- Switzerland

- /

- Semiconductors

- /

- SWX:AMS

3 European Stock Picks Estimated To Be Trading At Up To 46.8% Discount

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively flat and major stock indexes exhibit mixed returns, investors are keenly observing economic indicators such as inflation rates and labor market stability across the eurozone. In this environment, identifying stocks that are trading at a discount can offer potential value opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SNGN Romgaz (BVB:SNG) | RON6.70 | RON13.16 | 49.1% |

| QPR Software Oyj (HLSE:QPR1V) | €0.822 | €1.62 | 49.3% |

| Lectra (ENXTPA:LSS) | €24.80 | €49.36 | 49.8% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €56.20 | €110.26 | 49% |

| innoscripta (XTRA:1INN) | €99.10 | €195.80 | 49.4% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.71 | €5.38 | 49.6% |

| Green Oleo (BIT:GRN) | €0.795 | €1.58 | 49.6% |

| Galderma Group (SWX:GALD) | CHF117.30 | CHF230.53 | 49.1% |

| Carl Zeiss Meditec (XTRA:AFX) | €53.60 | €106.60 | 49.7% |

| Almirall (BME:ALM) | €10.76 | €21.21 | 49.3% |

Let's dive into some prime choices out of the screener.

Qt Group Oyj (HLSE:QTCOM)

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across Finland, Europe, the Asia Pacific, and North America, with a market cap of €1.55 billion.

Operations: The company's revenue segment includes Software Development Tools, generating €211.22 million.

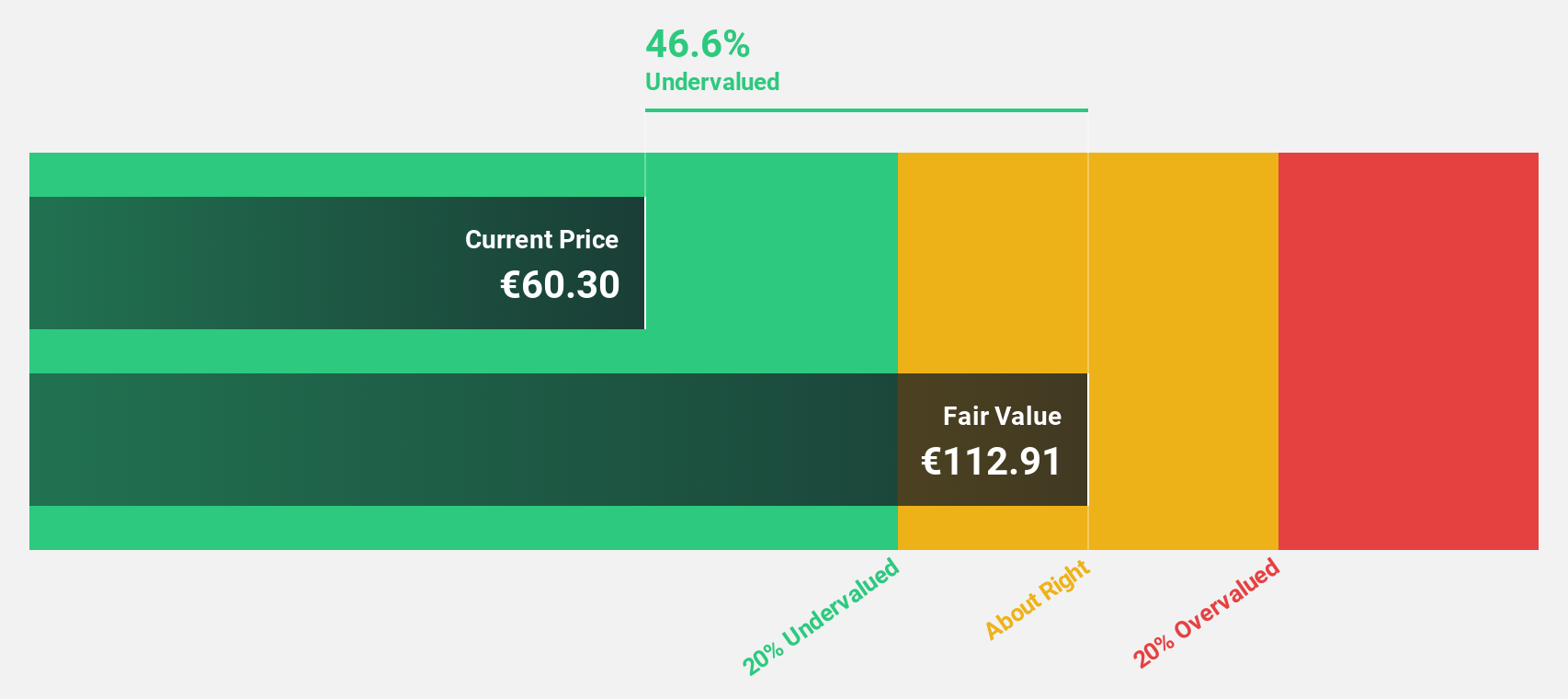

Estimated Discount To Fair Value: 45.9%

Qt Group Oyj, trading at €61.05, is significantly undervalued based on its discounted cash flow valuation of €112.92. Despite recent earnings decline, with Q1 net income dropping to €4.97 million from €7.62 million year-on-year, the company forecasts a 10-20% sales increase for 2025 and strong revenue growth at 12.6% annually—outpacing the Finnish market average of 3.6%. Recent strategic expansions in platform capabilities and AI investments further enhance its long-term value proposition amidst volatile share prices.

- According our earnings growth report, there's an indication that Qt Group Oyj might be ready to expand.

- Unlock comprehensive insights into our analysis of Qt Group Oyj stock in this financial health report.

TF Bank (OM:TFBANK)

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions through its proprietary IT platform in Sweden, with a market cap of SEK8.34 billion.

Operations: The company's revenue segments consist of Credit Cards generating SEK677.50 million, Consumer Lending contributing SEK611.92 million, and Ecommerce Solutions (excluding Credit Cards) adding SEK393.80 million.

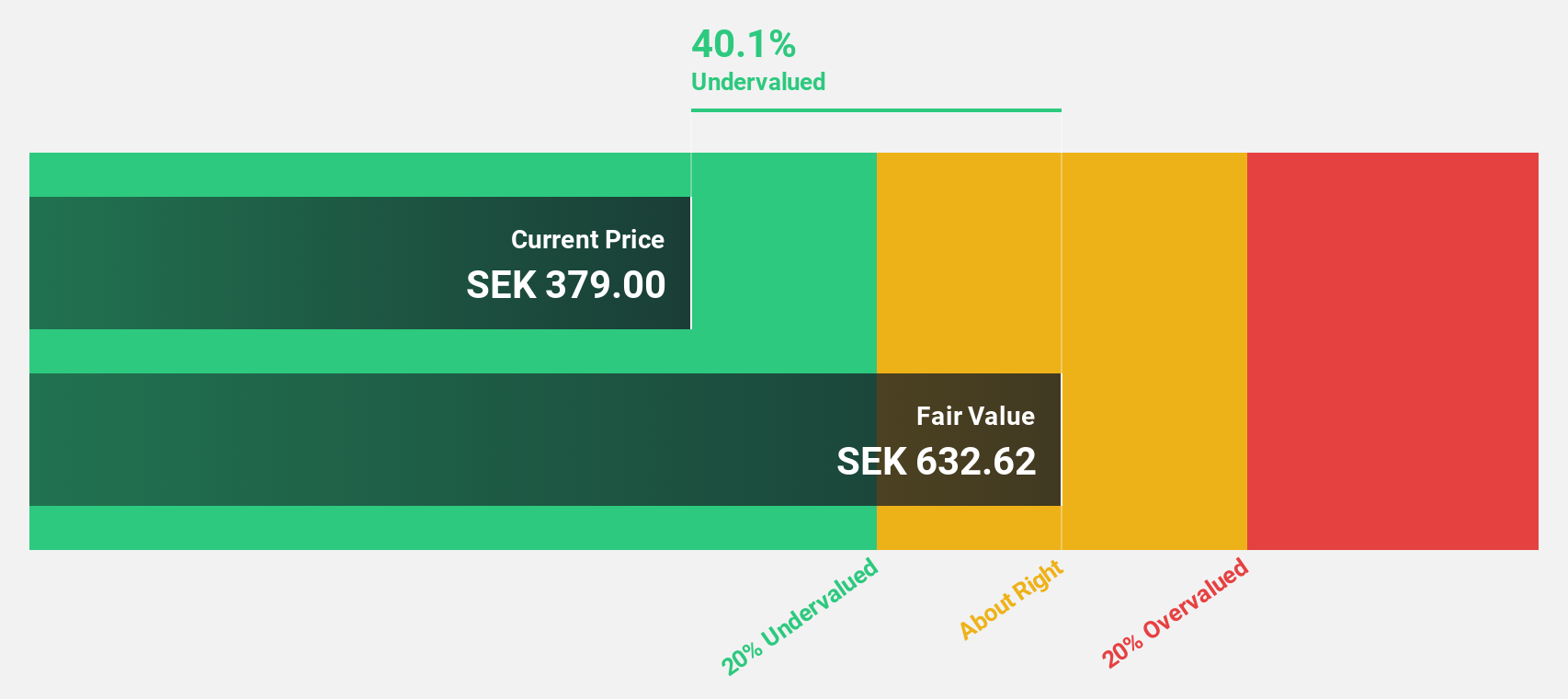

Estimated Discount To Fair Value: 38.5%

TF Bank, trading at SEK 387, is highly undervalued with a fair value estimate of SEK 629.16. It boasts strong revenue growth forecasts of 31.4% annually, surpassing the Swedish market average. However, it faces challenges with a high bad loans ratio of 2.8%. Recent developments include an extraordinary dividend and a share split to optimize share numbers, potentially affecting liquidity and investor perception positively despite significant insider selling in recent months.

- Our earnings growth report unveils the potential for significant increases in TF Bank's future results.

- Navigate through the intricacies of TF Bank with our comprehensive financial health report here.

ams-OSRAM (SWX:AMS)

Overview: ams-OSRAM AG designs, manufactures, and sells LED and optical sensor solutions across Europe, the Middle East, Africa, the Americas, and the Asia/Pacific with a market cap of CHF1.19 billion.

Operations: The company's revenue segments include Lamps & Systems generating €981 million, Opto Semiconductors (OS) with €1.44 billion, and CMOS Sensors and Asics (CSA) contributing €984 million.

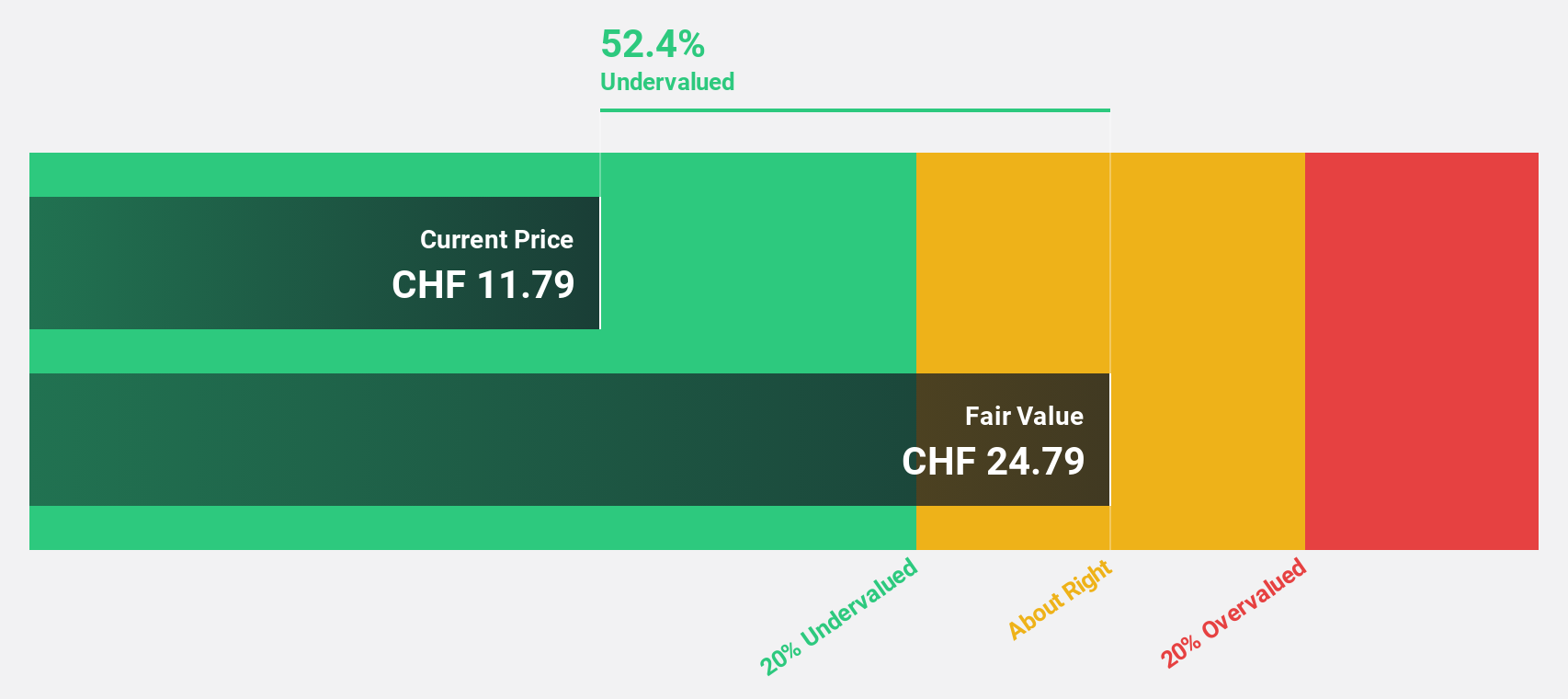

Estimated Discount To Fair Value: 46.8%

ams-OSRAM, trading at CHF12, is significantly undervalued with a fair value estimate of CHF22.57. Despite recent volatility, it is expected to achieve profitability within three years and exhibits robust revenue growth forecasts of 7.2% annually, outpacing the Swiss market average. The company reported Q1 2025 sales of €820 million and a reduced net loss compared to the previous year. However, its return on equity remains forecasted at a modest 7.5%.

- Upon reviewing our latest growth report, ams-OSRAM's projected financial performance appears quite optimistic.

- Take a closer look at ams-OSRAM's balance sheet health here in our report.

Taking Advantage

- Explore the 177 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AMS

ams-OSRAM

Engages in the design, manufacture, and sale of LED and optical sensor solutions in Europe, the Middle East, Africa, the Americas, and the Asia/Pacific.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives