We Wouldn't Be Too Quick To Buy Orion Oyj (HEL:ORNBV) Before It Goes Ex-Dividend

It looks like Orion Oyj (HEL:ORNBV) is about to go ex-dividend in the next three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. In other words, investors can purchase Orion Oyj's shares before the 15th of October in order to be eligible for the dividend, which will be paid on the 23rd of October.

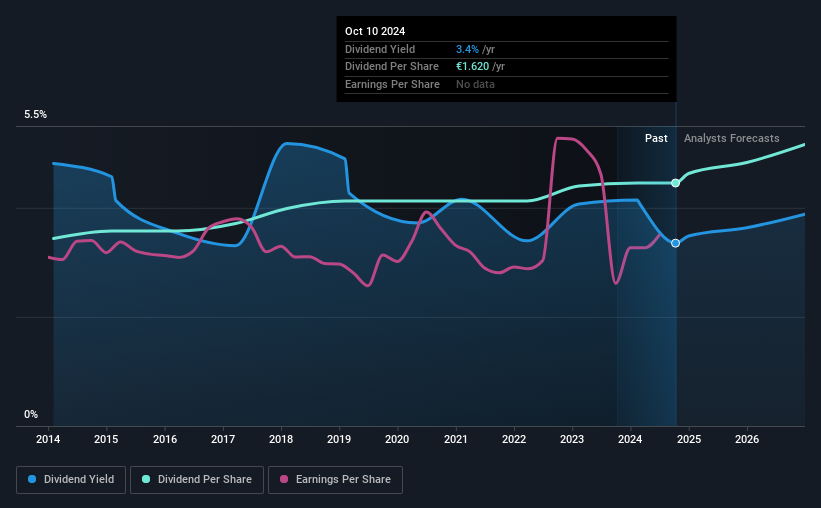

The company's next dividend payment will be €0.81 per share, on the back of last year when the company paid a total of €1.62 to shareholders. Based on the last year's worth of payments, Orion Oyj has a trailing yield of 3.4% on the current stock price of €48.33. If you buy this business for its dividend, you should have an idea of whether Orion Oyj's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Orion Oyj

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Orion Oyj paid out 98% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 84% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while Orion Oyj's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if this were to happen repeatedly, we'd be concerned about whether the dividend is sustainable in a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Orion Oyj earnings per share are up 3.3% per annum over the last five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Orion Oyj has increased its dividend at approximately 2.6% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has Orion Oyj got what it takes to maintain its dividend payments? While earnings per share have been growing slowly, Orion Oyj is paying out an uncomfortably high percentage of its earnings. However it did pay out a lower percentage of its cashflow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Although, if you're still interested in Orion Oyj and want to know more, you'll find it very useful to know what risks this stock faces. To that end, you should learn about the 2 warning signs we've spotted with Orion Oyj (including 1 which shouldn't be ignored).

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ORNBV

Orion Oyj

Develops, manufactures, and markets human and veterinary pharmaceuticals and active pharmaceutical ingredients (APIs) in Finland, Scandinavia, rest of Europe, North America, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.