Readers hoping to buy BNP Paribas SA (EPA:BNP) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase BNP Paribas' shares before the 24th of May to receive the dividend, which will be paid on the 26th of May.

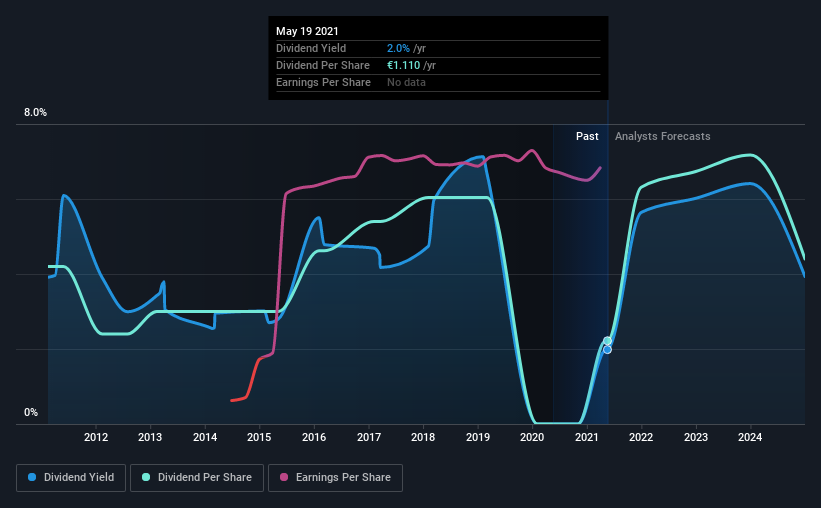

The company's next dividend payment will be €1.11 per share, and in the last 12 months, the company paid a total of €1.11 per share. Looking at the last 12 months of distributions, BNP Paribas has a trailing yield of approximately 2.0% on its current stock price of €55.94. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for BNP Paribas

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. BNP Paribas has a low and conservative payout ratio of just 20% of its income after tax.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at BNP Paribas, with earnings per share up 2.0% on average over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. BNP Paribas has seen its dividend decline 6.2% per annum on average over the past 10 years, which is not great to see. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

Final Takeaway

From a dividend perspective, should investors buy or avoid BNP Paribas? BNP Paribas has seen its earnings per share grow slowly in recent years, and the company reinvests more than half of its profits in the business, which generally bodes well for its future prospects. We think this is a pretty attractive combination, and would be interested in investigating BNP Paribas more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 1 warning sign for BNP Paribas and you should be aware of this before buying any shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade BNP Paribas, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives