- Switzerland

- /

- Machinery

- /

- SWX:MIKN

Incap Oyj And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes like Germany's DAX and the UK's FTSE 100 showing solid gains, investors are increasingly on the lookout for promising small-cap opportunities amidst a backdrop of subdued inflation. In this environment, identifying stocks that exhibit strong fundamentals and potential for growth can be particularly rewarding; Incap Oyj and two other lesser-known European companies exemplify such hidden gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Incap Oyj (HLSE:ICP1V)

Simply Wall St Value Rating: ★★★★★★

Overview: Incap Oyj, along with its subsidiaries, offers electronics manufacturing services across Europe, North America, and Asia with a market capitalization of €271.21 million.

Operations: Incap Oyj generates €229.66 million in revenue from its electronics manufacturing services across multiple regions. The company's market capitalization stands at €271.21 million, reflecting its presence in the global market.

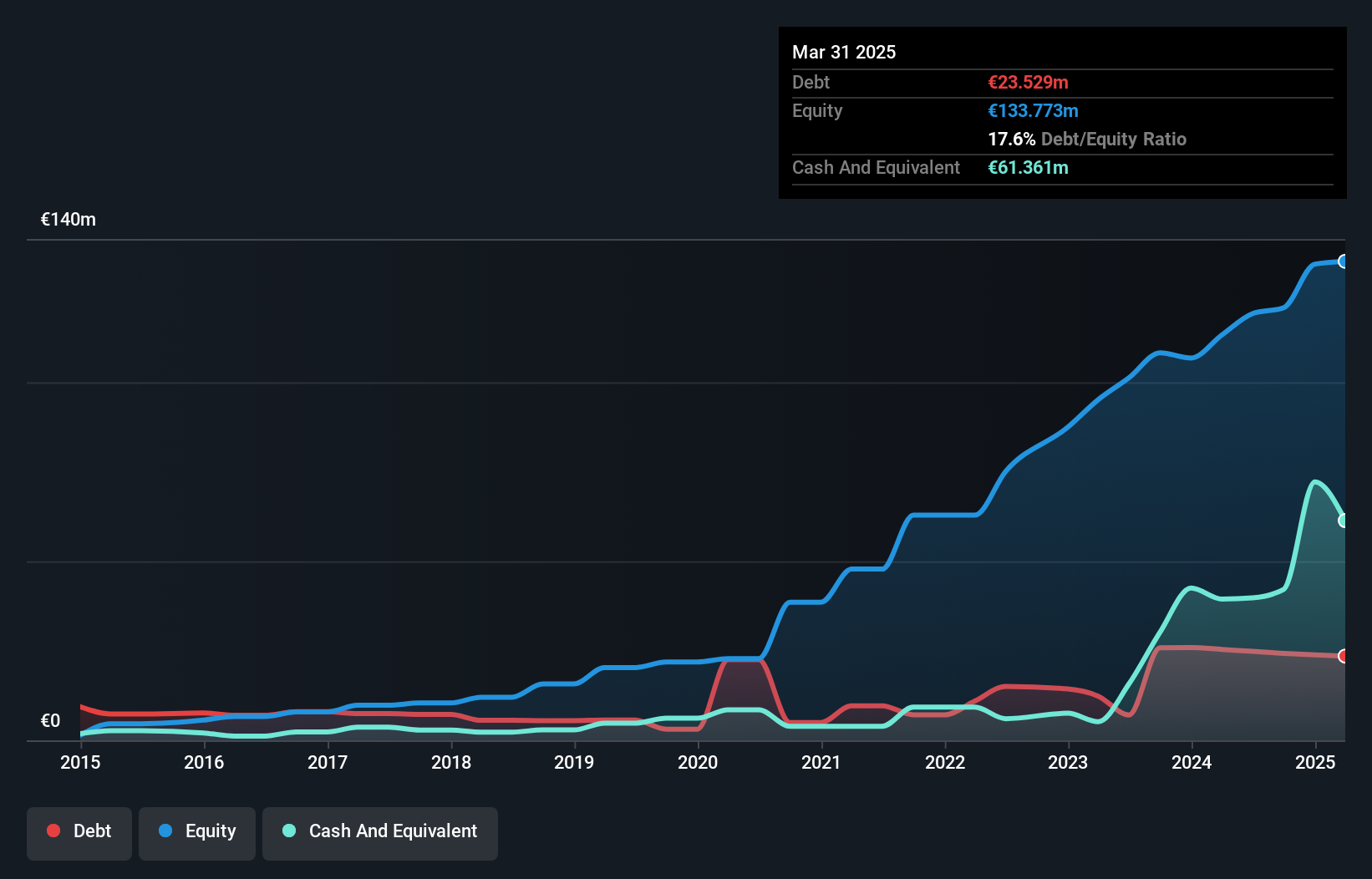

Incap Oyj, a nimble player in the electronics manufacturing sector, is leveraging digitalization and renewable energy trends to boost its market position. Over the past year, earnings grew by 10.2%, surpassing industry averages. The company trades at 39.5% below its fair value estimate and has reduced its debt to equity ratio from 98.6% to 17.9% over five years, signaling financial prudence. Despite risks like client concentration and currency volatility, Incap's strategic expansion in Asia and North America supports long-term growth prospects with analysts forecasting an annual revenue increase of 8.3%. Currently priced at €9.84 per share, it offers potential upside toward a target of €12 by 2028.

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★★★

Overview: Nolato AB (publ) is a company that specializes in the development, manufacturing, and sale of plastic, silicone, and thermoplastic elastomer products across Europe, Asia, North America, and internationally with a market cap of approximately SEK16.47 billion.

Operations: The company's primary revenue streams are Medical Solutions, generating SEK5.42 billion, and Engineered Solutions, contributing SEK4.17 billion.

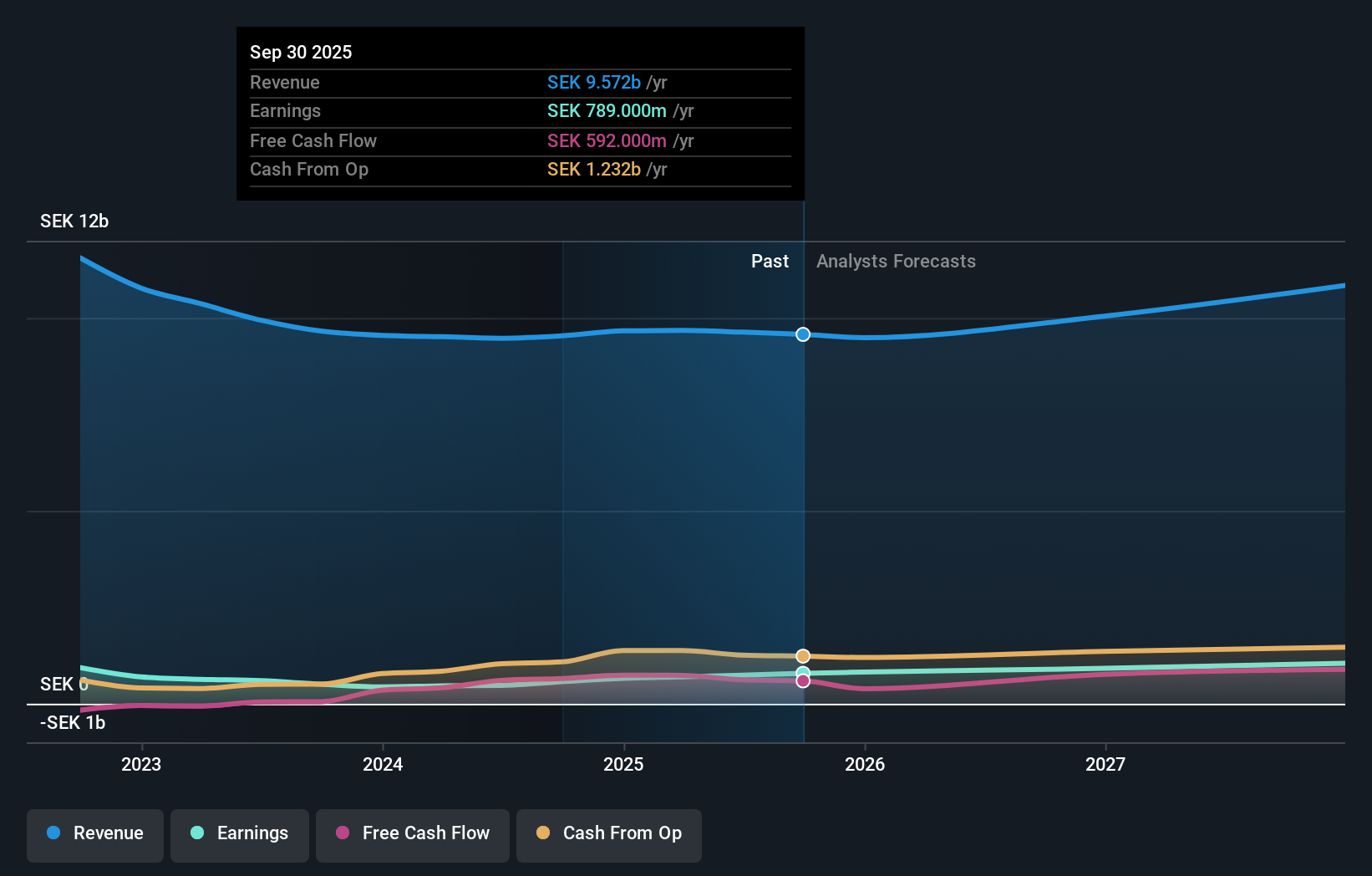

Nolato, a notable player in the European market, is making strides with its strategic expansion into sectors like medical solutions and electronics. The company reported third-quarter sales of SEK 2.34 billion, slightly down from last year, yet net income rose to SEK 215 million from SEK 164 million. With high-quality earnings and a debt-to-equity ratio reduced to 26.7% over five years, Nolato's financial health seems robust. Its earnings growth of 38.4% outpaced the industry average significantly, while trading at a discount of nearly 36% below fair value suggests potential upside for investors mindful of capacity utilization risks during downturns.

Mikron Holding (SWX:MIKN)

Simply Wall St Value Rating: ★★★★★★

Overview: Mikron Holding AG is a company that develops, produces, and markets automation solutions, machining systems, and cutting tools across Switzerland, Europe, North America, the Asia Pacific, and internationally with a market cap of CHF341.59 million.

Operations: Mikron generates revenue primarily from its Automation segment, which accounts for CHF 226.27 million, and its Machining Solutions segment, contributing CHF 149.10 million. The company's financial performance is impacted by a net profit margin trend worth noting.

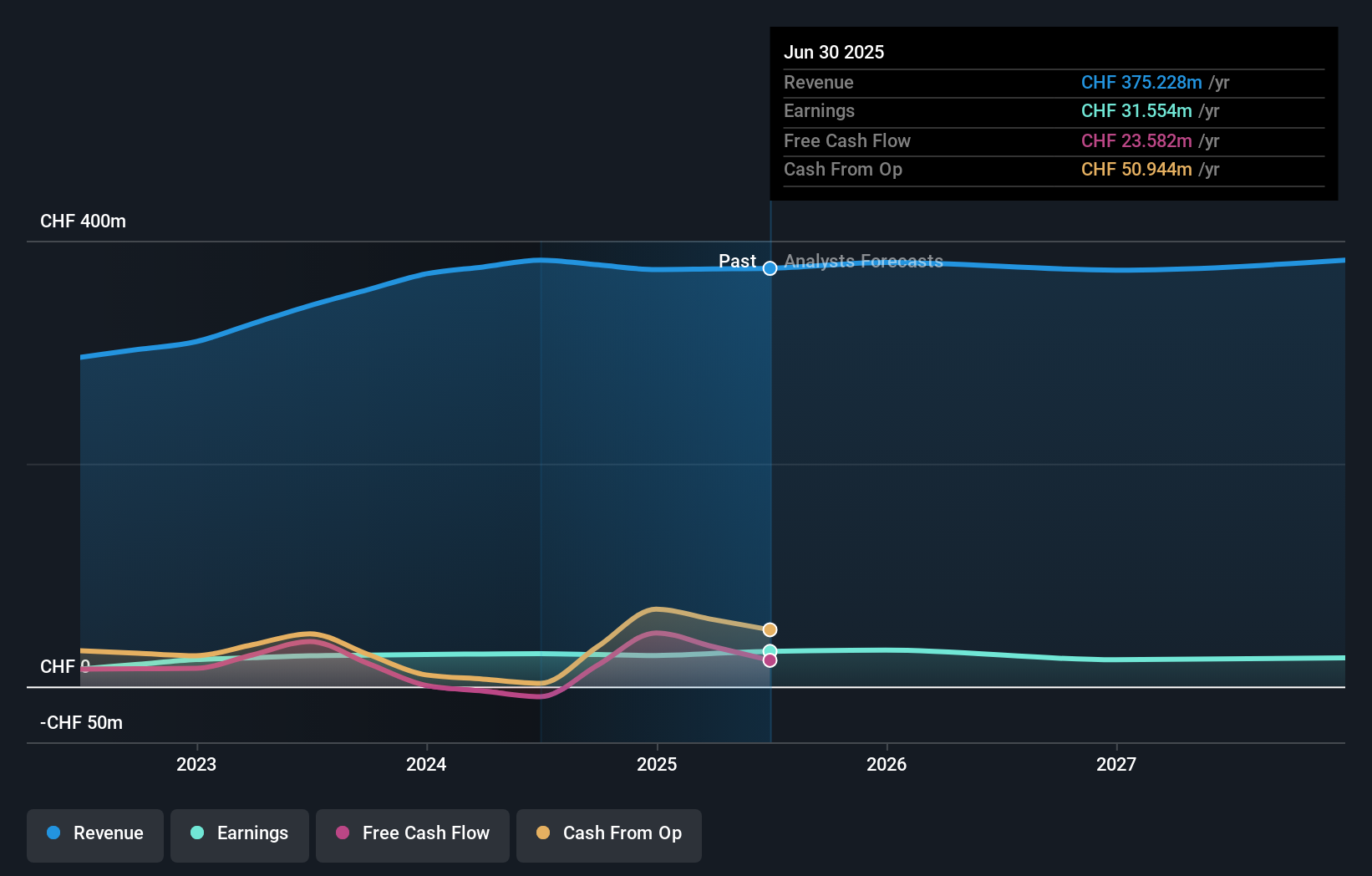

Mikron Holding, a compact player in the machinery sector, has shown a robust earnings growth of 7% over the past year, surpassing the industry average of 5.5%. The company boasts high-quality earnings and trades at an impressive 58.6% below its estimated fair value, indicating potential for investors seeking undervalued opportunities. With interest payments covered by EBIT at 37 times and a debt-to-equity ratio reduced from 16.6% to just 1.2% over five years, Mikron's financial health appears solid despite forecasts suggesting an average annual earnings decline of 11% over the next three years.

- Take a closer look at Mikron Holding's potential here in our health report.

Gain insights into Mikron Holding's past trends and performance with our Past report.

Where To Now?

- Discover the full array of 313 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MIKN

Mikron Holding

Develops, produces, and markets automation solutions, machining systems, and cutting tools in the Switzerland, Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026