- Finland

- /

- Communications

- /

- HLSE:NOKIA

Is Nokia (HLSE:NOKIA) Still Undervalued? A Fresh Look at Valuation After Recent Gains

Reviewed by Kshitija Bhandaru

Nokia Oyj (HLSE:NOKIA) shares have been steady lately. The stock is up around 9% over the past month despite fluctuations in the broader technology sector. Investors may be taking note of its improving annual revenue and earnings growth.

See our latest analysis for Nokia Oyj.

Over the past year, Nokia Oyj has delivered a total shareholder return of about 9.9%, reflecting solid long-term momentum even as day-to-day share price moves remain relatively modest. Recent gains suggest growing confidence among investors about the company’s ongoing operational progress and margin improvements.

If you’re watching how tech names like Nokia are developing, it is worth taking the next step and exploring See the full list for free.

This raises the crucial question: with shares trending higher and stronger financials, is Nokia still undervalued or are investors already pricing in the company's next phase of growth? Could there be a buying opportunity here?

Most Popular Narrative: 5.1% Undervalued

With the narrative estimating Nokia Oyj’s fair value at €4.45, just above the last close of €4.22, this outlook hints at modest upside potential based on future earnings and margin projections.

Ongoing global build-out of fiber and advanced 5G/6G networks, accelerated by regulatory programs and large CSP capex, provides a multi-year runway for increased product and service revenues, particularly in Fixed and Optical Networks. Acceleration of private wireless networks and digital transformation across industrial verticals is driving sustained double-digit growth in Cloud and Network Services, improving both recurring revenues and operating margins.

What are the numbers behind this calculated optimism? The secret sauce: ambitious assumptions for margin expansion and long-term revenue growth. Find out which financial levers drive that fair value and see if the forecast story lines up with market reality.

Result: Fair Value of €4.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and challenges in Nokia’s Mobile Networks segment could still limit future earnings growth, even with the current optimism.

Find out about the key risks to this Nokia Oyj narrative.

Another View: What Does Our DCF Model Say?

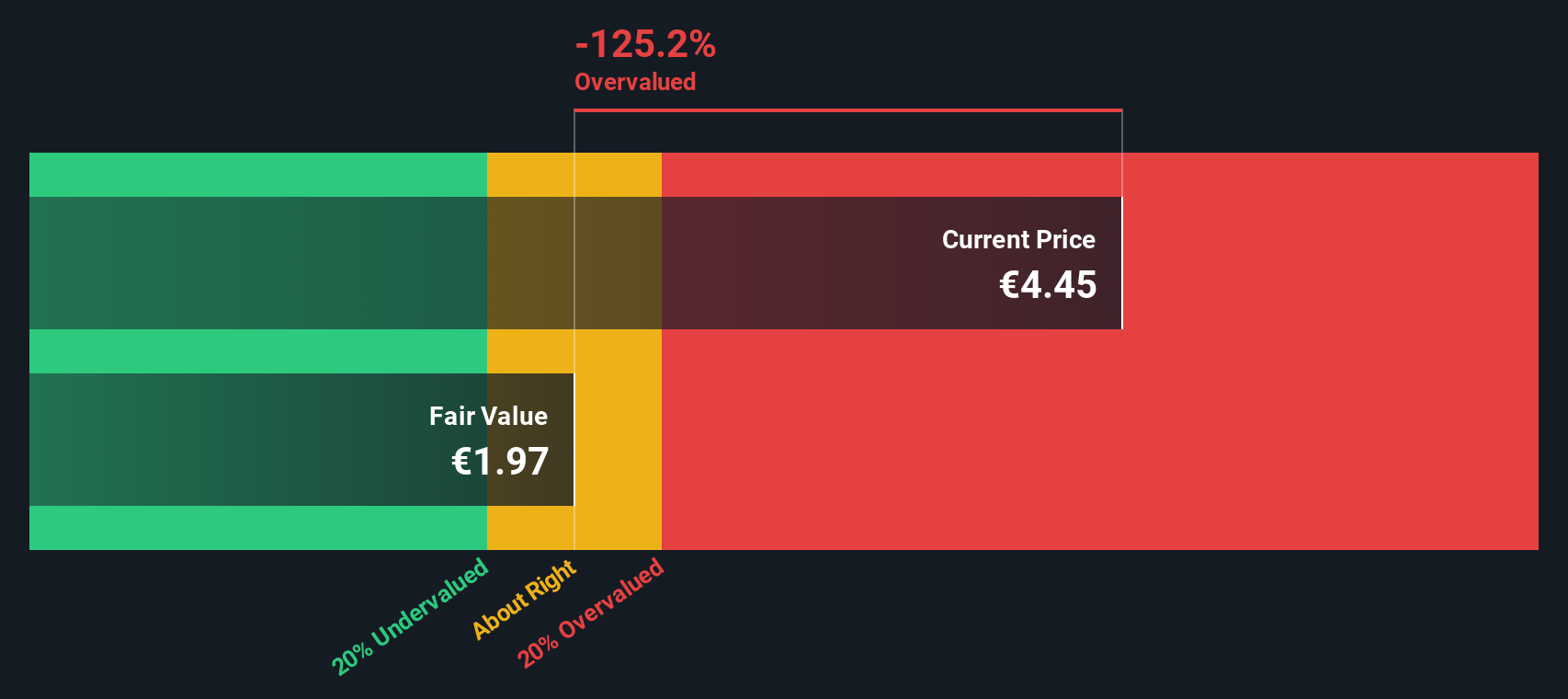

While the market’s fair value estimate points to Nokia being slightly undervalued, our DCF model comes to a different conclusion. The SWS DCF model suggests that Nokia’s shares are actually priced above their estimated fair value, which raises questions about how much upside is truly left for new investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nokia Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nokia Oyj Narrative

If you have a different take on Nokia’s numbers or want to dig deeper into your own analysis, you can build a personalized view in just a few minutes. Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead on your portfolio by tapping into opportunities that others overlook. Use the Simply Wall Street Screener to reveal stocks with exciting stories that fit your ambitions.

- Multiply your growth potential by evaluating AI innovators. Start with these 25 AI penny stocks and see which companies are making the biggest leaps in artificial intelligence.

- Boost your income stream by targeting businesses with generous payouts. Secure your spot with these 19 dividend stocks with yields > 3% and focus on stocks offering strong yields.

- Seize the early mover advantage in digital assets by checking out these 78 cryptocurrency and blockchain stocks and spot companies powering the blockchain and cryptocurrency revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives