- Finland

- /

- Entertainment

- /

- HLSE:NXTGMS

Imagine Owning Next Games Oyj (HEL:NXTGMS) And Trying To Stomach The 76% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Next Games Oyj (HEL:NXTGMS) shareholders will doubtless be very grateful to see the share price up 32% in the last week. But that doesn't change the fact that the returns over the last year have been stomach churning. To wit, the stock has dropped 76% over the last year. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

See our latest analysis for Next Games Oyj

Next Games Oyj isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Next Games Oyj increased its revenue by 8.6%. That's not a very high growth rate considering it doesn't make profits. Even so you could argue that it's surprising that the share price has tanked 76%. We'd venture this growth was too low to give holders confidence that profitability is on the horizon. If and only if this company is still likely to succeed, just a little slower, this could be a good opportunity.

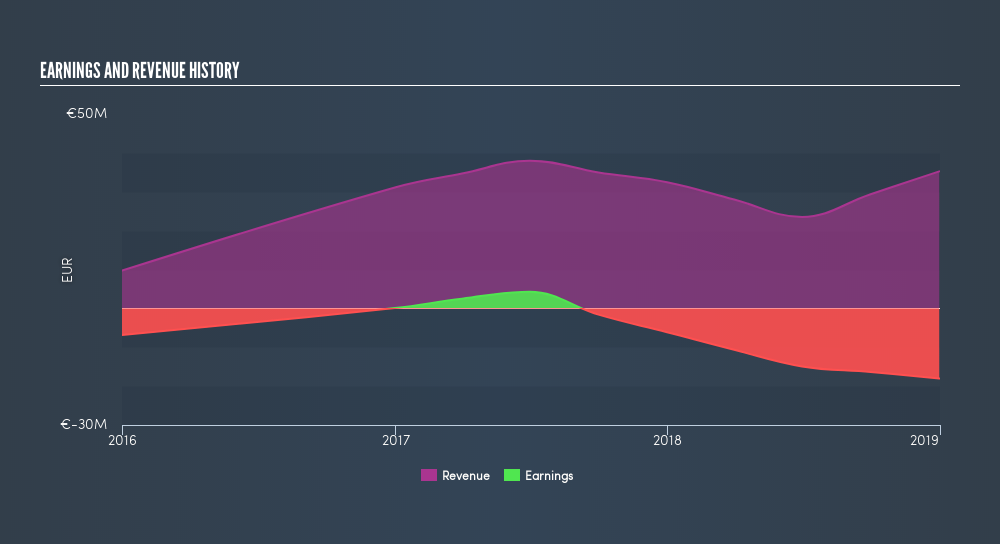

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Next Games Oyj's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Next Games Oyj shareholders are happy with the loss of 76% over twelve months. That falls short of the market, which lost 0.3%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 9.4% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Next Games Oyj may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:NXTGMS

Next Games Oyj

Next Games Oyj develops and publishes mobile games in North America, Finland, rest of Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)