- Finland

- /

- Real Estate

- /

- HLSE:TOIVO

A Piece Of The Puzzle Missing From Toivo Group Oyj's (HEL:TOIVO) 25% Share Price Climb

Toivo Group Oyj (HEL:TOIVO) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

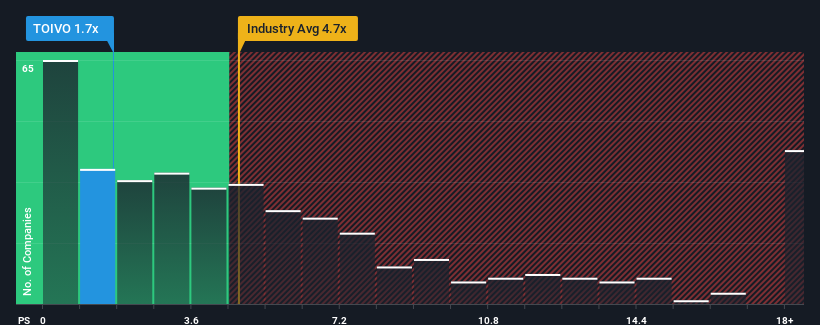

Even after such a large jump in price, when close to half the companies operating in Finland's Real Estate industry have price-to-sales ratios (or "P/S") above 3.1x, you may still consider Toivo Group Oyj as an enticing stock to check out with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Toivo Group Oyj

What Does Toivo Group Oyj's P/S Mean For Shareholders?

Toivo Group Oyj certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Toivo Group Oyj.Is There Any Revenue Growth Forecasted For Toivo Group Oyj?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Toivo Group Oyj's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.3% over the next year. With the industry predicted to deliver 7.3% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Toivo Group Oyj is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Toivo Group Oyj's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Toivo Group Oyj remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Toivo Group Oyj you should be aware of, and 2 of them are potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Toivo Group Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toivo Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TOIVO

Reasonable growth potential with questionable track record.

Market Insights

Community Narratives