- Finland

- /

- Capital Markets

- /

- HLSE:EVLI

Discovering 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of economic indicators, with U.S. consumer confidence dipping and durable goods orders declining, investors are keenly observing the performance of small-cap stocks, like those in the S&P 600 Index. In this environment, identifying promising opportunities requires a focus on companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics with a market cap of €503.58 million.

Operations: Clínica Baviera generates revenue primarily from its ophthalmology services, amounting to €252.47 million.

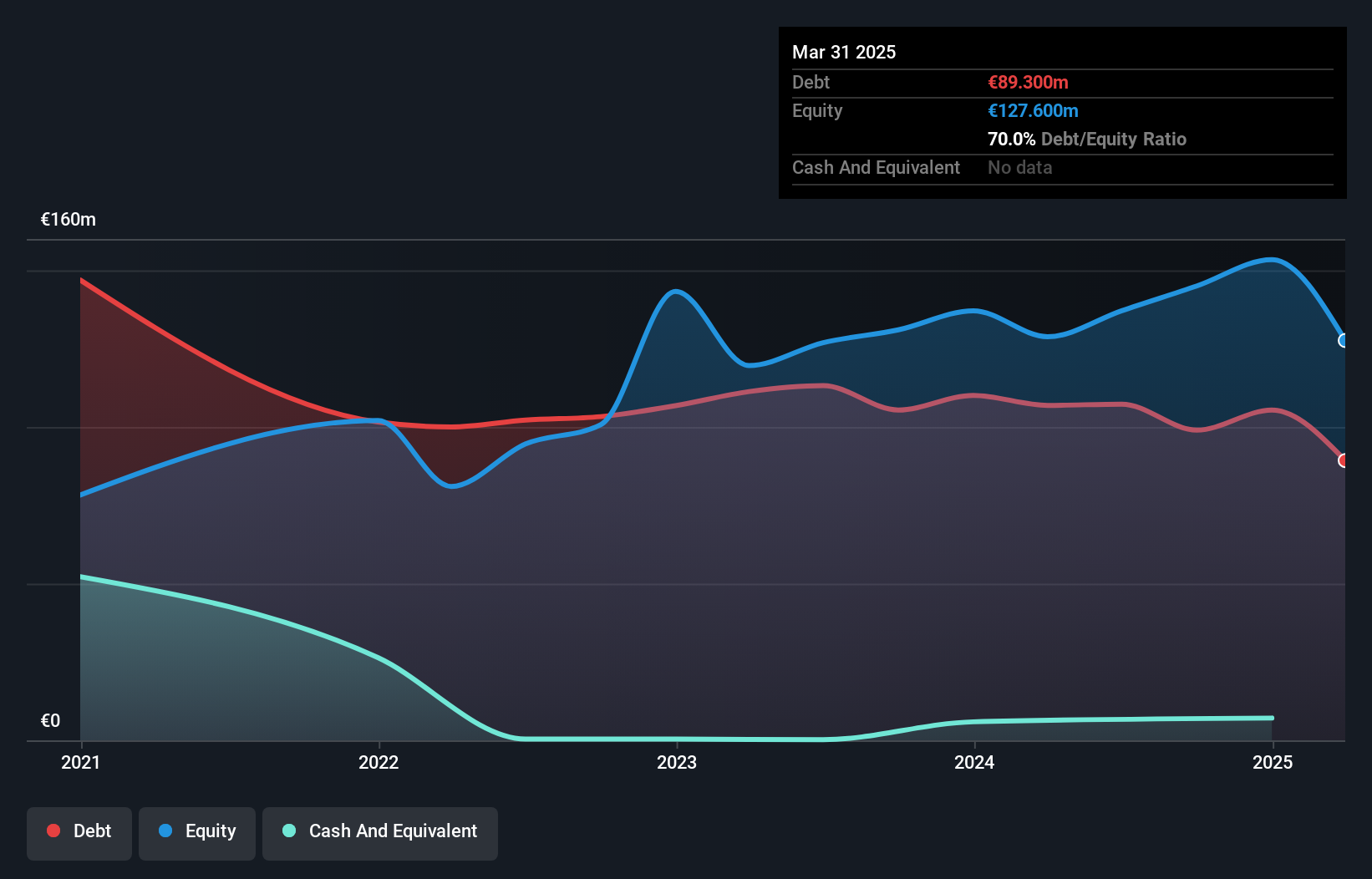

Clínica Baviera, a notable player in the healthcare sector, has shown robust financial health with its debt to equity ratio dropping significantly from 63.2% to 9.5% over five years. Despite its earnings growth of 14.9% last year, it slightly lagged behind the broader industry growth of 15.5%. The company reported sales of €189 million for the nine months ending September 2024, a rise from €163.59 million in the previous year, while net income saw an increase to €28.02 million from €26.92 million. Trading at a discount of 43%, Clínica Baviera appears undervalued relative to its estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of Clínica Baviera.

Understand Clínica Baviera's track record by examining our Past report.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse customer groups in France, with a market cap of approximately €1.09 billion.

Operations: The cooperative generates revenue primarily through its diverse banking products and services offered to various customer segments in France. With a market capitalization of approximately €1.09 billion, its financial performance is reflected in the profitability metrics, where net profit margin trends provide insights into operational efficiency and cost management strategies.

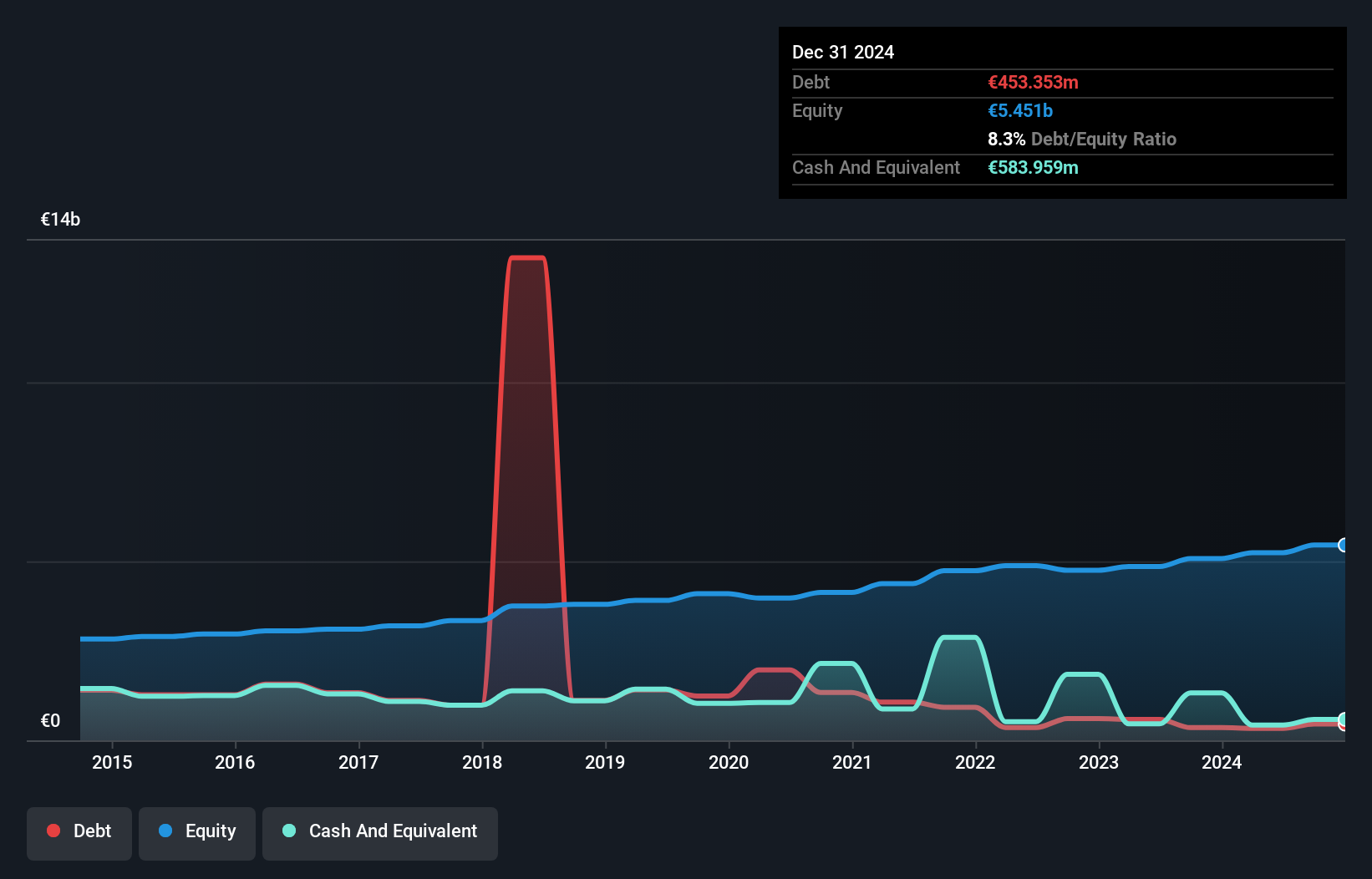

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, a cooperative bank with €35.3B in assets and €5.2B in equity, presents an intriguing investment case. With 94% of its liabilities funded through low-risk customer deposits, it seems to have a stable funding base. The bank's allowance for bad loans stands at 133%, which is sufficient given the non-performing loan ratio of 1.4%. Despite trading at nearly 59% below estimated fair value, its earnings growth over the last five years has been modest at 4.2% annually and did not outpace industry growth recently.

Evli Oyj (HLSE:EVLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Evli Oyj is an asset management company that, along with its subsidiaries, provides services to institutional, corporate, and private clients across Finland, Sweden, and internationally with a market capitalization of €474.08 million.

Operations: Evli Oyj generates revenue primarily from its Wealth Management and Investor Clients segment, contributing €91.10 million, followed by Advisory and Corporate Clients at €12.80 million, and Group Operations at €9.20 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

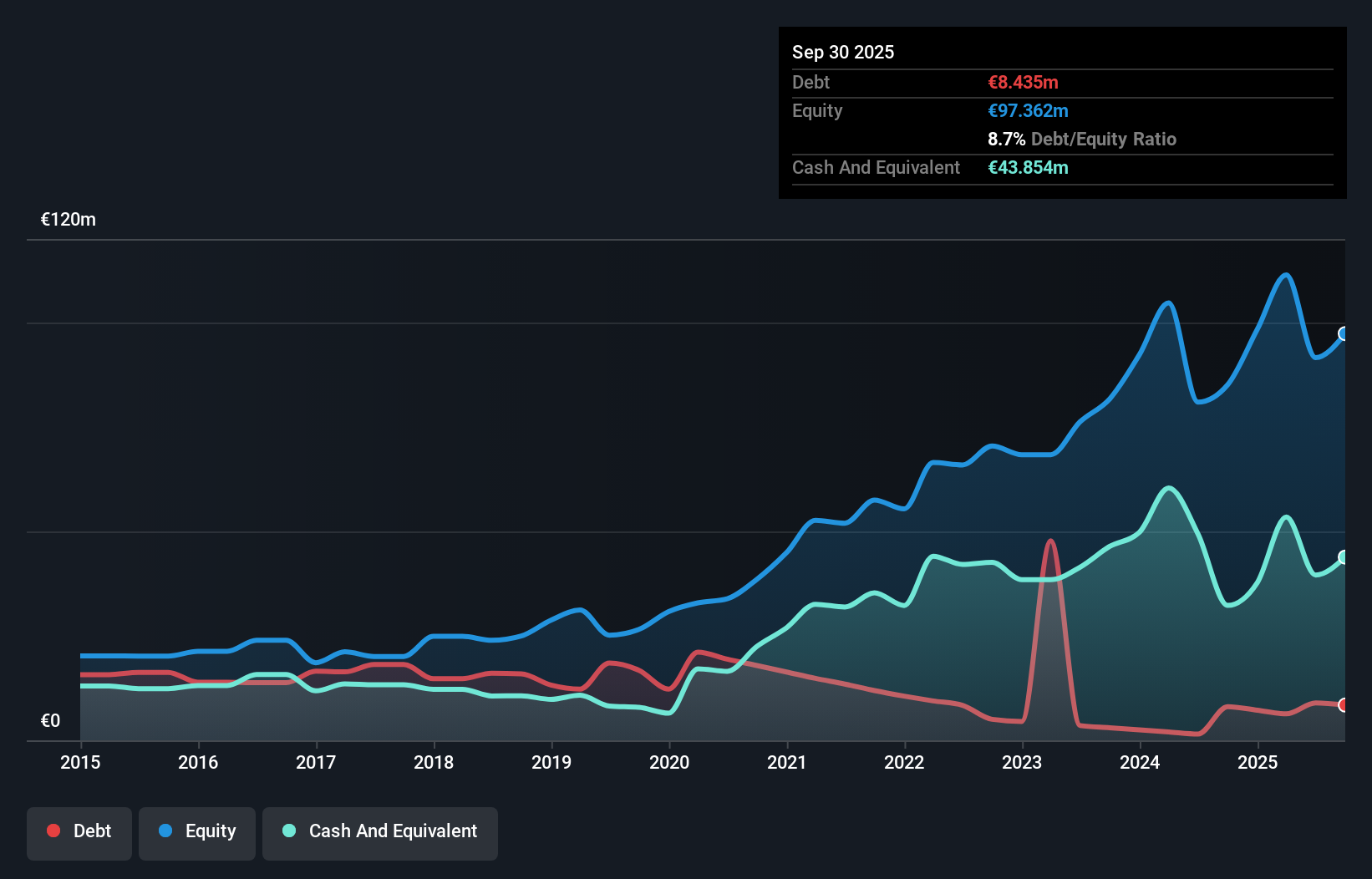

Evli Oyj, a nimble player in the financial sector, reported a robust earnings growth of 79.9% over the past year, surpassing industry averages. Despite its high net debt to equity ratio of 64.2%, interest payments are comfortably covered by EBIT at 13 times. The company trades at an attractive value, being 26.1% below estimated fair value. Recent figures show revenue for nine months reached EUR 103.4 million from EUR 83.2 million previously, while net income rose to EUR 37.7 million from EUR 21.7 million last year, demonstrating strong operational performance despite forecasted earnings decline ahead.

- Get an in-depth perspective on Evli Oyj's performance by reading our health report here.

Explore historical data to track Evli Oyj's performance over time in our Past section.

Where To Now?

- Delve into our full catalog of 4644 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evli Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:EVLI

Evli Oyj

Operates as an asset manager serving institutional, corporate, and private clients in Finland, Sweden, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives