- Sweden

- /

- Entertainment

- /

- OM:MTG B

High Growth Tech Stocks In Europe To Watch April 2025

Reviewed by Simply Wall St

As trade tensions escalate, the European market has experienced fluctuations with the pan-European STOXX Europe 600 Index ending lower, though some losses were mitigated by a temporary delay in U.S. tariffs. In this environment of uncertainty, high growth tech stocks in Europe are gaining attention as potential opportunities for investors seeking resilience and innovation amidst broader market volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

We'll examine a selection from our screener results.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ParTec AG specializes in the development, manufacturing, and supply of supercomputer and quantum computer solutions, with a market capitalization of €292 million.

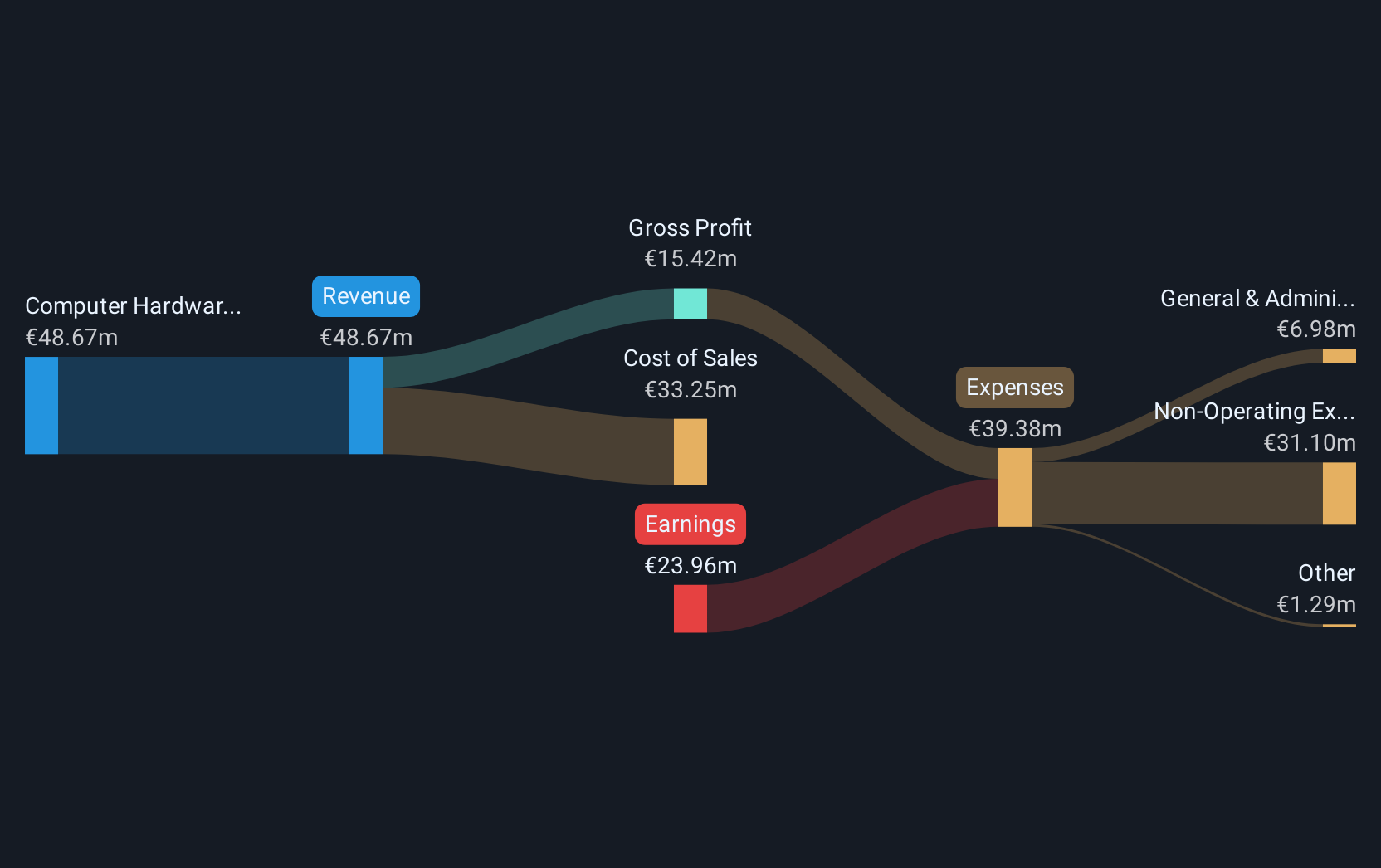

Operations: ParTec AG generates revenue primarily from its computer hardware segment, amounting to €48.67 million. The company focuses on the supercomputer and quantum computer markets, leveraging its expertise in these advanced technology solutions.

ParTec AG is making significant strides in Europe's tech landscape, particularly through its involvement in the DARE SGA1 Project, which aims to enhance digital autonomy in high-performance computing (HPC) and AI. The company's innovative contributions include designing a RISC-V based prototype system that integrates multiple processing units for enhanced efficiency and developing a digital twin to optimize performance predictions for large-scale HPC/AI setups. These technological advancements not only underscore ParTec’s role at the forefront of HPC and AI integration but also bolster its potential within the rapidly evolving tech sector. Despite recent executive changes, with key figures transitioning to new roles within its Modular Computing Lab, ParTec maintains a robust developmental trajectory highlighted by an expected annual revenue growth of 32.5% and profit growth forecast at 41.7%, positioning it well above average market projections.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

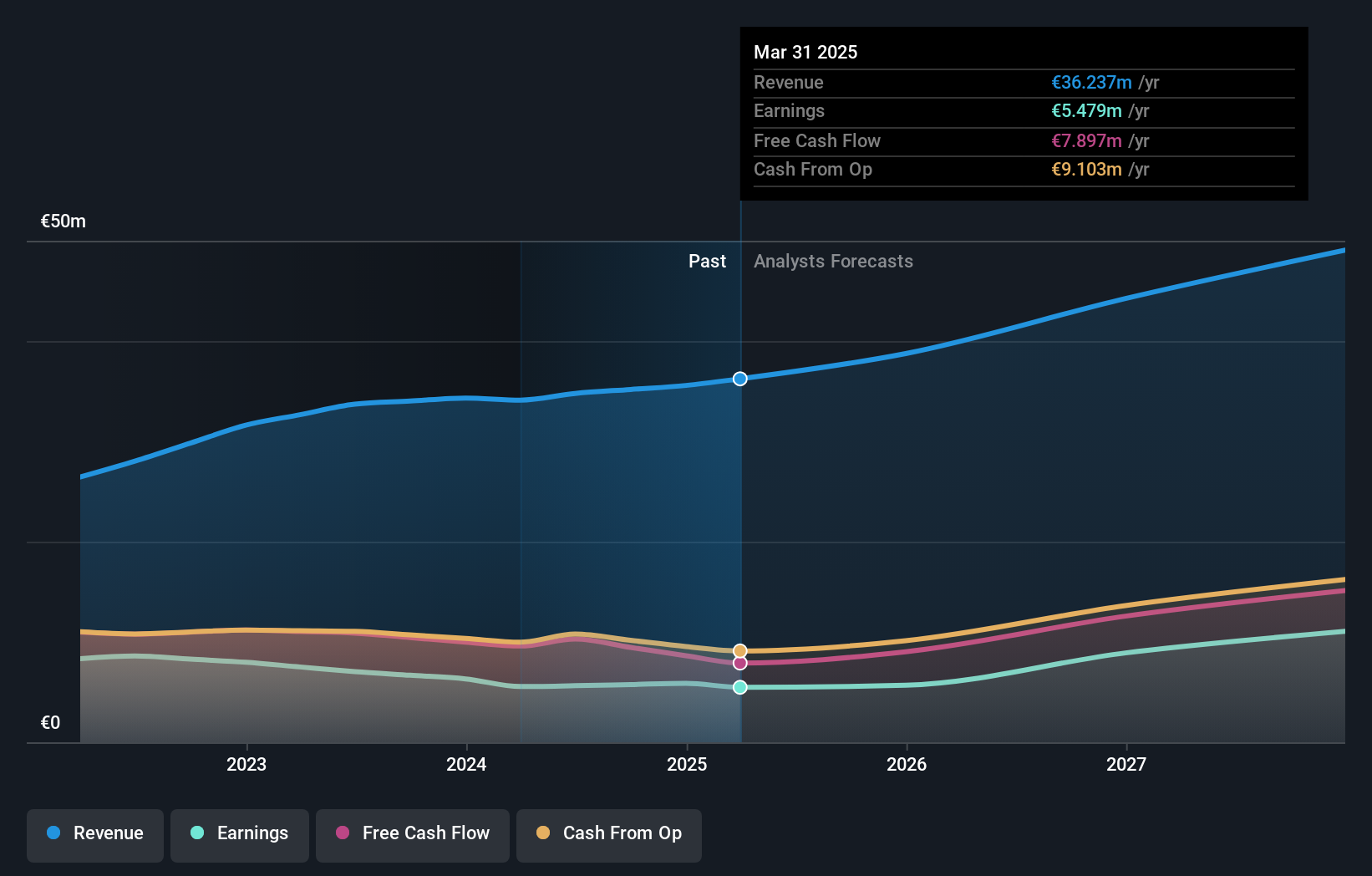

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market capitalization of €233.87 million.

Operations: The company focuses on delivering cloud-based software and automation solutions, primarily serving the Finnish market.

Admicom Oyj, a European tech firm, recently projected its annual recurring revenue (ARR) to increase by 8% to 14% for 2025, with total revenue growth anticipated between 6% and 11%. This guidance follows a first-quarter performance where sales rose from EUR 8.61 million the previous year to EUR 9.27 million. Despite a slight dip in net income from EUR 1.07 million to EUR 0.676 million in the same period, Admicom's strategic focus on enhancing software solutions could bolster its market position. Significantly, the company's R&D investment aligns with its innovation trajectory, crucial for maintaining competitive advantage in the swiftly evolving tech landscape.

- Unlock comprehensive insights into our analysis of Admicom Oyj stock in this health report.

Gain insights into Admicom Oyj's historical performance by reviewing our past performance report.

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★★☆

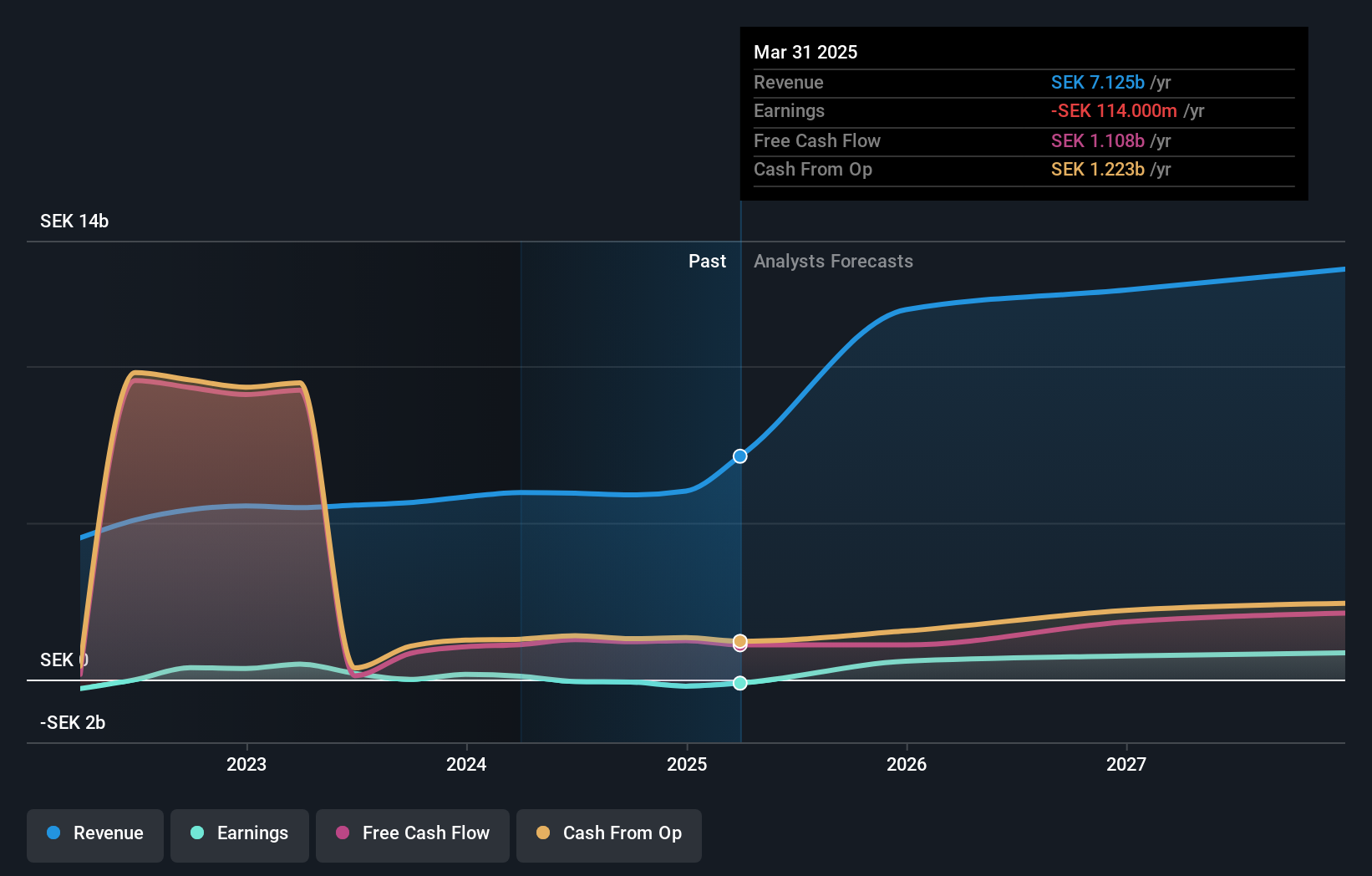

Overview: Modern Times Group MTG AB operates through its subsidiaries to provide game franchises across various regions including Sweden, the United Kingdom, Germany, and several other countries, with a market cap of SEK13.13 billion.

Operations: MTG focuses on game franchises with significant operations in regions such as Sweden, the UK, and Germany. The company generates revenue primarily from broadcasting, amounting to SEK 6.02 billion.

Modern Times Group MTG, navigating through a transformative phase, is on track with an impressive 21.6% annual revenue growth forecast, outpacing the Swedish market's average of 2.8%. Despite current unprofitability, projections indicate a robust profit surge, expected at 52.27% annually over the next three years. This growth trajectory is supported by strategic executive changes and significant R&D investments that align with its expansion into profitable sectors. The recent appointment of Nick Hopkins as CFO underscores a strengthened focus on strategic M&A and operational execution to leverage opportunities in gaming and media sectors effectively.

Where To Now?

- Click here to access our complete index of 230 European High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Modern Times Group MTG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, engages in the provision of game franchises in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives