- Japan

- /

- Hospitality

- /

- TSE:7550

3 Stocks Estimated To Be Undervalued In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across various sectors. With inflation data aligning with expectations and interest rate cuts becoming less likely, discerning undervalued stocks becomes crucial for those seeking opportunities in this fluctuating landscape. Identifying stocks that are potentially undervalued involves assessing their intrinsic value relative to current market prices, especially amid such economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.63 | CN¥33.16 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.20 | 50% |

| Insyde Software (TPEX:6231) | NT$464.50 | NT$927.39 | 49.9% |

| SeSa (BIT:SES) | €75.50 | €150.49 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.20 | SEK450.07 | 49.7% |

| Accent Group (ASX:AX1) | A$2.51 | A$5.00 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥12.90 | CN¥25.73 | 49.9% |

| Advanced Energy Industries (NasdaqGS:AEIS) | US$109.84 | US$219.25 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.82 | A$17.59 | 49.8% |

| St. James's Place (LSE:STJ) | £8.21 | £16.37 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

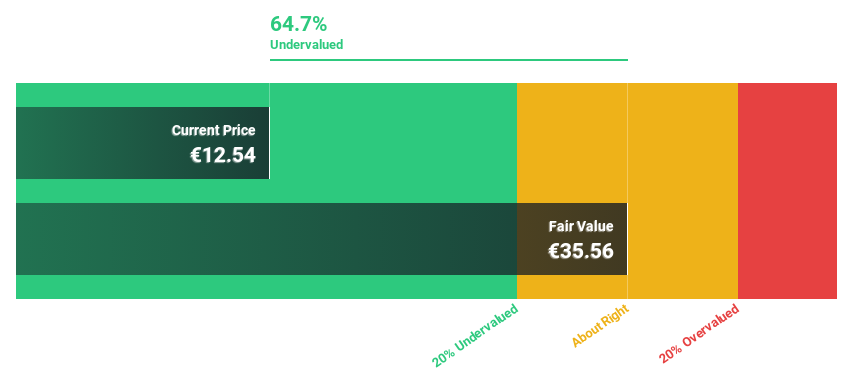

Tokmanni Group Oyj (HLSE:TOKMAN)

Overview: Tokmanni Group Oyj is a discount retailer operating in Finland, Sweden, and Denmark with a market cap of €686.76 million.

Operations: The company's revenue segments include €1.22 billion from its main operations, with an additional segment adjustment of €381.51 million.

Estimated Discount To Fair Value: 45.1%

Tokmanni Group Oyj is trading significantly below its estimated fair value of €21.27, with a current price of €11.67, reflecting potential undervaluation based on cash flows. Despite lower profit margins compared to the previous year and interest payments not being well covered by earnings, Tokmanni's earnings are forecasted to grow at 22% annually over the next three years—outpacing the Finnish market's growth rate. However, recent guidance revisions indicate slightly lowered revenue expectations for 2024.

- The growth report we've compiled suggests that Tokmanni Group Oyj's future prospects could be on the up.

- Take a closer look at Tokmanni Group Oyj's balance sheet health here in our report.

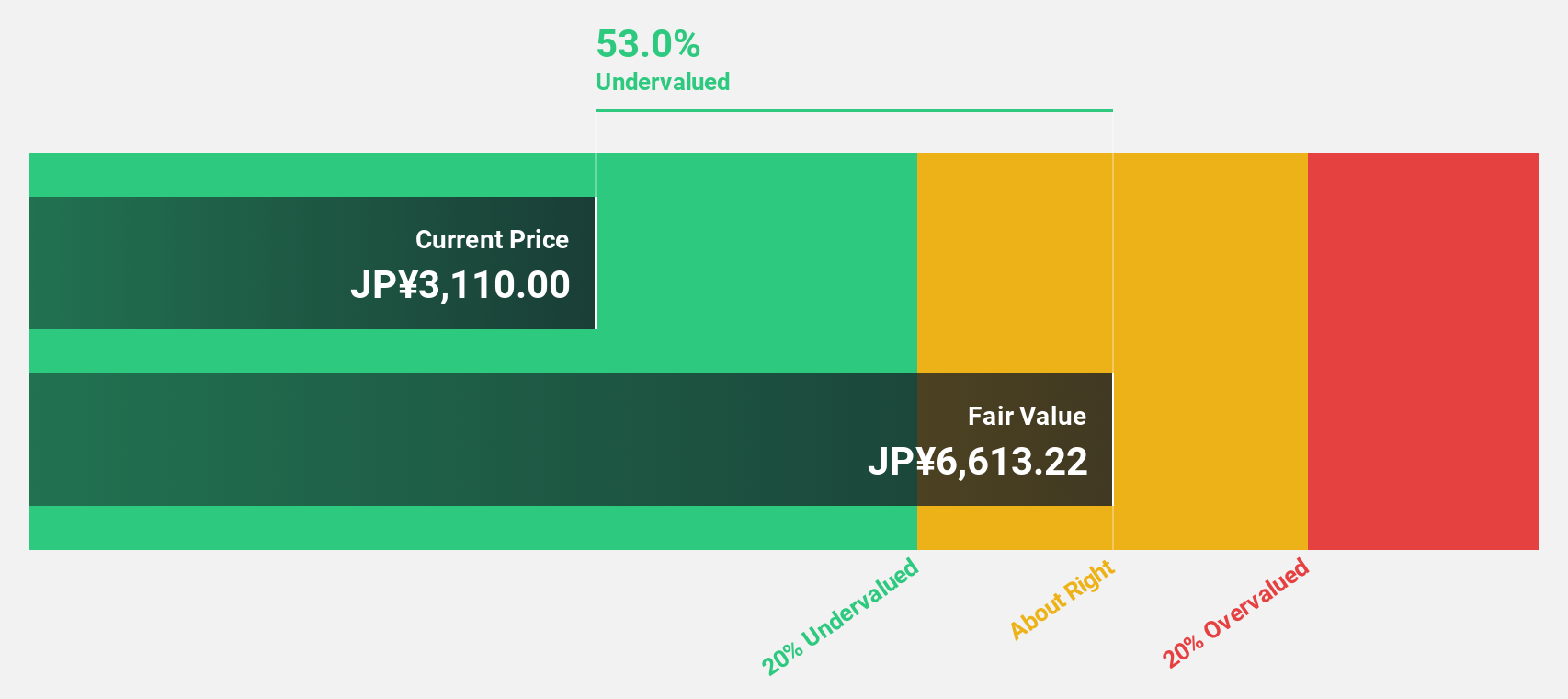

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market cap of ¥136.92 billion.

Operations: The company's revenue is derived from its Human Resource Platform Business, generating ¥19.45 billion, Medical Platform Business with ¥6.52 billion, and New Services contributing ¥713 million.

Estimated Discount To Fair Value: 46.7%

Medley, Inc. is trading at ¥4215, significantly below its estimated fair value of ¥7907.09, indicating potential undervaluation based on cash flows. Earnings are forecast to grow 31.5% annually, surpassing the JP market's growth rate of 8%. Despite recent volatility in share price and large one-off items impacting financial results, Medley’s revenue is expected to grow robustly at 25.6% per year. Recent board meetings discussed strategic acquisitions to expand operations further.

- Our comprehensive growth report raises the possibility that Medley is poised for substantial financial growth.

- Get an in-depth perspective on Medley's balance sheet by reading our health report here.

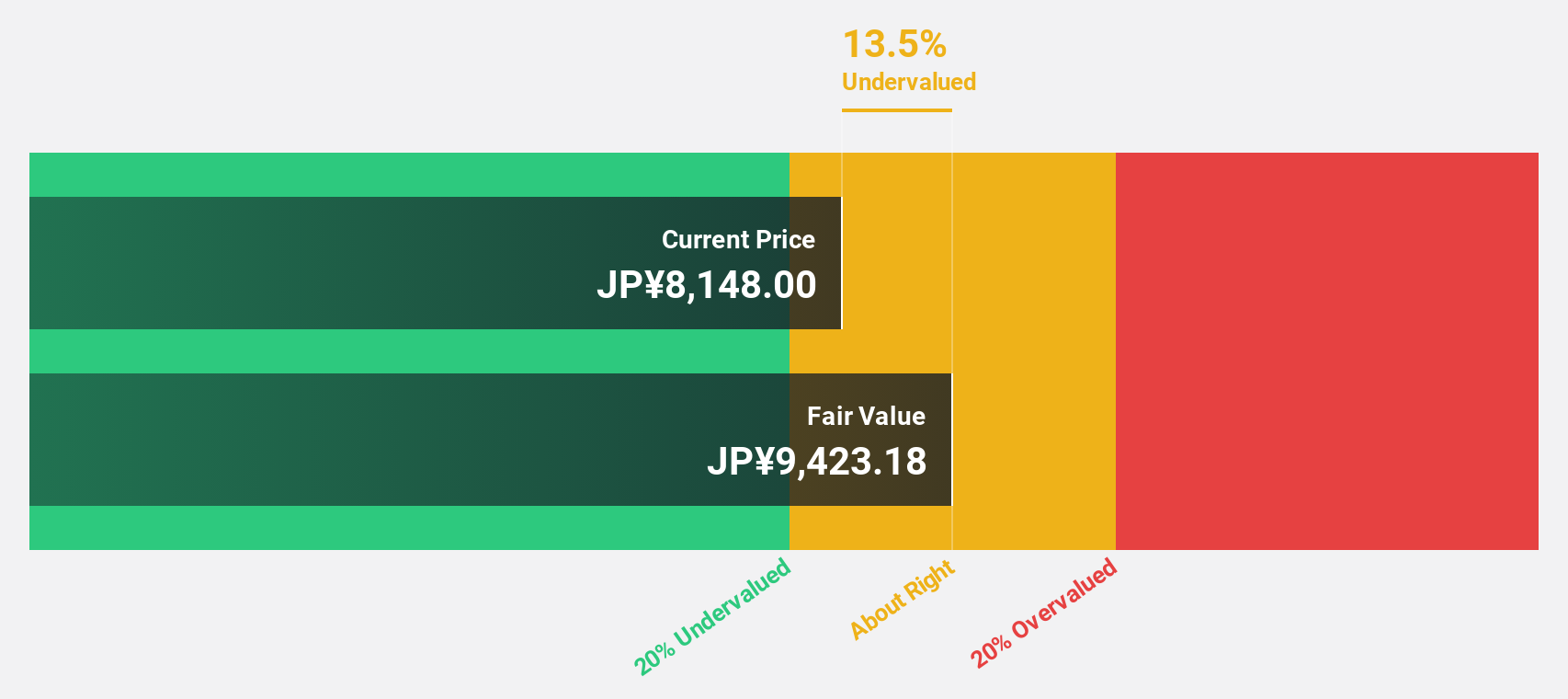

Zensho Holdings (TSE:7550)

Overview: Zensho Holdings Co., Ltd. operates food service chain restaurants in Japan and internationally, with a market cap of ¥1.30 trillion.

Operations: The company's revenue segments include Restaurants at ¥148.60 million, Global Sukiya at ¥279.84 million, Global Fast Food at ¥302.52 million, Global Hamasushi at ¥220.45 million, Retail at ¥78.43 million, and Corporate and Support services contributing ¥383.15 million.

Estimated Discount To Fair Value: 43.8%

Zensho Holdings is trading at ¥8315, well below its estimated fair value of ¥14783.29, highlighting potential undervaluation based on cash flows. The company recently announced a dividend increase to ¥35 per share and plans to raise JPY 10 billion through a subordinated loan to bolster growth strategies. Despite high debt levels and past shareholder dilution, earnings are forecast to grow 17.7% annually, outpacing the JP market's growth rate of 8%.

- Our expertly prepared growth report on Zensho Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Zensho Holdings stock in this financial health report.

Taking Advantage

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 932 more companies for you to explore.Click here to unveil our expertly curated list of 935 Undervalued Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zensho Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7550

Zensho Holdings

Manages food service chain restaurants in Japan and internationally.

Undervalued with solid track record.