- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:TOKMAN

November 2024's Top Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

In November 2024, global markets experienced notable fluctuations as investors reacted to the incoming Trump administration's policy signals and Federal Reserve Chair Jerome Powell's comments on interest rates. The S&P 600 index, which tracks small-cap stocks, was influenced by these broader economic dynamics, showcasing a mix of opportunities and challenges for investors focusing on smaller companies. In this context, identifying promising small-cap stocks involves assessing those that demonstrate resilience amid policy shifts and economic changes while also considering insider activity as a potential indicator of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.1x | 0.8x | 28.44% | ★★★★★☆ |

| Tokmanni Group Oyj | 16.6x | 0.4x | 45.13% | ★★★★★☆ |

| PSC | 7.9x | 0.4x | 42.00% | ★★★★☆☆ |

| Avia Avian | 16.8x | 3.8x | 8.20% | ★★★★☆☆ |

| NCL Industries | 14.1x | 0.5x | -73.27% | ★★★☆☆☆ |

| USCB Financial Holdings | 18.7x | 5.3x | 49.58% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.4x | 0.6x | 30.69% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.6x | 1.6x | -35.91% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sagicor Financial | 1.1x | 0.3x | -243.14% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

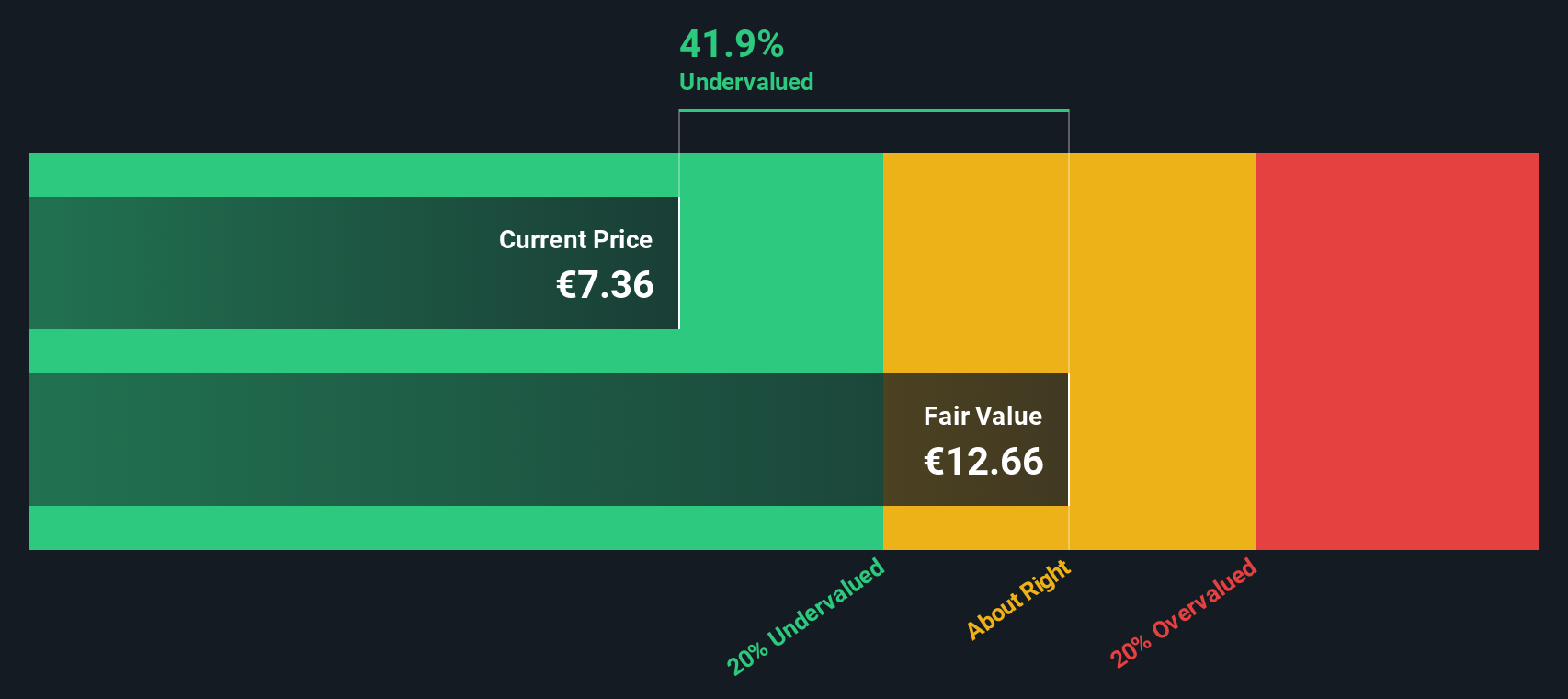

Tokmanni Group Oyj (HLSE:TOKMAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tokmanni Group Oyj is a Finnish retail company specializing in the sale of consumer goods, with a market capitalization of €1.21 billion.

Operations: The company generates revenue primarily from its core operations, with recent figures showing a revenue of €1.60 billion and a gross profit of €570.35 million as of June 2024. The cost structure includes significant expenses such as COGS at €1.03 billion and operating expenses totaling €478.39 million for the same period. Notably, the gross profit margin has shown an upward trend, reaching 35.68% in June 2024 from earlier periods.

PE: 16.6x

Tokmanni Group, a small-cap retailer, has drawn attention with insider confidence as they purchased shares recently. Despite lowering its 2024 earnings guidance to a revenue range of €1.65 billion - €1.7 billion and comparable EBIT between €98 million - €110 million, the company maintains shareholder value through dividend payments of €0.38 per share in November 2024. However, its profit margins have dipped from 4.6% to 2.6%, highlighting some financial challenges amidst growth forecasts of 22% annually in earnings.

- Click here and access our complete valuation analysis report to understand the dynamics of Tokmanni Group Oyj.

Evaluate Tokmanni Group Oyj's historical performance by accessing our past performance report.

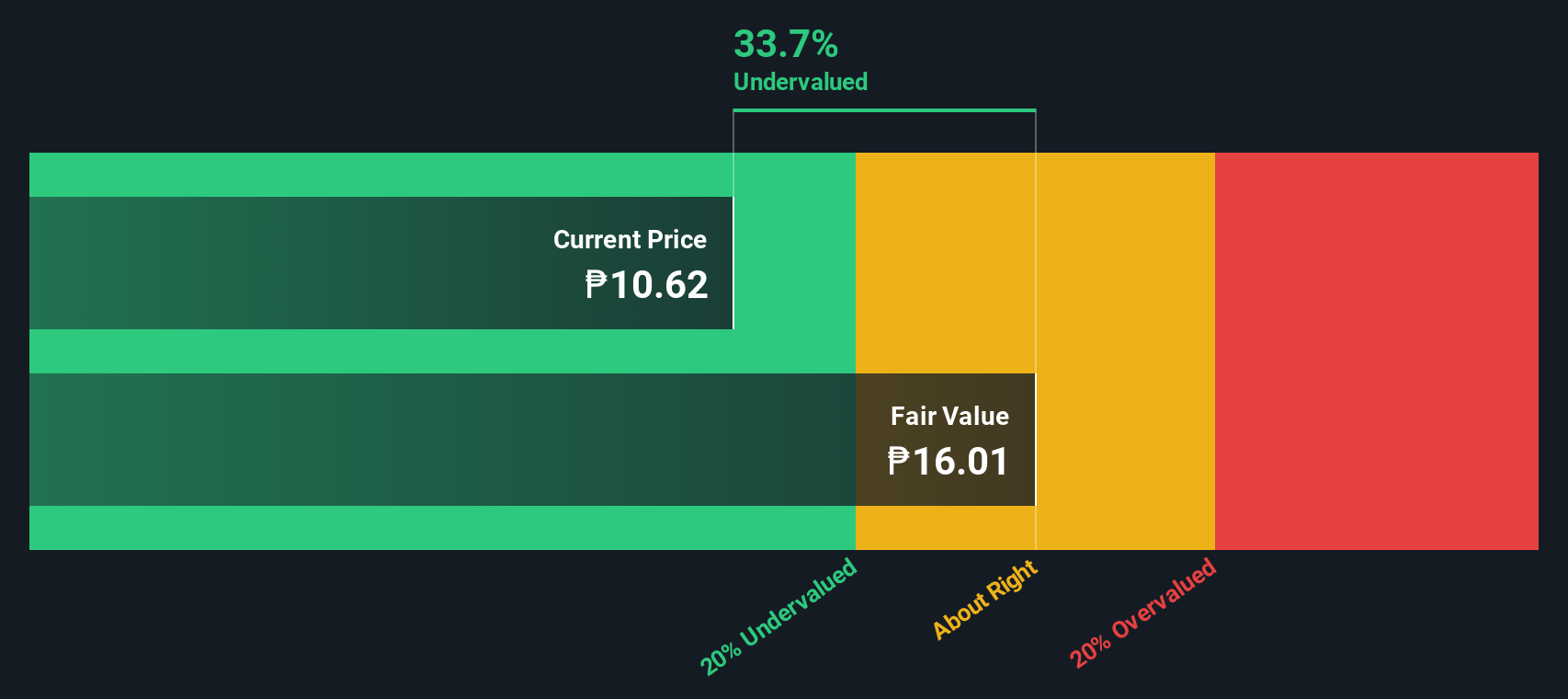

East West Banking (PSE:EW)

Simply Wall St Value Rating: ★★★★★☆

Overview: East West Banking Corporation is a financial institution in the Philippines that provides a range of banking services, including retail and corporate banking, with a market capitalization of ₱28.5 billion.

Operations: East West Banking's revenue primarily stems from its operations, with a notable gross profit margin trend peaking at 99.66% in September 2014 and adjusting to 98.88% by June 2024. The company's operating expenses are significant, with general and administrative expenses consistently forming a substantial portion, reaching ₱10.79 billion by September 2024.

PE: 3.1x

East West Banking, a smaller player in the financial sector, shows potential for value appreciation. Recent earnings revealed a net income of PHP 2.3 billion for Q3 2024, up from PHP 1.6 billion last year, reflecting strong operational performance despite a high bad loans ratio of 5.4%. Insider confidence is evident as an executive purchased over 903,900 shares worth approximately PHP 8.7 million between October and November 2024, signaling trust in the bank's future prospects amidst leadership transitions.

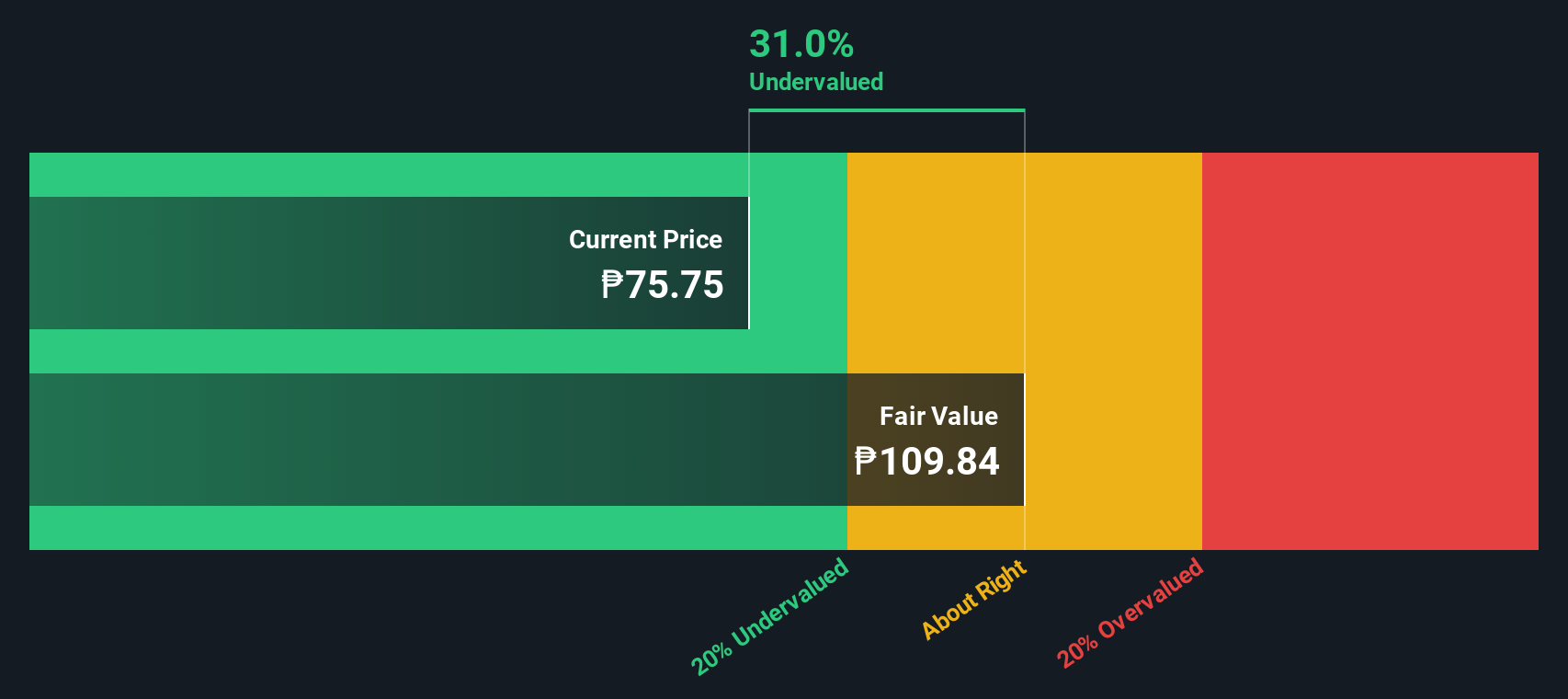

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Security Bank is a financial institution in the Philippines offering a range of services including retail and commercial banking, with a market capitalization of approximately ₱100.54 billion.

Operations: SECB's revenue has shown a consistent upward trend, reaching ₱44.64 billion by September 2024. The company has experienced fluctuations in its net income margin, which peaked at 48.86% in March 2015 and declined to 22.39% by September 2024. Operating expenses have increased over time, with general and administrative expenses being a significant component, amounting to ₱13.66 billion in the latest period reported.

PE: 6.4x

Security Bank, a company in the small cap category, recently showcased strong financial results with third-quarter net interest income rising to PHP 10.72 billion from PHP 8.98 billion last year, and net income increasing to PHP 3.01 billion from PHP 2.65 billion over the same period. Insider confidence is evident as an independent director acquired 49,000 shares worth approximately ₱2.95 million between September and November 2024, reflecting a significant increase of over 35% in their holdings despite challenges like high bad loan levels at 3.4% and low allowance for bad loans at only 83%. The bank's earnings are projected to grow by nearly 18% annually, indicating potential for future value despite existing hurdles in non-performing loans management.

- Navigate through the intricacies of Security Bank with our comprehensive valuation report here.

Gain insights into Security Bank's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 169 more companies for you to explore.Click here to unveil our expertly curated list of 172 Undervalued Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokmanni Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TOKMAN

Tokmanni Group Oyj

Operates as a discount retailer in Finland, Sweden, and Denmark.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives