- Japan

- /

- Infrastructure

- /

- TSE:9364

3 Reliable Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

In a year marked by mixed performances in global markets, with U.S. stocks closing out another strong year despite some volatility and economic indicators showing varied trends, investors are increasingly looking towards reliable income sources such as dividend stocks. As the market navigates through profit-taking phases and economic uncertainties like fluctuating GDP forecasts and manufacturing contractions, dividend-paying stocks can offer stability and regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

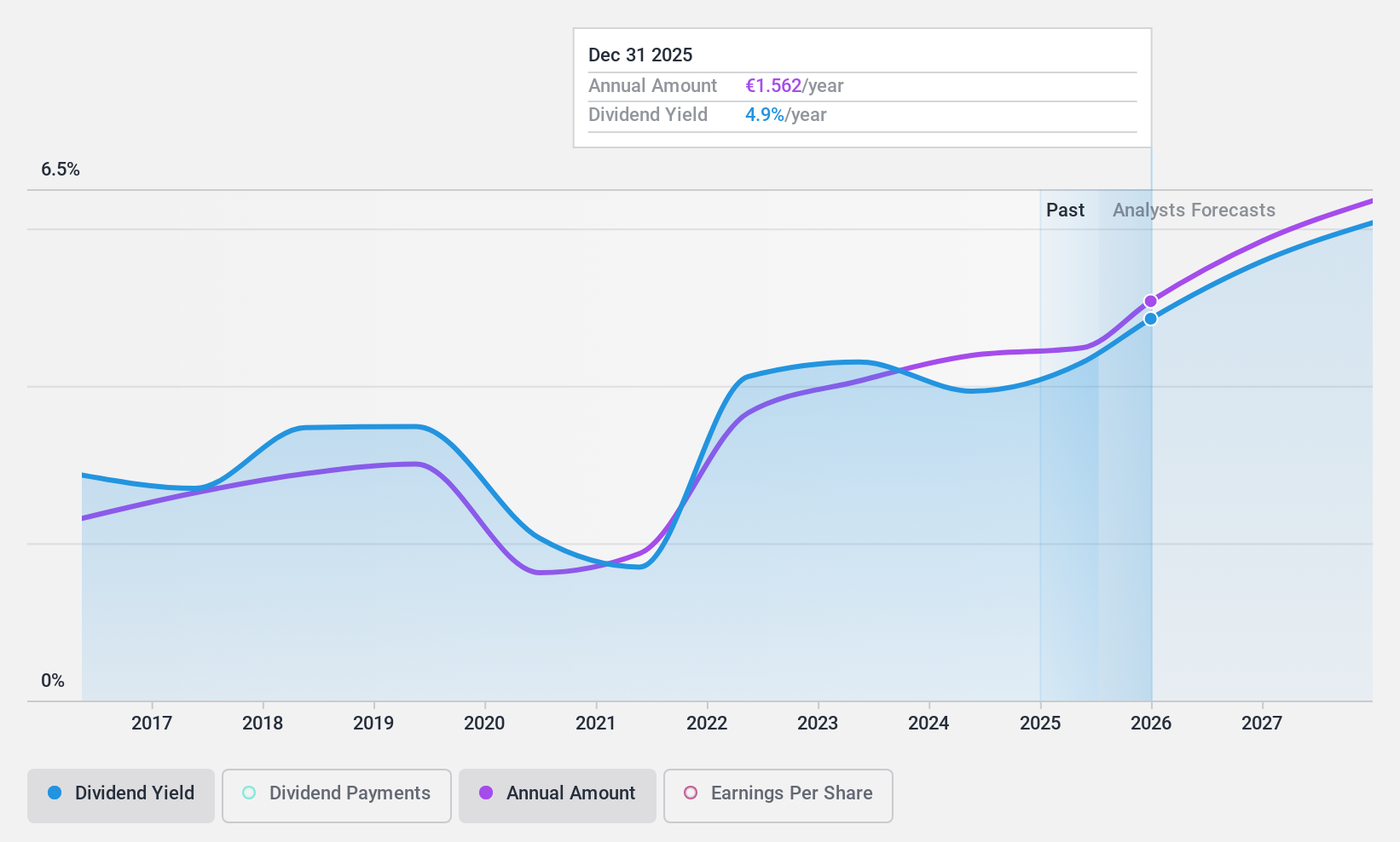

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions manufactures and sells tires globally, with a market cap of €22.51 billion.

Operations: Michelin generates revenue through its Automotive and Related Distribution segment (€14.16 billion), Road Transportation and Related Distribution segment (€6.84 billion), and Specialty Businesses and Related Distribution segment (€6.74 billion).

Dividend Yield: 4.2%

Michelin's dividend payments have been volatile over the past decade, though they show an upward trend. The company's payout ratio of 50.2% suggests dividends are well-covered by earnings and cash flows, with a cash payout ratio of 32.4%. However, its dividend yield of 4.23% is lower than the top quartile in France. Recent strategic moves like its partnership with Brembo may influence future stability and growth prospects despite recent plant closures impacting operations.

- Get an in-depth perspective on Compagnie Générale des Établissements Michelin Société en commandite par actions' performance by reading our dividend report here.

- According our valuation report, there's an indication that Compagnie Générale des Établissements Michelin Société en commandite par actions' share price might be on the expensive side.

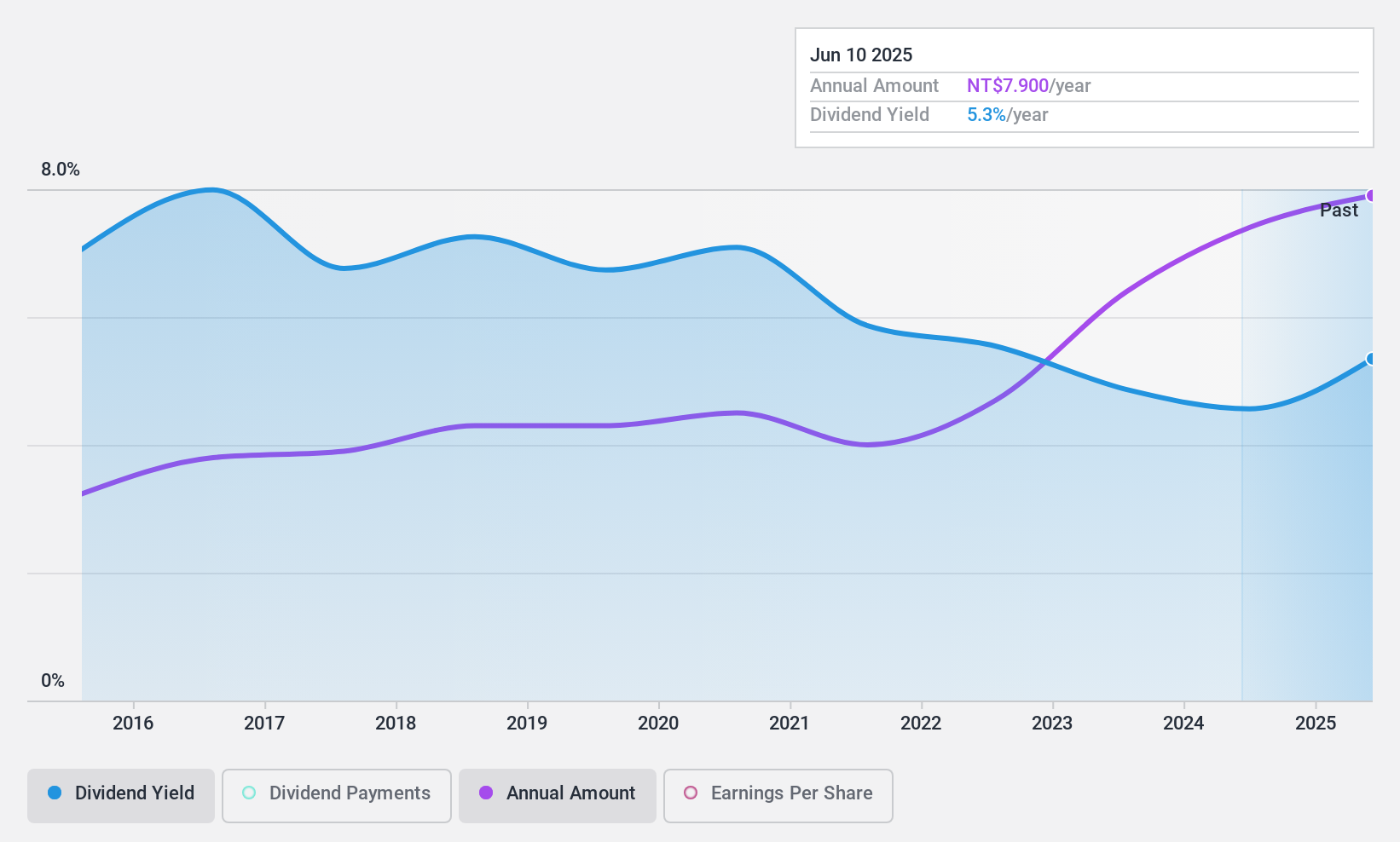

Planet Technology (TPEX:6263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Planet Technology Corporation offers IP-based networking products and solutions for small-to-medium-sized businesses, enterprises, and network infrastructures globally, with a market cap of NT$9.47 billion.

Operations: Planet Technology Corporation's revenue primarily comes from its Computer Network Equipment/Furniture & Telecommunication Products segment, which generated NT$1.85 billion.

Dividend Yield: 4.9%

Planet Technology's dividends have been reliable and stable over the past decade, with a top-tier yield of 4.88% in Taiwan. However, the high payout ratio of 89.9% indicates earnings cover dividends but not cash flows, as shown by a cash payout ratio of 95.7%. Recent earnings show slight growth in sales and net income for Q3 2024, which may support dividend sustainability despite concerns about non-cash earnings quality impacting future payouts.

- Dive into the specifics of Planet Technology here with our thorough dividend report.

- The valuation report we've compiled suggests that Planet Technology's current price could be quite moderate.

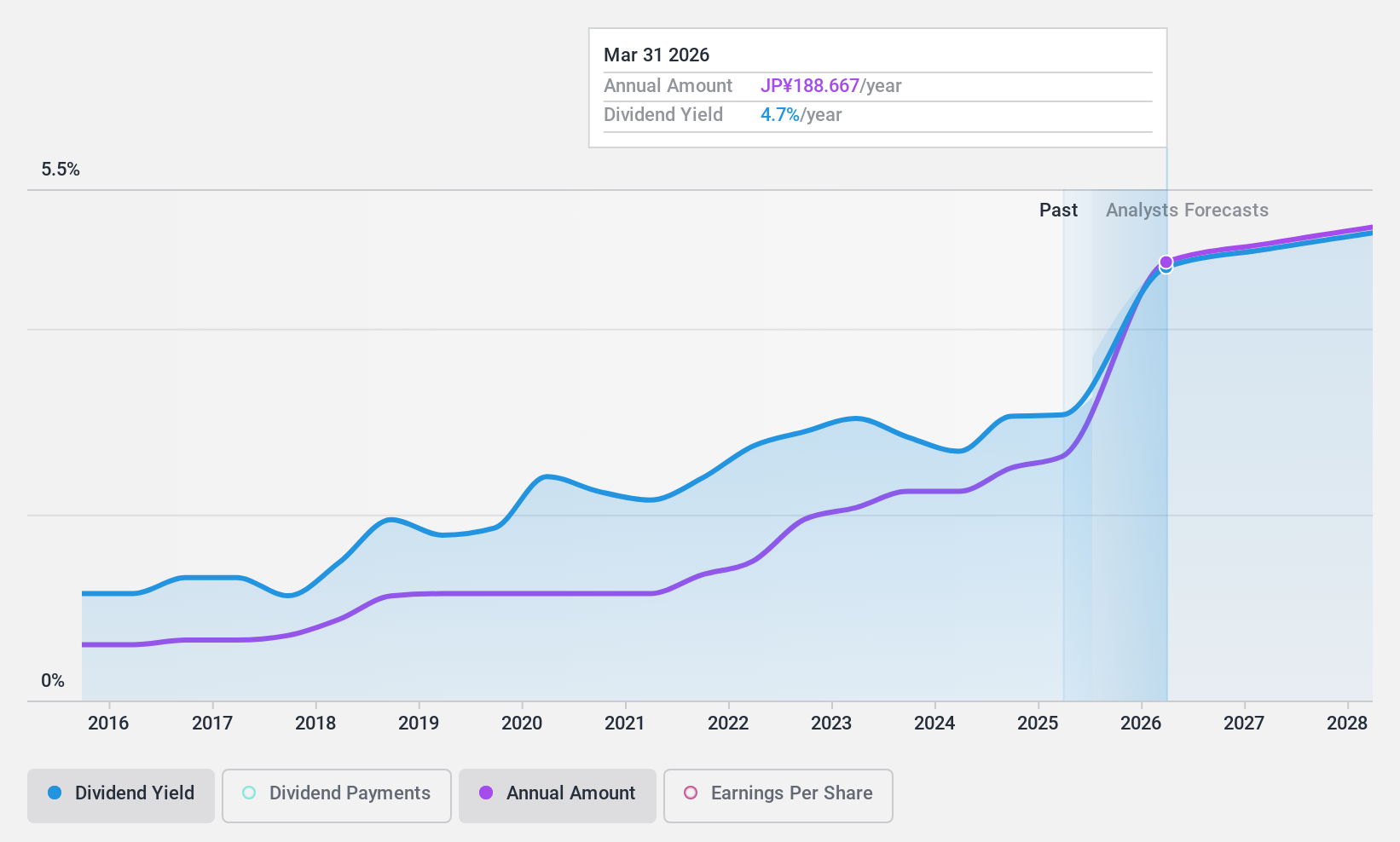

Kamigumi (TSE:9364)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kamigumi Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥353.54 billion.

Operations: Kamigumi Co., Ltd.'s revenue primarily comes from its Logistics Business segment, which generated ¥234.52 billion.

Dividend Yield: 3%

Kamigumi's dividend payments are adequately covered by earnings and cash flows, with payout ratios of 43.1% and 31.2%, respectively. Despite a recent increase in dividends to ¥50 per share, the yield remains lower than top-tier Japanese dividend stocks at 3.04%. The company has completed a significant share buyback, enhancing shareholder value but faces challenges with historically volatile and unreliable dividends over the past decade despite overall growth in payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Kamigumi.

- Our valuation report here indicates Kamigumi may be overvalued.

Taking Advantage

- Discover the full array of 1981 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamigumi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9364

Kamigumi

Provides integrated logistics services in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives