Admicom (HLSE:ADMCM) Margin Miss on €3.7m Loss Challenges Quality Sentiment Despite Growth Outlook

Reviewed by Simply Wall St

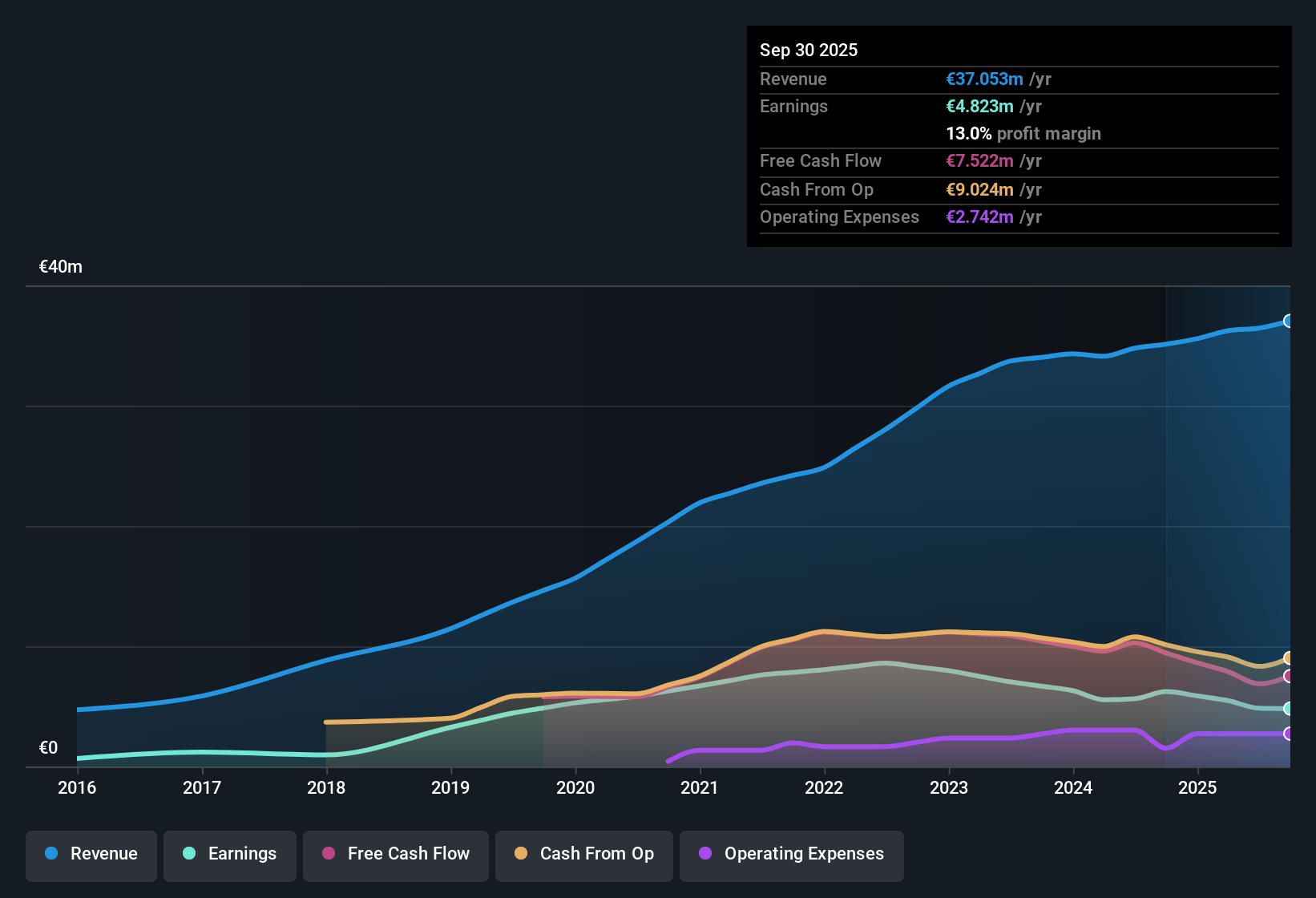

Admicom Oyj (HLSE:ADMCM) posted net profit margins of 13%, down from 17.7% a year ago, as earnings continued a five-year trend of 7.7% annual declines. The latest results were heavily impacted by a one-off €3.7 million loss. Analysts see a turnaround ahead, projecting earnings to climb 27.7% per year over the next three years and revenue to outpace the Finnish market. With shares trading at €45.95, below the fair value estimate of €67.58, investors are weighing recent margin pressures and earnings volatility against forecasts for robust profit and sales growth.

See our full analysis for Admicom Oyj.Next up, we’ll see how these headline numbers compare against the prevailing market narratives. This will highlight where expectations match up and where the story could shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Drives Down Margins

- The recent €3.7 million one-off charge was the single biggest factor dragging profit margins from 17.7% to 13% over the last year. This demonstrates the significant impact that event-driven costs can have on Admicom’s bottom line.

- The company’s recurring SaaS model and stable market position acted as a buffer, even as this major expense occurred. The prevailing market view highlights that Admicom is regarded as a niche leader in Finnish construction tech, maintaining a resilient digital platform that supports steady results when unexpected charges arise.

- Market observers note the absence of dramatic negative surprises or profit warnings, suggesting that confidence in the business model remains steady despite margin setbacks.

- There is a sense that investors expect such one-off events to be absorbed over time rather than derail the underlying trajectory.

Growth Outlook Outpaces the Market

- Analysts now project Admicom’s earnings to grow at 27.7% per year for the next three years, well ahead of the Finnish market’s 16.6% average. This points to a clear rebound from recent declines.

- The prevailing market view strongly supports the idea that Admicom will benefit from ongoing sector digitalization and steady SaaS revenues, with optimistic perspectives highlighting:

- A 10% annual revenue growth expectation, more than double the local market pace, indicating momentum behind its core construction tech offering.

- Consistent recognition of recurring income streams as a value driver, making growth prospects less vulnerable to short-term fluctuations.

Valuation: Discount to DCF But Premium to Peers

- Admicom’s share price of €45.95 is well below the €67.58 DCF fair value, although its price-to-earnings multiple of 47.8x remains significantly higher than both Finnish peers (36.6x) and the broader European software sector (28.7x).

- The prevailing market view highlights this unusual situation. While discounted cash flow estimates make the stock appear undervalued, analysts and investors are also considering whether the quality of earnings justifies paying such a substantial premium to industry averages.

- Recent earnings volatility and margin compression are likely key reasons why some discount persists, suggesting the potential upside is balanced against ongoing risks.

- Investors seem to be rewarding Admicom’s stability and growth forecast, while maintaining a close watch on reported results and sector developments.

See our latest analysis for Admicom Oyj.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Admicom Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Admicom’s high earnings multiple and recent margin pressures highlight concerns about earnings volatility, which are compressing profits even as growth is forecast to rebound.

If you’re looking for steadier performance, use our stable growth stocks screener to discover companies showing consistent revenue and earnings growth through changing conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ADMCM

Admicom Oyj

Engages in the cloud-based software and business process automation solutions in Finland.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives