- France

- /

- Auto Components

- /

- ENXTPA:FR

Do Valeo’s (ENXTPA:FR) New Mobility Initiatives Reveal a Shift in Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In early October 2025, Valeo and partners LIDEO and MOBILIANS announced major collaborations focused on advancing mobility technologies, launching professional training, and expanding circular economy initiatives in the automotive sector.

- This multi-pronged approach highlights Valeo's commitment to electrification, remanufacturing, and technical upskilling, reflecting broader shifts toward sustainable and technology-driven automotive services.

- We'll examine how Valeo's efforts to expand training for electric and hybrid vehicle technologies may influence its future market positioning.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Valeo Investment Narrative Recap

To be a shareholder in Valeo right now, you have to believe in the company's capacity to deliver on electrification and software-driven mobility, despite recent financial pressures and order cancellations. The newly announced collaborations with LIDEO and MOBILIANS reinforce Valeo's focus on training and sustainable technologies, but these developments are unlikely to materially change the most important near-term catalyst, securing recovery and execution on deferred and new orders, or alter the key risks from ongoing revenue challenges and market volatility.

Among the recent announcements, the partnership with LIDEO to expand technical upskilling for electric and hybrid vehicles stands out as directly relevant. Improving expertise in diagnosing and maintaining advanced vehicle systems could support Valeo’s ability to capture future order intake, which remains one of the primary levers for earnings growth as postponed and new projects are expected to materialize.

Yet, against this backdrop, investors should also be aware of the continuing risk posed by...

Read the full narrative on Valeo (it's free!)

Valeo's narrative projects €22.1 billion in revenue and €874.8 million in earnings by 2028. This requires 1.6% yearly revenue growth and a €749.8 million earnings increase from the current €125.0 million.

Uncover how Valeo's forecasts yield a €11.54 fair value, a 17% upside to its current price.

Exploring Other Perspectives

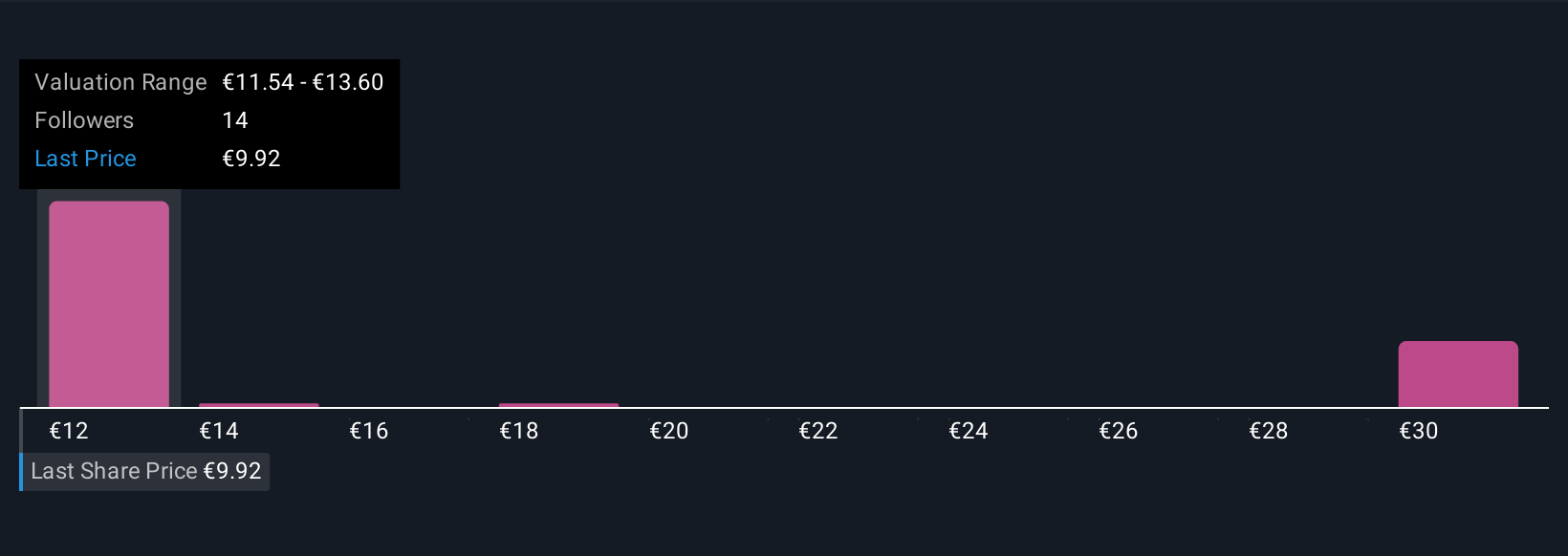

Four different fair value estimates from the Simply Wall St Community range from €11.54 to €32.08 per share, with many views above the current price. While order recovery and new project wins are considered pivotal by some, this diversity of opinion shows how differently market participants assess Valeo’s execution and potential, explore several viewpoints to inform your own outlook.

Explore 4 other fair value estimates on Valeo - why the stock might be worth over 3x more than the current price!

Build Your Own Valeo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valeo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Valeo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valeo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)