- France

- /

- Auto Components

- /

- ENXTPA:ML

Investors Aren't Entirely Convinced By Compagnie Générale des Établissements Michelin Société en commandite par actions' (EPA:ML) Earnings

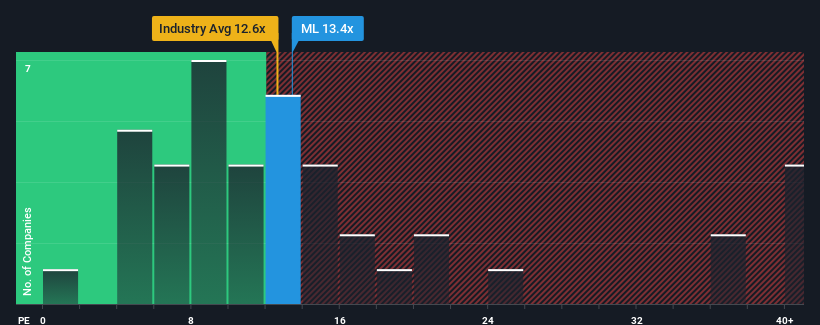

Compagnie Générale des Établissements Michelin Société en commandite par actions' (EPA:ML) price-to-earnings (or "P/E") ratio of 13.4x might make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 18x and even P/E's above 30x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The recently shrinking earnings for Compagnie Générale des Établissements Michelin Société en commandite par actions have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

Compagnie Générale des Établissements Michelin Société en commandite par actions' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.2%. Still, the latest three year period has seen an excellent 215% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 12% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is not materially different.

With this information, we find it odd that Compagnie Générale des Établissements Michelin Société en commandite par actions is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Compagnie Générale des Établissements Michelin Société en commandite par actions' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Compagnie Générale des Établissements Michelin Société en commandite par actions' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Compagnie Générale des Établissements Michelin Société en commandite par actions that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives