As European markets navigate a period of mixed performance, with the STOXX Europe 600 Index remaining relatively stable amidst ongoing trade discussions with the U.S., investors are keenly observing opportunities for steady income. In this context, dividend stocks can be particularly appealing, offering potential stability and income through regular payouts even when market conditions are uncertain.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.10% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.60% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.84% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| ERG (BIT:ERG) | 5.30% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.54% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ERG (BIT:ERG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: ERG S.p.A. operates through its subsidiaries to produce energy from renewable sources across several European countries, including Italy, France, and Germany, with a market cap of €2.72 billion.

Operations: ERG S.p.A. generates revenue by producing energy from renewable sources across various European nations, including the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

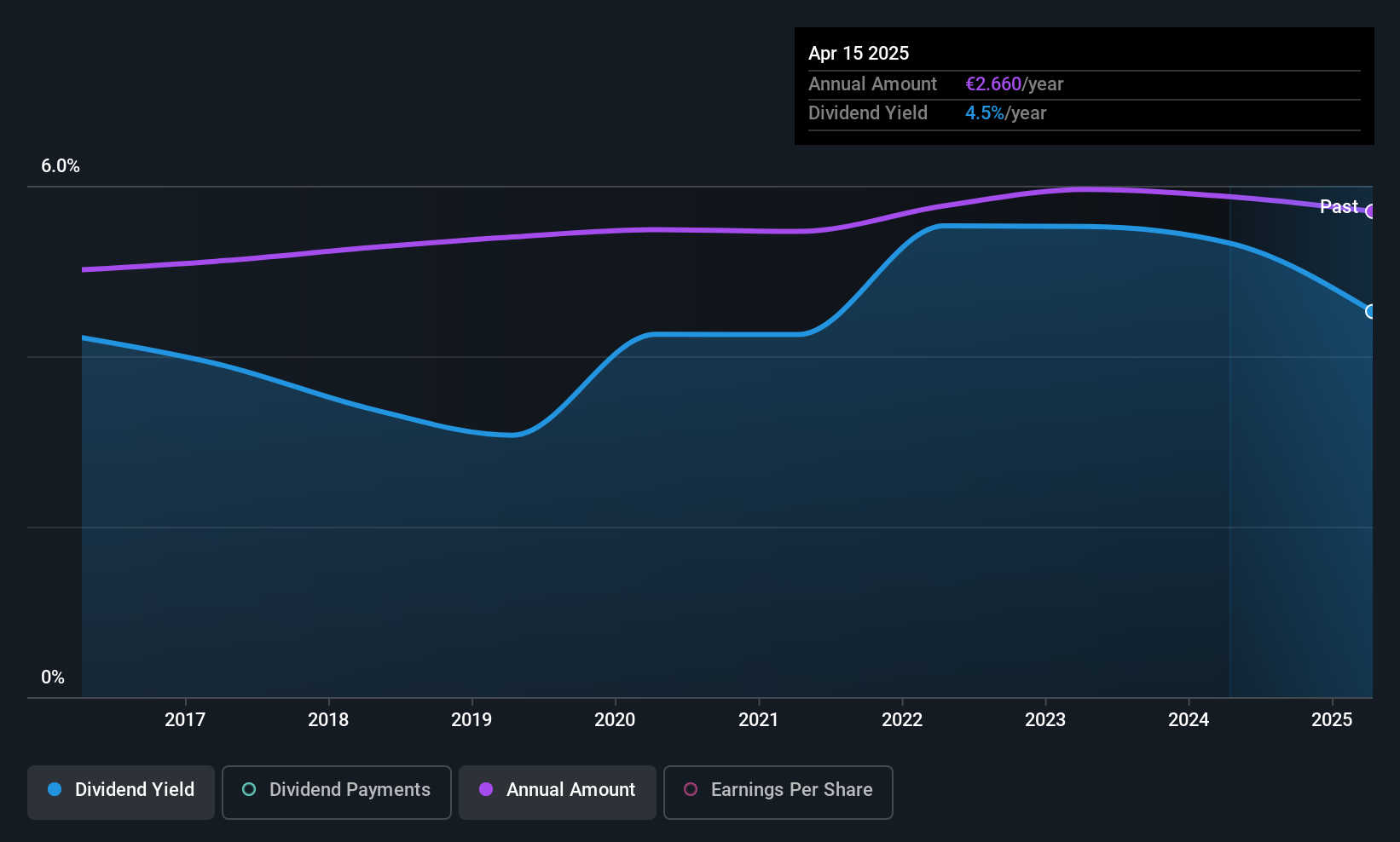

Dividend Yield: 5.3%

ERG offers a reliable dividend profile with stable and growing payouts over the past decade. Its dividend yield of 5.3% ranks in the top 25% in Italy, supported by a reasonable cash payout ratio of 65.1%. The company's earnings and cash flows adequately cover its dividends, with a payout ratio of 78.2%. Despite recent declines in sales and net income, ERG maintains attractive valuation metrics like a P/E ratio below industry average.

- Get an in-depth perspective on ERG's performance by reading our dividend report here.

- According our valuation report, there's an indication that ERG's share price might be on the expensive side.

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is engaged in the production and sale of food packaging products both in France and internationally, with a market cap of €539.82 million.

Operations: Groupe Guillin S.A.'s revenue is primarily derived from its Packaging Sector, which accounts for €818 million, complemented by the Material Sector contributing €51.67 million.

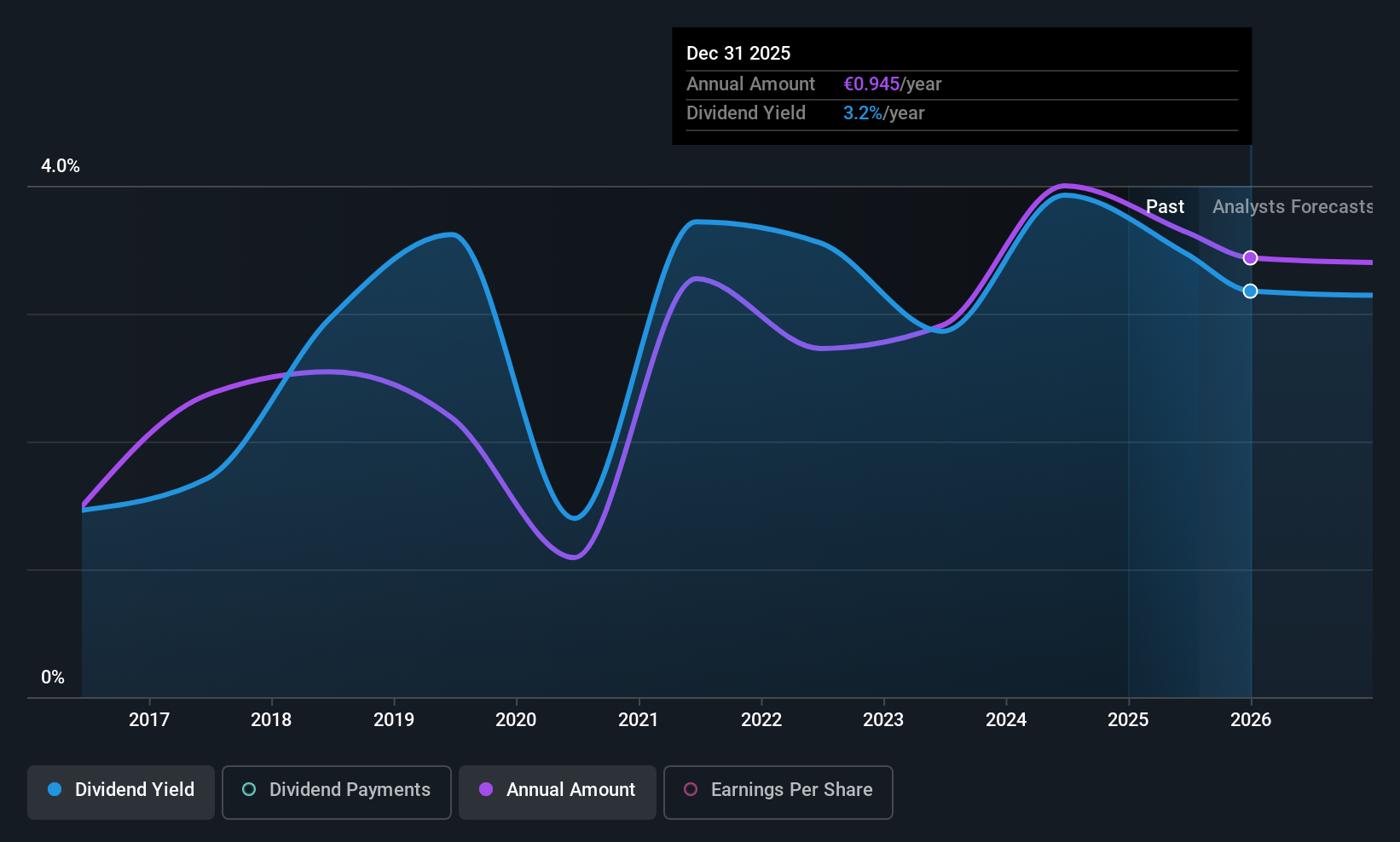

Dividend Yield: 3.4%

Groupe Guillin's dividend payments have been volatile over the past decade, with a recent annual dividend of €1.00 per share. The dividends are well-covered by earnings (payout ratio: 30.9%) and cash flows (cash payout ratio: 63.2%), though the yield of 3.41% is below top-tier French payers. Despite trading at good value relative to peers, earnings are forecasted to decline slightly in the coming years, posing potential challenges for dividend sustainability.

- Take a closer look at Groupe Guillin's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Groupe Guillin is priced lower than what may be justified by its financials.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse clients in France, with a market cap of €1.23 billion.

Operations: The company's revenue is primarily derived from Retail Banking in France, which accounts for €456.43 million.

Dividend Yield: 4.2%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc has consistently increased its dividends over the past decade, maintaining stability with minimal volatility. The current dividend yield of 4.19% is below the top tier in France but remains attractive due to a modest payout ratio of 30.3%, indicating strong earnings coverage. Trading at 28.5% below estimated fair value suggests potential undervaluation, though future dividend coverage remains uncertain due to insufficient data on earnings projections.

- Navigate through the intricacies of Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be too pessimistic.

Make It Happen

- Click through to start exploring the rest of the 225 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALGIL

Groupe Guillin

Produces and sells food packaging products in France, the United Kingdom, Italy, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives