- Finland

- /

- Telecom Services and Carriers

- /

- HLSE:ELISA

Elisa (HLSE:ELISA): Is the Steady Telecom Giant Trading Above Fair Value?

Reviewed by Simply Wall St

Price-to-Earnings of 20.1x: Is it justified?

Based on the Price-to-Earnings (P/E) ratio, Elisa's shares are currently priced at 20.1 times earnings. This appears expensive compared to both the European Telecom industry average at 19x and its peer group average at 11.9x.

The P/E ratio measures how much investors are willing to pay for each euro of the company's earnings. This makes it a key metric for comparing valuations across companies in the same sector. Telecom stocks often carry moderate P/E ratios, reflecting the defensive nature of consistent cash flows but slower growth prospects.

With Elisa trading at a premium to both its sector and similar companies, the market may be placing a higher value on Elisa’s stability or potential future growth. However, the fundamentals suggest this premium is difficult to justify given current performance and outlook.

Result: Fair Value of €45.5 (OVERVALUED)

See our latest analysis for Elisa Oyj.However, slower revenue growth or a sharper market downturn could quickly challenge perceptions. This highlights that even stable telecoms are not immune to broader risks.

Find out about the key risks to this Elisa Oyj narrative.Another View: Our DCF Model Weighs In

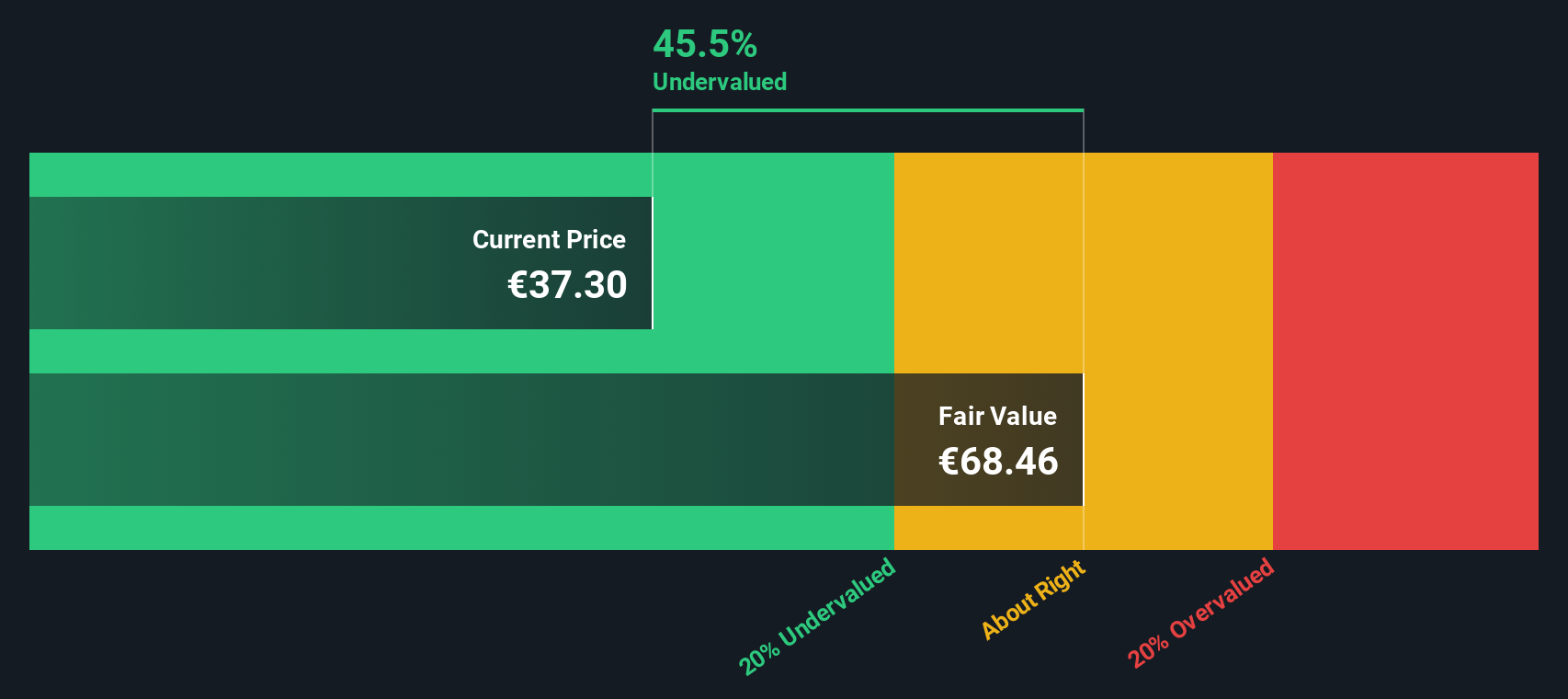

Taking a different approach, our DCF model suggests the market may be missing something. The results point in the opposite direction of the earlier valuation. Could the truth lie somewhere between these two perspectives?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elisa Oyj Narrative

If you see things differently or want to put your own research to the test, you can build your own narrative in just minutes, your way. Do it your way.

A great starting point for your Elisa Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss out on the chance to spot your next market breakthrough. The right stock could be just a click away with the Simply Wall Street Screener.

- Uncover value opportunities by finding companies trading below their cash flow potential using our undervalued stocks based on cash flows which highlights hidden bargains.

- Tap into future healthcare breakthroughs by searching companies excelling with artificial intelligence in medicine through our healthcare AI stocks.

- Unlock growth potential by checking out innovative firms at the frontier of cryptocurrency and blockchain using our cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Elisa Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HLSE:ELISA

Elisa Oyj

Provides telecommunications, information and communication technology (ICT), and online services in Finland, rest of Europe, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion