BNP Paribas (ENXTPA:BNP) Is Down 8.8% After Landmark US Jury Verdict on Sudan Atrocities - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In the past week, a New York federal jury found BNP Paribas liable for enabling atrocities by Sudan's government, awarding nearly US$21 million in damages to three Sudanese-born American plaintiffs for the bank's role in facilitating financial services under the Omar al-Bashir regime.

- This landmark verdict could open the door for thousands of additional survivors to pursue civil claims against BNP Paribas, raising potential for wider legal and reputational risks for the bank.

- We'll assess how this landmark legal ruling may alter BNP Paribas's risk outlook and its previously anticipated pace of long-term earnings growth.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BNP Paribas Investment Narrative Recap

To be a shareholder in BNP Paribas today, you need to believe in the group’s ability to drive earnings and margin growth through digitalization, integration, and expansion into higher-growth markets, even as it faces persistent margin pressure in its traditional Eurozone business. The recent US$21 million verdict against BNP Paribas for enabling atrocities in Sudan introduces immediate legal and reputational risk, which could affect market sentiment in the short term, though at present it does not appear to materially alter the bank’s core earnings catalysts such as digital platform investments and business integration.

Among recent bank announcements, news of senior executive appointments in the Nordic region stands out. While unrelated to the legal verdict, these changes extend BNP Paribas’s geographic reach and support its stated goal of generating fee-based revenue from markets outside the Eurozone, reinforcing the long-term catalyst of expansion and distribution network growth.

Yet, in contrast to expansion efforts, the potential for further lawsuits stemming from the legal ruling presents a risk to be aware of...

Read the full narrative on BNP Paribas (it's free!)

BNP Paribas' narrative projects €57.9 billion revenue and €13.8 billion earnings by 2028. This requires 7.7% yearly revenue growth and a €3.2 billion earnings increase from €10.6 billion currently.

Uncover how BNP Paribas' forecasts yield a €92.08 fair value, a 33% upside to its current price.

Exploring Other Perspectives

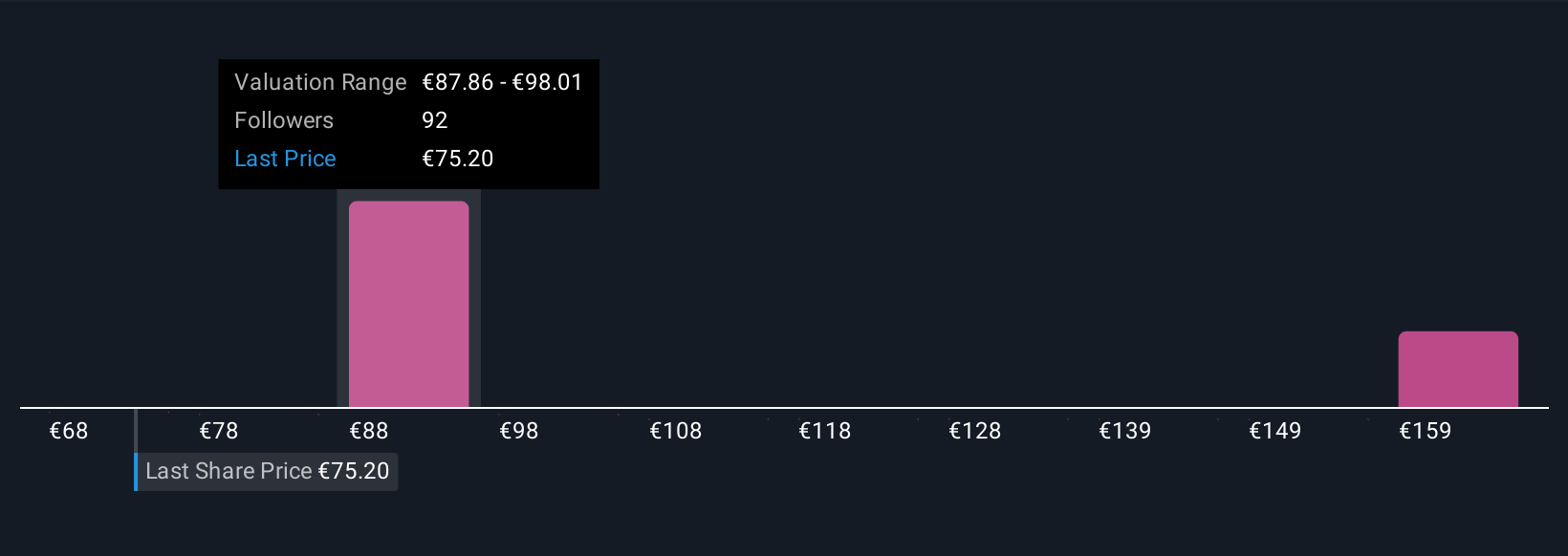

Simply Wall St Community members provided 12 fair value estimates, ranging from €67.56 to €167.21 per share. With legal and reputational risk now at the forefront, your view on this issue could shape your approach to BNP Paribas’s future performance.

Explore 12 other fair value estimates on BNP Paribas - why the stock might be worth just €67.56!

Build Your Own BNP Paribas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BNP Paribas research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BNP Paribas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BNP Paribas' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives