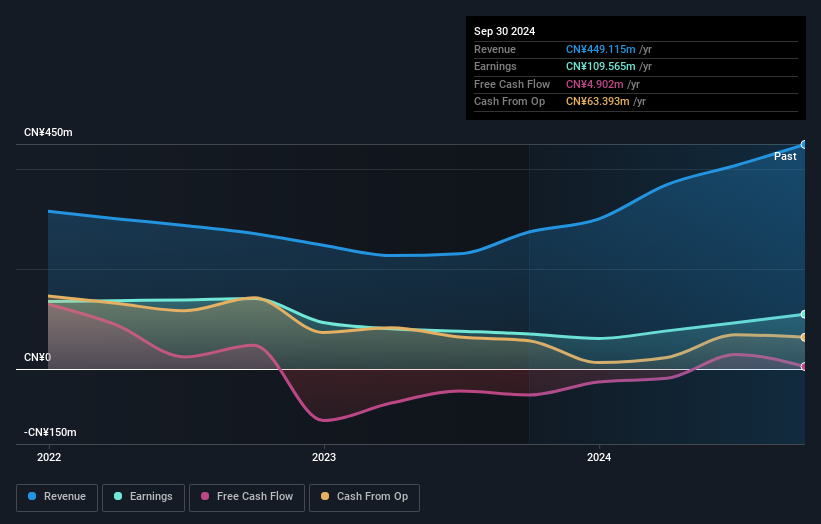

Sinotherapeutics, a nimble player in the pharmaceutical sector, has demonstrated impressive earnings growth of 56.7% over the past year, outpacing the industry average of -2.5%. With no debt on its balance sheet for five years and high-quality non-cash earnings contributing to its robust financial health, it stands out among peers. The company recently completed a share buyback program, repurchasing 4.34 million shares for CNY 36.13 million by February 2025. Despite fluctuations in free cash flow over recent years, it remains positive at CNY 4.9 million as of September 2024, indicating sound financial management strategies are in place.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4742 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603277

Yindu Kitchen Equipment

Engages in the research, development, production, sale, and service of commercial catering equipment in China and Internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives