- Finland

- /

- Real Estate

- /

- HLSE:CTY1S

Did Changing Sentiment Drive Citycon Oyj's (HEL:CTY1S) Share Price Down By 38%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Citycon Oyj (HEL:CTY1S), since the last five years saw the share price fall 38%.

View our latest analysis for Citycon Oyj

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

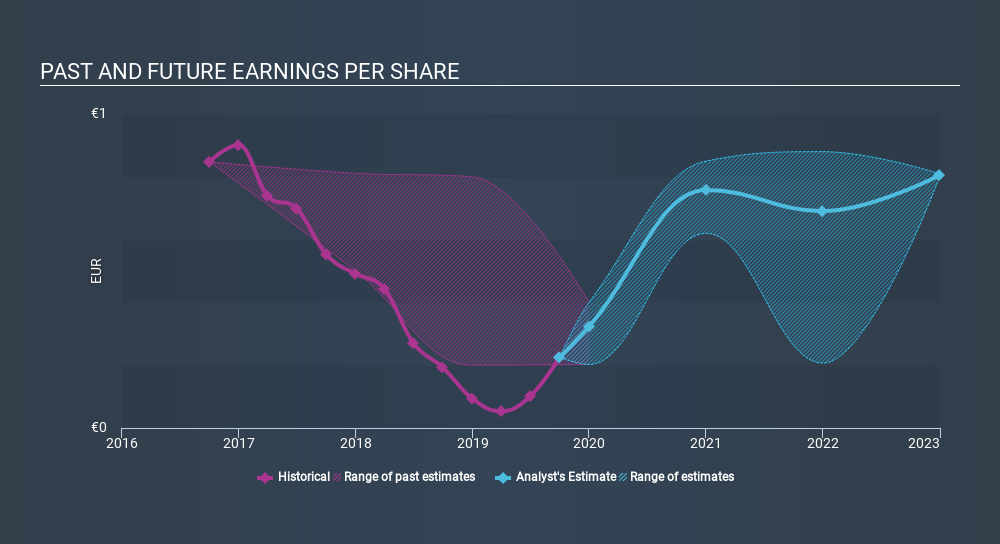

During the five years over which the share price declined, Citycon Oyj's earnings per share (EPS) dropped by 26% each year. The share price decline of 9.1% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Citycon Oyj has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Citycon Oyj, it has a TSR of -8.9% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Citycon Oyj has rewarded shareholders with a total shareholder return of 17% in the last twelve months. That's including the dividend. That certainly beats the loss of about 1.9% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Citycon Oyj better, we need to consider many other factors. Take risks, for example - Citycon Oyj has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:CTY1S

Citycon Oyj

A real estate investment company, owns and develops mixed-use centers in Finland, Norway, Sweden, Denmark, and Estonia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)