As European markets experience a boost in sentiment following the easing of trade tensions between the U.S. and China, investors are increasingly looking for opportunities beyond traditional blue-chip stocks. Penny stocks, though often considered a term from the past, continue to offer intriguing prospects for those interested in smaller or newer companies. These stocks can present significant growth potential when backed by strong financials and solid fundamentals, making them an attractive option for investors seeking value in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.29 | SEK2.19B | ✅ 4 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.72 | SEK466.39M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.74 | SEK246.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.50 | SEK212.94M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.75 | PLN127.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.67 | €56.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.74 | €17.72M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.175 | €300.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 446 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Kamux Oyj (HLSE:KAMUX)

Simply Wall St Financial Health Rating: ★★★★☆☆

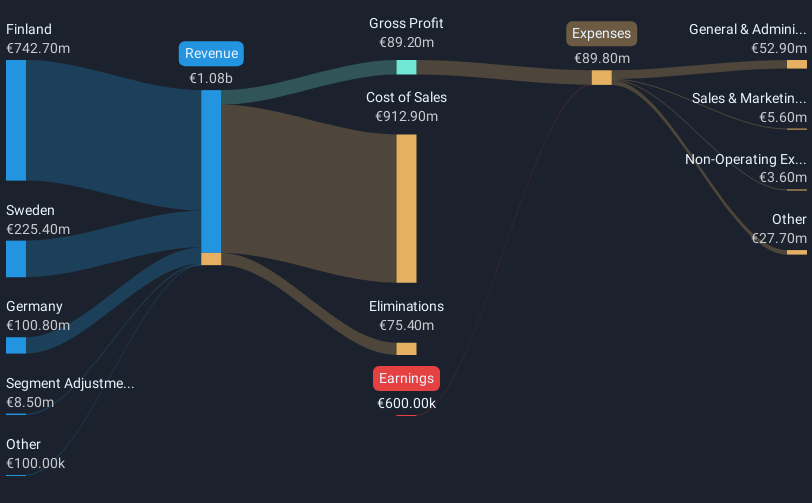

Overview: Kamux Oyj operates in the wholesale and retail used car market across Finland, Sweden, and Germany, with a market capitalization of €85.73 million.

Operations: Kamux Oyj's operations span the wholesale and retail used car market in Finland, Sweden, and Germany.

Market Cap: €85.73M

Kamux Oyj, with a market cap of €85.73 million, operates in the used car market across Finland, Sweden, and Germany. Despite trading at 42.5% below its estimated fair value and having short-term assets exceeding liabilities, it remains unprofitable with a net loss of €4 million in Q1 2025. The company's dividend yield is unsustainable by earnings, and interest payments are not well covered by EBIT. Recent expansions include new showrooms in Germany and Finland to support its omnichannel strategy. Management changes are underway with a new CFO joining soon to strengthen financial oversight amidst operational challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Kamux Oyj.

- Gain insights into Kamux Oyj's future direction by reviewing our growth report.

Spinnova Oyj (HLSE:SPINN)

Simply Wall St Financial Health Rating: ★★★★★★

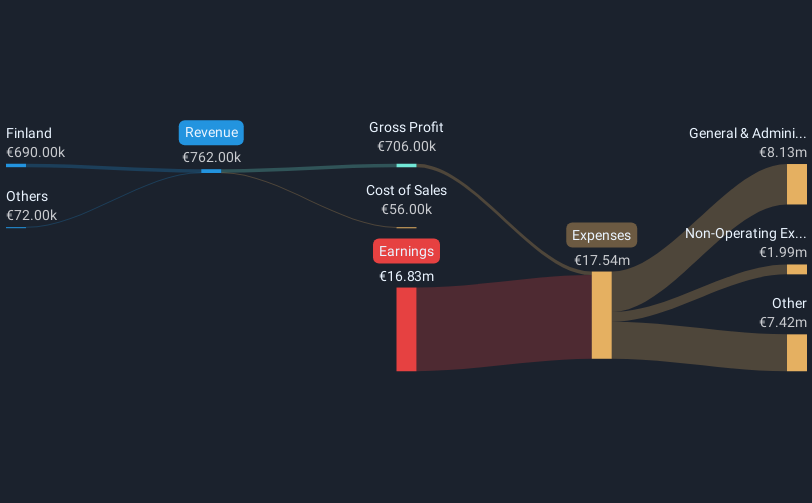

Overview: Spinnova Oyj is involved in the production and sale of natural fiber materials both in Finland and internationally, with a market cap of €23.90 million.

Operations: The company's revenue is primarily derived from its textile manufacturing segment, amounting to €0.76 million.

Market Cap: €23.9M

Spinnova Oyj, with a market cap of €23.90 million, is pre-revenue, generating only €0.76 million from its textile manufacturing segment. Despite having more cash than debt and short-term assets exceeding liabilities, the company remains unprofitable with a negative return on equity of -23.65%. Recent management changes include new roles for key executives to align with development goals, while strategic partnerships face uncertainty as Suzano Plc decided not to invest further in their joint venture. Spinnova's board and management team are relatively inexperienced but are conducting a strategic review to reassess future directions and financial targets.

- Click here to discover the nuances of Spinnova Oyj with our detailed analytical financial health report.

- Explore Spinnova Oyj's analyst forecasts in our growth report.

Binero Group (OM:BINERO)

Simply Wall St Financial Health Rating: ★★★★☆☆

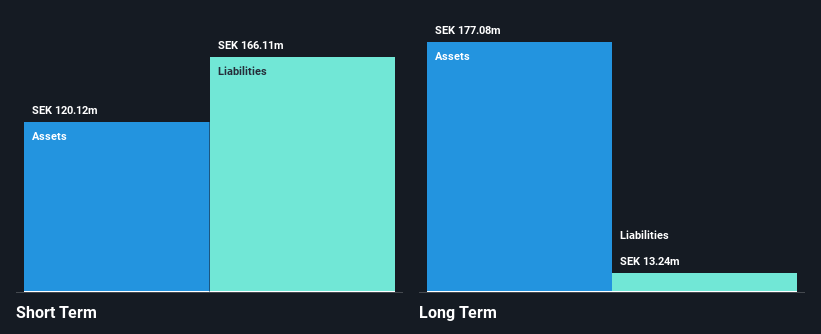

Overview: Binero Group AB (publ) offers cloud and digital infrastructure services to companies and organizations in Sweden, with a market cap of SEK316.18 million.

Operations: The company's revenue of SEK416.38 million is derived from its Internet Software & Services segment.

Market Cap: SEK316.18M

Binero Group AB, with a market cap of SEK316.18 million, reported revenue of SEK417.2 million for 2024 and achieved profitability with a net income of SEK12.9 million, reversing a prior loss. The company has demonstrated strong earnings growth over the past five years and its debt is well-covered by operating cash flow at 52%. While Binero's board lacks experience with an average tenure of 1.3 years, its management team is seasoned at 2.8 years on average. Despite stable weekly volatility, short-term assets do not fully cover liabilities, posing potential liquidity concerns in the near term.

- Click to explore a detailed breakdown of our findings in Binero Group's financial health report.

- Evaluate Binero Group's prospects by accessing our earnings growth report.

Seize The Opportunity

- Reveal the 446 hidden gems among our European Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Binero Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Binero Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BINERO

Binero Group

Provides cloud and digital infrastructure services for companies and organizations in Sweden.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives