European Penny Stocks: S.C. Comcm And 2 Other Promising Picks

Reviewed by Simply Wall St

As European markets experience a pullback amid political turmoil in France and international trade tensions, investors are increasingly looking for opportunities that might be overlooked by the mainstream. Penny stocks, while often associated with smaller or newer companies, can offer unique growth potential when backed by strong financial health. In this article, we explore several European penny stocks that stand out for their resilience and potential to thrive despite current market uncertainties.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.32 | €44.1M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.92 | €26.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.55 | DKK115.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.52 | €36.65M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.96 | €77.87M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.079 | €8.35M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

S.C. Comcm (BVB:CMCM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.C. Comcm S.A. is a Romanian company involved in the manufacture and sale of concrete, with a market cap of RON60.32 million.

Operations: The company's revenue is primarily derived from space rental income, totaling RON0.32 million.

Market Cap: RON60.32M

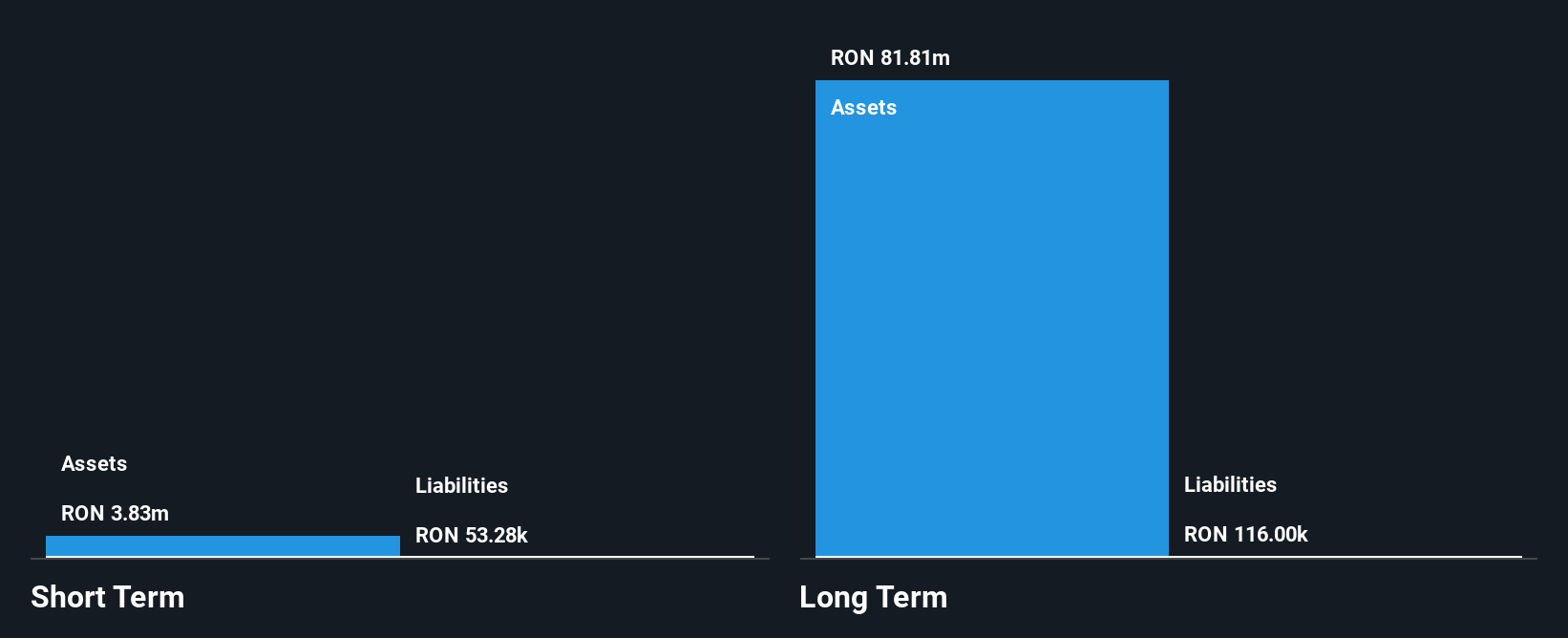

S.C. Comcm S.A., a Romanian concrete manufacturer, remains a pre-revenue company with sales of RON0.109 million for the half year ending June 30, 2025, and reported a net loss of RON0.935645 million. Despite its small revenue base, the company has shown significant earnings growth over the past year at 105.4%, surpassing industry standards and demonstrating high-quality earnings without shareholder dilution or debt concerns. Its price-to-earnings ratio of 13.1x suggests good value compared to the broader Romanian market's average of 15.7x, while strong asset coverage indicates financial stability amidst limited revenue streams.

- Dive into the specifics of S.C. Comcm here with our thorough balance sheet health report.

- Gain insights into S.C. Comcm's historical outcomes by reviewing our past performance report.

Componenta (HLSE:CTH1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Componenta Corporation, with a market cap of €40.56 million, operates in Finland and specializes in providing cast iron components through its subsidiaries.

Operations: The company generates revenue primarily from its Contract Workshop Business, which amounts to €109.99 million.

Market Cap: €40.56M

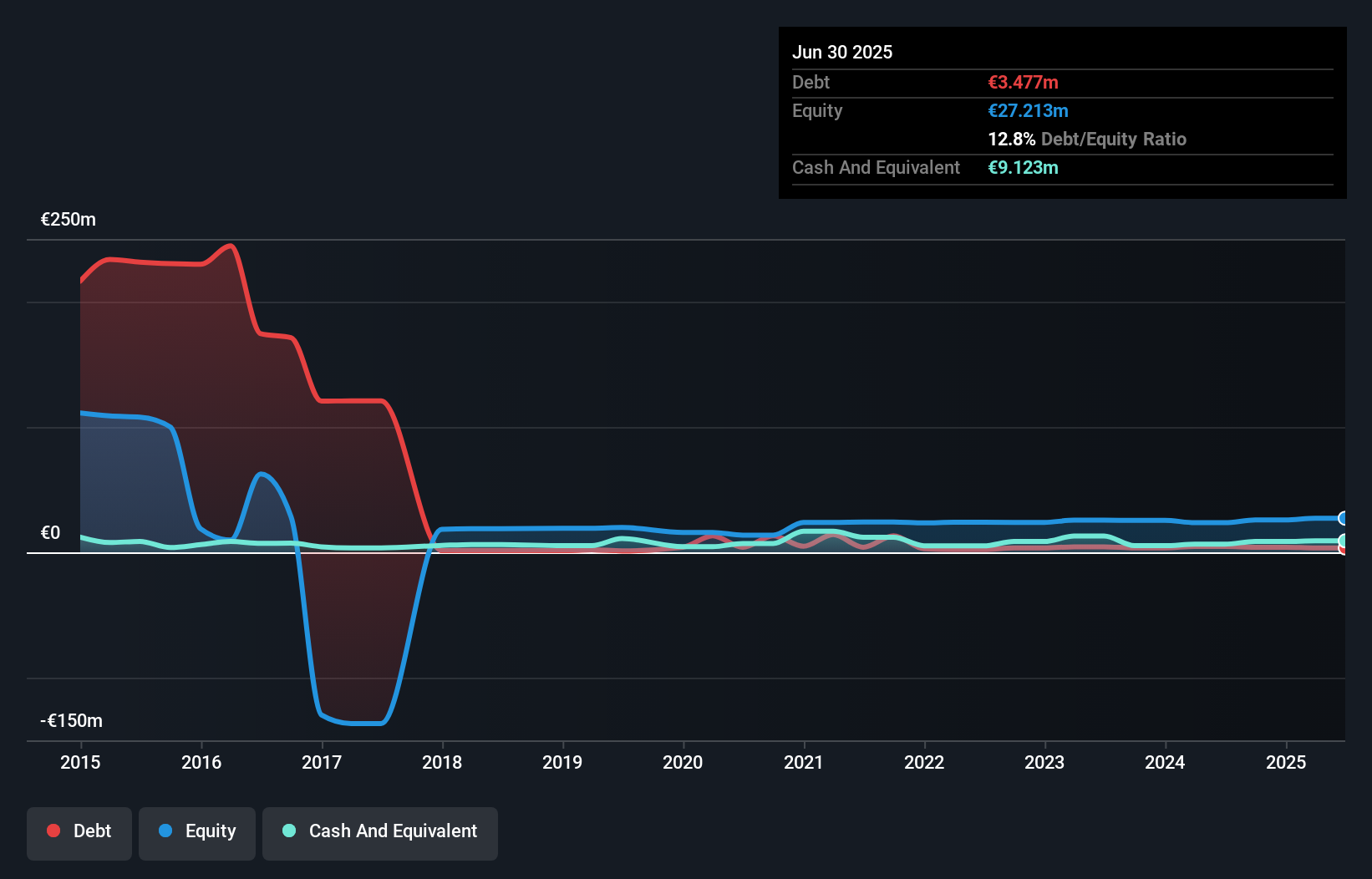

Componenta Corporation, with a market cap of €40.56 million, has transitioned to profitability in the past year, reporting net income of €1.28 million for the half-year ending June 30, 2025. The company's debt is well-managed with a reduced debt-to-equity ratio and operating cash flow covering debt at 273.8%. It trades at a significant discount to its estimated fair value and has stable weekly volatility at 4%. Recent orders from the Finnish Defence Forces valued at €10.4 million bolster its revenue outlook without impacting profit guidance for 2025-2028, reflecting ongoing operational stability and growth potential amidst industry challenges.

- Get an in-depth perspective on Componenta's performance by reading our balance sheet health report here.

- Gain insights into Componenta's future direction by reviewing our growth report.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WithSecure Oyj operates in the corporate security business globally and has a market cap of €299.64 million.

Operations: The company generates revenue from its Elements Company segment (€105.12 million) and Cloud Protection for Salesforce (€12.01 million).

Market Cap: €299.64M

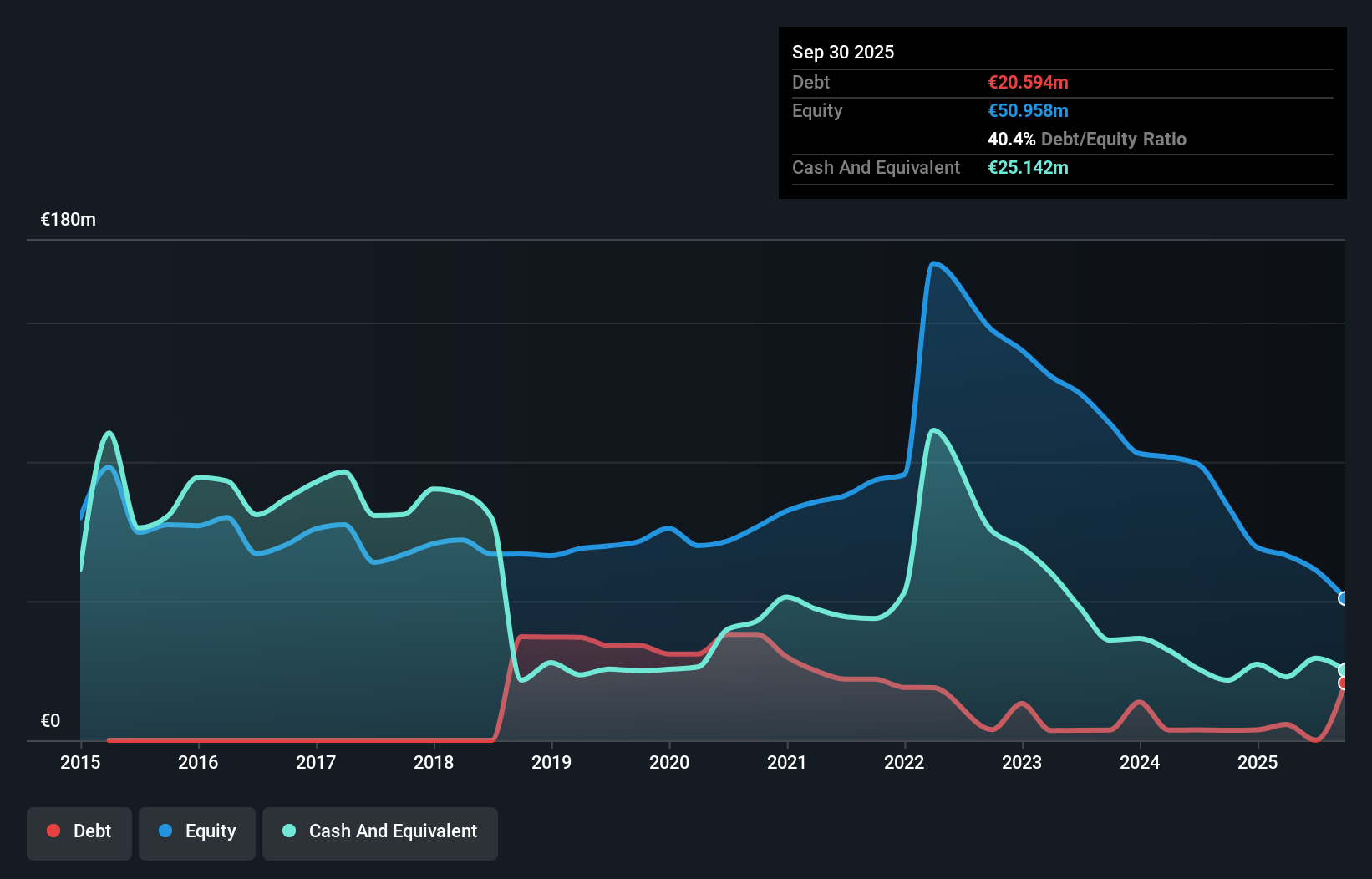

WithSecure Oyj, with a market cap of €299.64 million, is navigating significant transitions amidst its unprofitable status. Despite losses increasing at 20.9% annually over five years, the company maintains a strong cash position exceeding its debt and has sufficient runway for over three years. Recent restructuring efforts are expected to save €6.5 million annually but incur €2.8 million in one-off costs this year. Additionally, an acquisition by CVC Capital Partners plc valued at approximately €300 million is underway, potentially reshaping WithSecure's strategic direction as it aligns costs with managed services growth and addresses volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of WithSecure Oyj.

- Assess WithSecure Oyj's future earnings estimates with our detailed growth reports.

Make It Happen

- Unlock our comprehensive list of 279 European Penny Stocks by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WithSecure Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:WITH

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives