- Finland

- /

- Retail Distributors

- /

- HLSE:DUELL

Risks Still Elevated At These Prices As Duell Oyj (HEL:DUELL) Shares Dive 53%

The Duell Oyj (HEL:DUELL) share price has fared very poorly over the last month, falling by a substantial 53%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

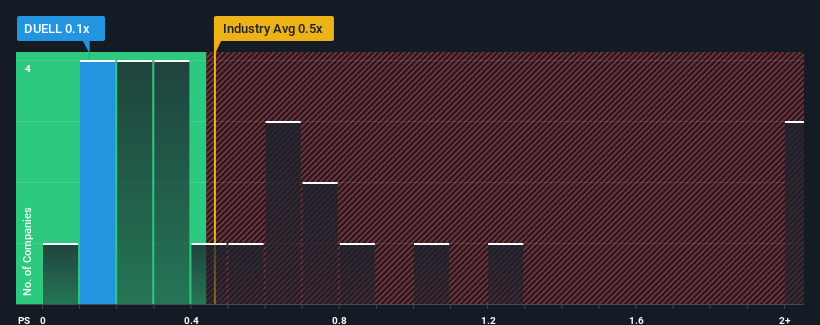

Even after such a large drop in price, it's still not a stretch to say that Duell Oyj's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Retail Distributors industry in Finland, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Duell Oyj

What Does Duell Oyj's Recent Performance Look Like?

Duell Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Duell Oyj.Is There Some Revenue Growth Forecasted For Duell Oyj?

The only time you'd be comfortable seeing a P/S like Duell Oyj's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.0%. Still, the latest three year period has seen an excellent 100% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 2.8% per year as estimated by the two analysts watching the company. With the industry predicted to deliver 9.7% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Duell Oyj's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Duell Oyj's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Duell Oyj's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Duell Oyj is showing 4 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DUELL

Duell Oyj

Engages in the wholesale, import, and distribution of powersports aftermarket products in Finland, Central Europe, and the Nordic countries.

Excellent balance sheet and good value.