- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:ICP1V

Top Undervalued Small Caps With Insider Buying In November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have seen a significant rally, with small-cap stocks like those in the Russell 2000 Index leading gains despite not yet reaching record highs. This surge is fueled by investor optimism around potential growth and tax reforms, alongside a Federal Reserve rate cut aimed at bolstering economic activity. In such an environment, identifying promising small-cap stocks often involves looking for companies with strong fundamentals and insider buying, which can signal confidence from those closest to the business amidst shifting market dynamics.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.0x | 0.8x | 28.53% | ★★★★★☆ |

| Maharashtra Seamless | 9.4x | 1.6x | 38.75% | ★★★★★☆ |

| PSC | 7.9x | 0.4x | 42.07% | ★★★★☆☆ |

| NCL Industries | 14.5x | 0.5x | -72.77% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.4x | 0.6x | 31.57% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.3x | 1.7x | -42.54% | ★★★☆☆☆ |

| BSP Financial Group | 7.7x | 2.7x | 3.40% | ★★★☆☆☆ |

| Tai Sin Electric | 12.5x | 0.5x | 14.51% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Bajel Projects | 240.0x | 1.9x | 31.99% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

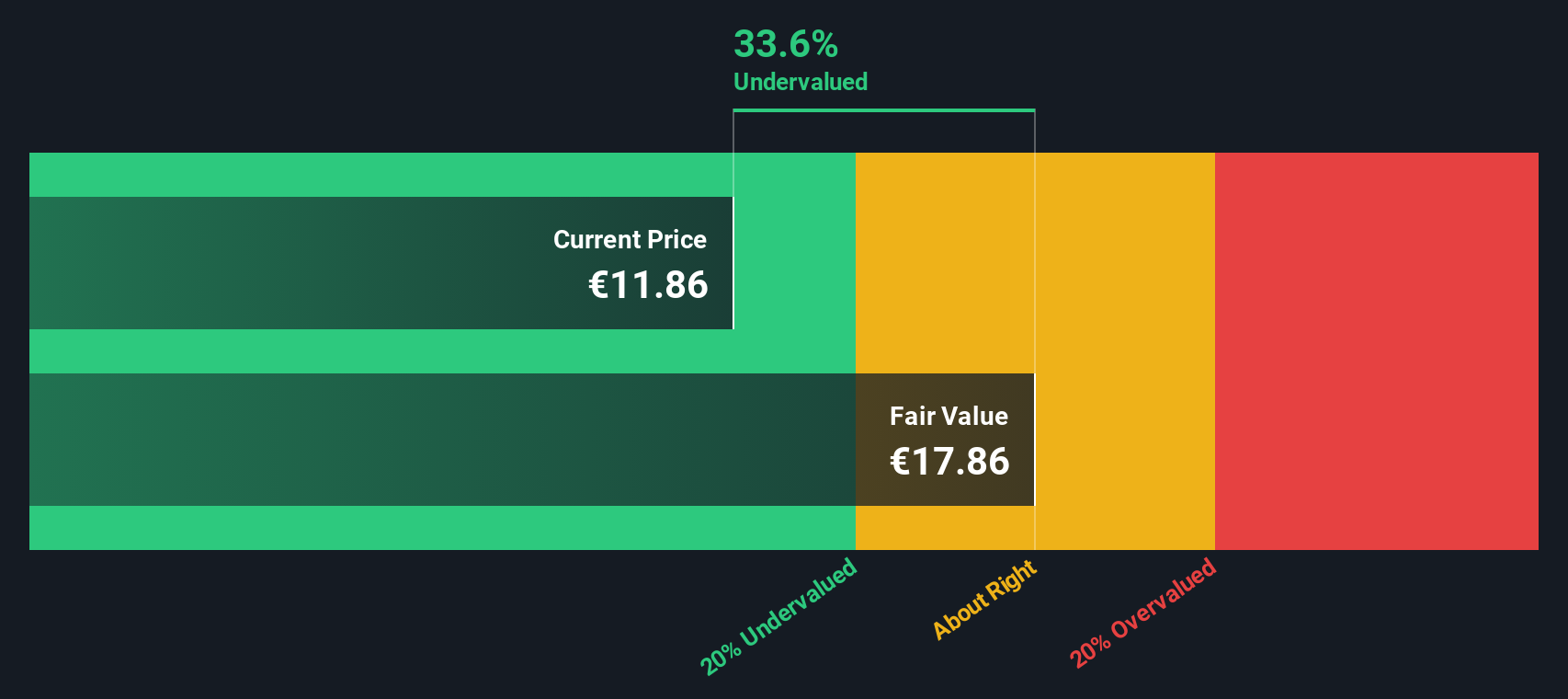

Incap Oyj (HLSE:ICP1V)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Incap Oyj is a company that provides electronics manufacturing services, with a market capitalization of €0.21 billion.

Operations: The company generates its revenue primarily from Electronics Manufacturing Services, with a recent gross profit margin of 33.55%. Operating expenses and non-operating expenses are significant cost components, impacting the net income.

PE: 19.2x

Incap Oyj, a smaller company in its sector, is currently exploring mergers and acquisitions to enhance its growth prospects. Despite a dip in nine-month sales to €170.77 million from €179.16 million last year, the firm remains optimistic about future revenue between €227 million and €237 million for 2024. Insider confidence is evident with recent share purchases, signaling potential value recognition within the company. With earnings projected to grow annually by 18%, Incap's strategic focus on M&A could reshape its footprint significantly over time.

- Dive into the specifics of Incap Oyj here with our thorough valuation report.

Gain insights into Incap Oyj's historical performance by reviewing our past performance report.

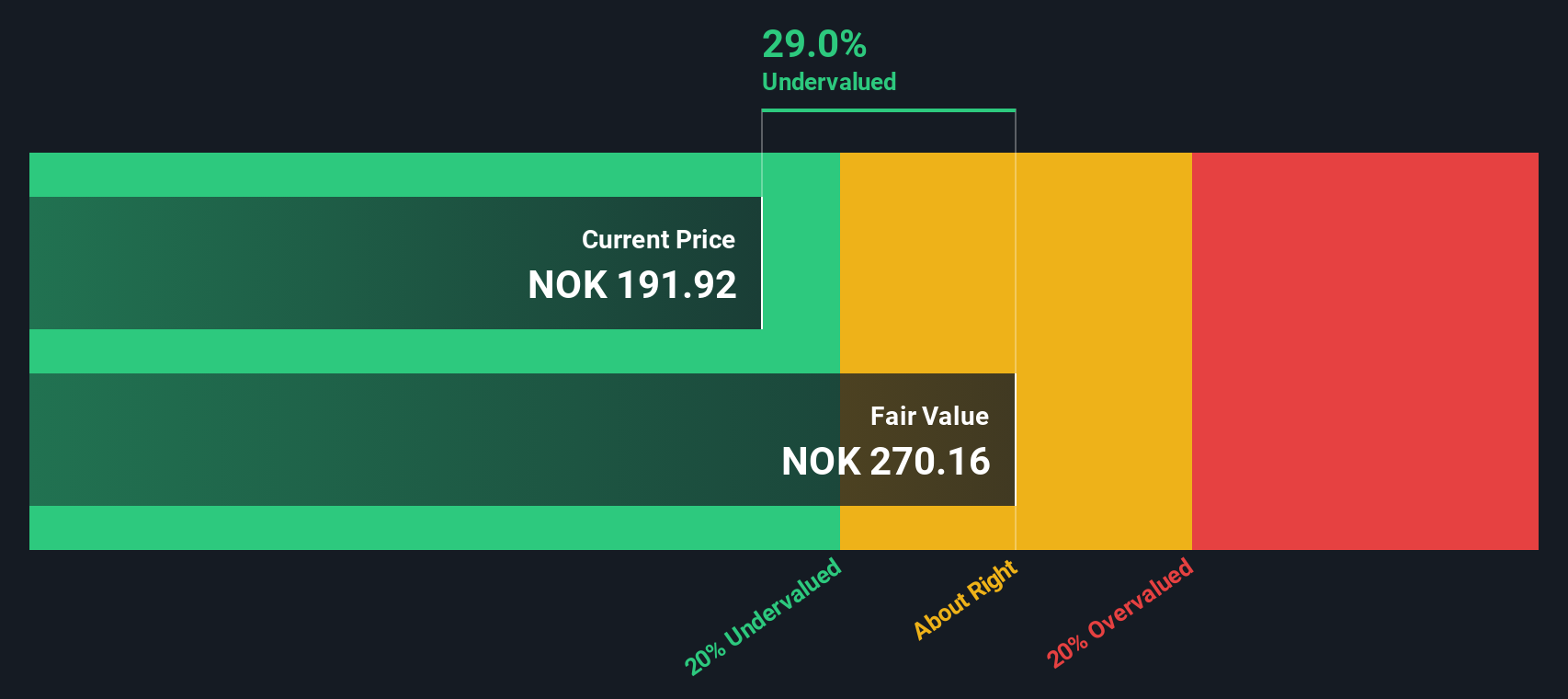

SpareBank 1 Østlandet (OB:SPOL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SpareBank 1 Østlandet is a Norwegian financial institution that provides a wide range of banking services through its retail and corporate divisions, along with real estate and financial partnerships, with a market capitalization of approximately NOK 10.6 billion.

Operations: The company's revenue streams are primarily driven by its Retail and Corporate Divisions, contributing NOK 2.36 billion and NOK 1.87 billion, respectively. Over the years, the company has consistently achieved a gross profit margin of 100%. Operating expenses have shown an upward trend, with general and administrative expenses reaching NOK 1.40 billion in recent periods. The net income margin has fluctuated but recently stood at approximately 30.88%.

PE: 10.1x

SpareBank 1 Østlandet, a smaller company in the financial sector, has seen significant insider confidence with recent share purchases. Their Q3 2024 earnings report revealed net income of NOK 1,080 million, more than doubling from NOK 417 million the previous year. Despite a low allowance for bad loans at 32%, earnings are expected to grow by over 17% annually. This growth potential positions them attractively within their industry context.

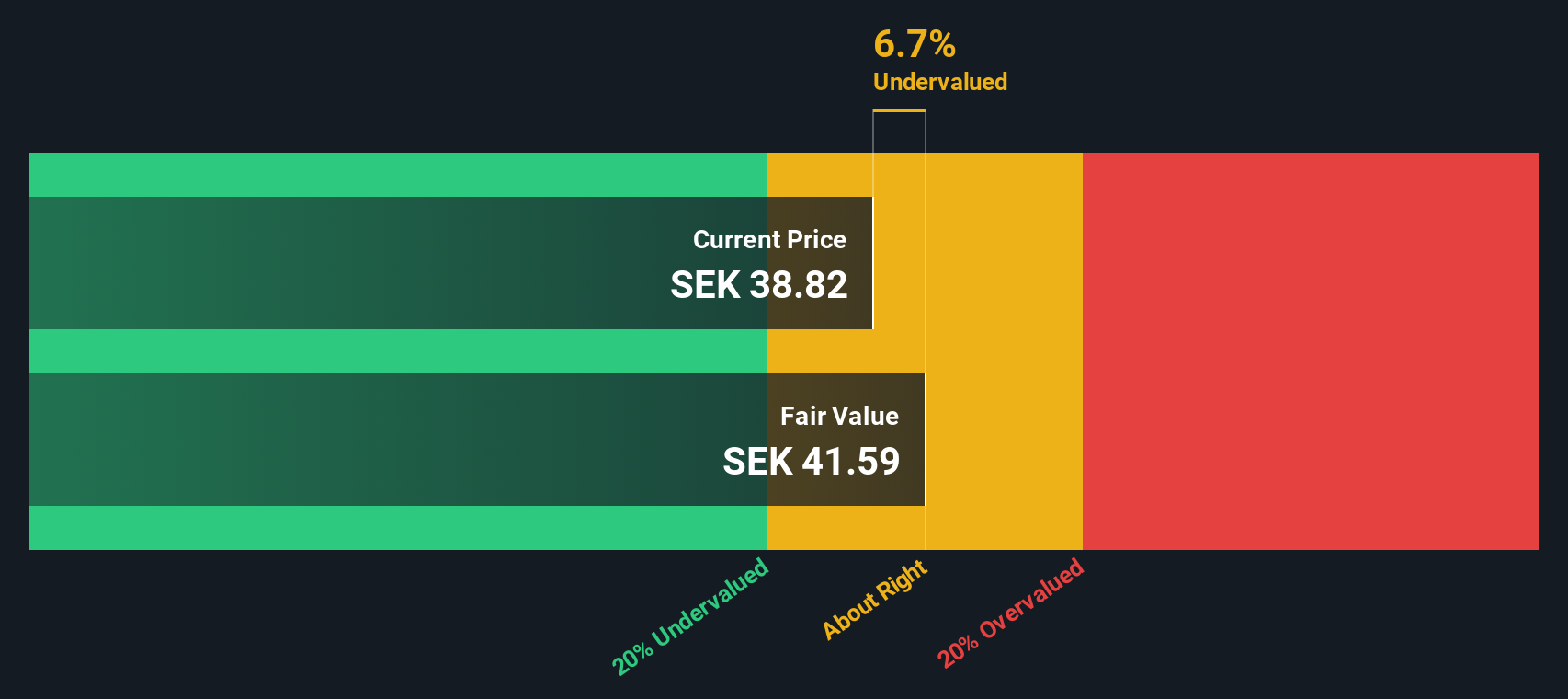

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ratos is a Swedish private equity conglomerate that operates across consumer, industry, and construction & services sectors with a market capitalization of approximately SEK 20.67 billion.

Operations: Ratos generates revenue primarily from its Construction & Services segment, followed by Industry and Consumer segments. The company reported a gross profit margin of 43.60% as of June 2024, showing an upward trend from earlier periods such as September 2020 when it was at 32.71%. Operating expenses are largely driven by general and administrative costs, with recent figures around SEK 11.62 billion in June 2024.

PE: 11.7x

Ratos, a company in the smaller end of the market spectrum, recently reported a challenging third quarter with sales at SEK 7.5 billion and a net loss of SEK 146 million compared to last year's profit. Despite these results, insider confidence is evident with recent share purchases by key stakeholders. The company's earnings are expected to grow annually by over 18%, suggesting potential recovery and growth prospects. However, reliance on external borrowing poses some risk to their financial stability.

- Take a closer look at Ratos' potential here in our valuation report.

Explore historical data to track Ratos' performance over time in our Past section.

Seize The Opportunity

- Click this link to deep-dive into the 177 companies within our Undervalued Small Caps With Insider Buying screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ICP1V

Incap Oyj

Provides electronics manufacturing services in Europe, North America, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives