Nurminen Logistics Oyj's (HEL:NLG1V) Earnings Are Weaker Than They Seem

Investors were disappointed with Nurminen Logistics Oyj's (HEL:NLG1V) earnings, despite the strong profit numbers. We did some digging and found some worrying underlying problems.

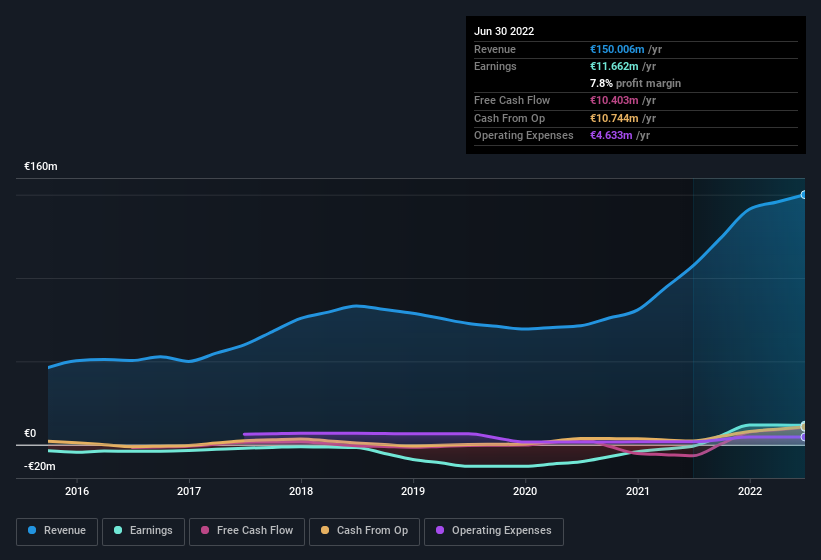

View our latest analysis for Nurminen Logistics Oyj

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Nurminen Logistics Oyj's profit received a boost of €795k in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Nurminen Logistics Oyj received a tax benefit which contributed €6.3m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Nurminen Logistics Oyj's Profit Performance

In the last year Nurminen Logistics Oyj received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. For the reasons mentioned above, we think that a perfunctory glance at Nurminen Logistics Oyj's statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 3 warning signs for Nurminen Logistics Oyj you should be mindful of and 1 of these bad boys is concerning.

Our examination of Nurminen Logistics Oyj has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Nurminen Logistics Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NLG1V

Nurminen Logistics Oyj

Provides logistics services in Finland, Russia, Sweden, and Baltic countries.

Excellent balance sheet and good value.

Market Insights

Community Narratives