- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

Is There an Opportunity in UPM-Kymmene Oyj After 1.1% Share Price Rebound This Week?

Reviewed by Bailey Pemberton

Trying to decide whether UPM-Kymmene Oyj deserves a place in your portfolio? You are definitely not alone. The company is well known for its sizable footprint in the forest products sector, and its stock has been anything but dull lately. Over just the past week, UPM-Kymmene shares crept up by 1.1%, reversing some of the recent downward momentum. Still, the past year has not been easy, with the stock down 17.6%. In fact, the shares have struggled year-to-date, off by 13.1%. Looking further back, the stock remains up 9.5% over the last five years, so there is certainly a longer-term growth case to consider. Short-term volatility, however, remains a fixture.

This recent back-and-forth tracks closely with developments in global demand patterns for pulp and paper products, as well as shifting investor sentiment around sustainability trends and evolving industrial uses of wood-based materials. For investors, the big question is whether the current price offers compelling value, especially as the company navigates changing market dynamics.

To put numbers around it, UPM-Kymmene currently earns a value score of 3 according to six key valuation checks, meaning it appears undervalued in half of the approaches considered. Coming up, we will break down these valuation methods, examining where the company stands out. We will also hint at an even smarter way to assess real value at the end.

Why UPM-Kymmene Oyj is lagging behind its peers

Approach 1: UPM-Kymmene Oyj Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company’s intrinsic value by forecasting its expected future cash flows and then discounting those cash flows back to today's value. For UPM-Kymmene Oyj, this involves projecting how much free cash the company will generate over the next several years based on current performance and expected growth patterns. These values are then reduced to reflect present-day terms.

Currently, UPM-Kymmene Oyj reports a Free Cash Flow (FCF) of approximately €442.4 million. Analysts project that FCF could reach up to €1.55 billion by 2029 as demand and efficiency improve. Over a 10-year view, projections (including analyst estimates and further extrapolations) show steady increases, with FCF expected to rise beyond €1.8 billion by 2035. All cash flows here are measured in euros (€), which is both the reporting and share listing currency for the company.

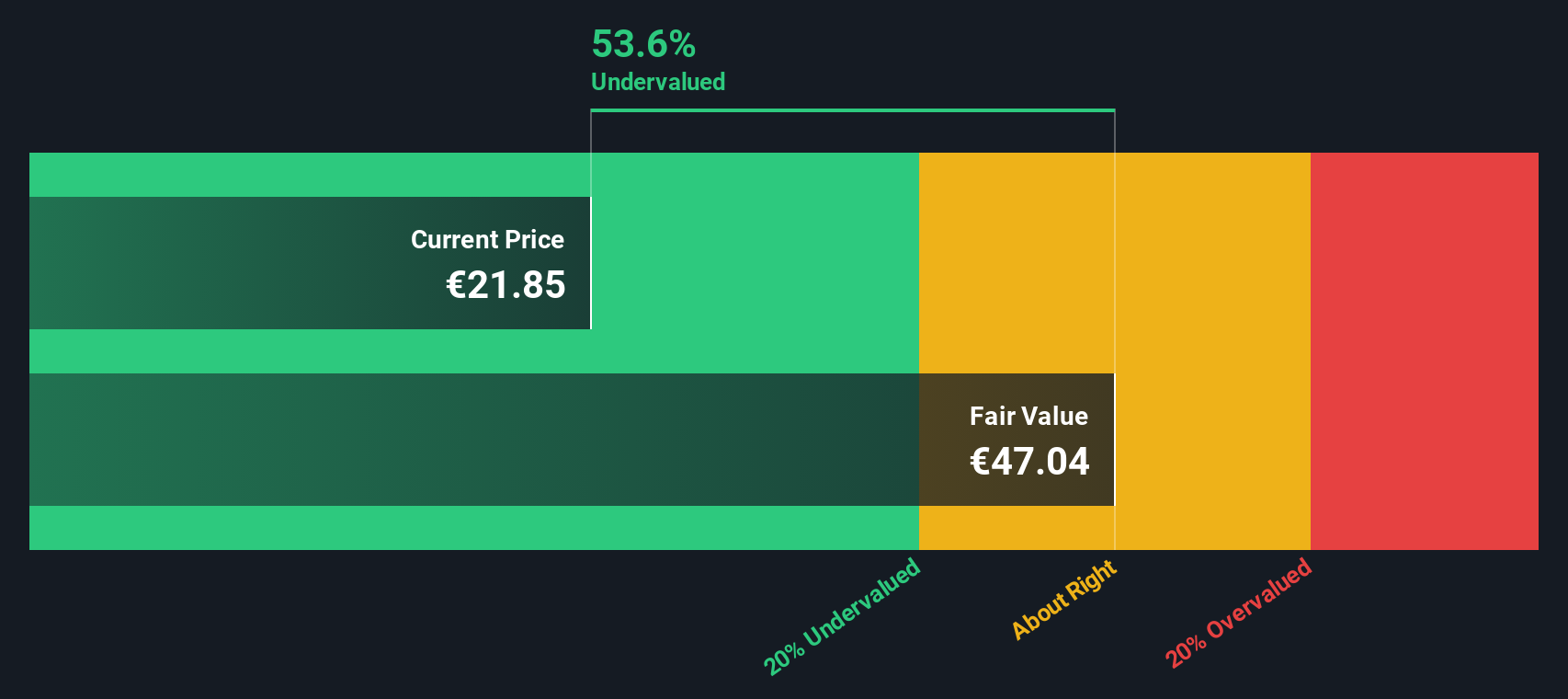

Based on the DCF model, the estimated intrinsic value per share is €47.81. This suggests the stock currently trades at a significant 50.6% discount to its fair value. This implies it may be considerably undervalued by the market at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UPM-Kymmene Oyj is undervalued by 50.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: UPM-Kymmene Oyj Price vs Earnings

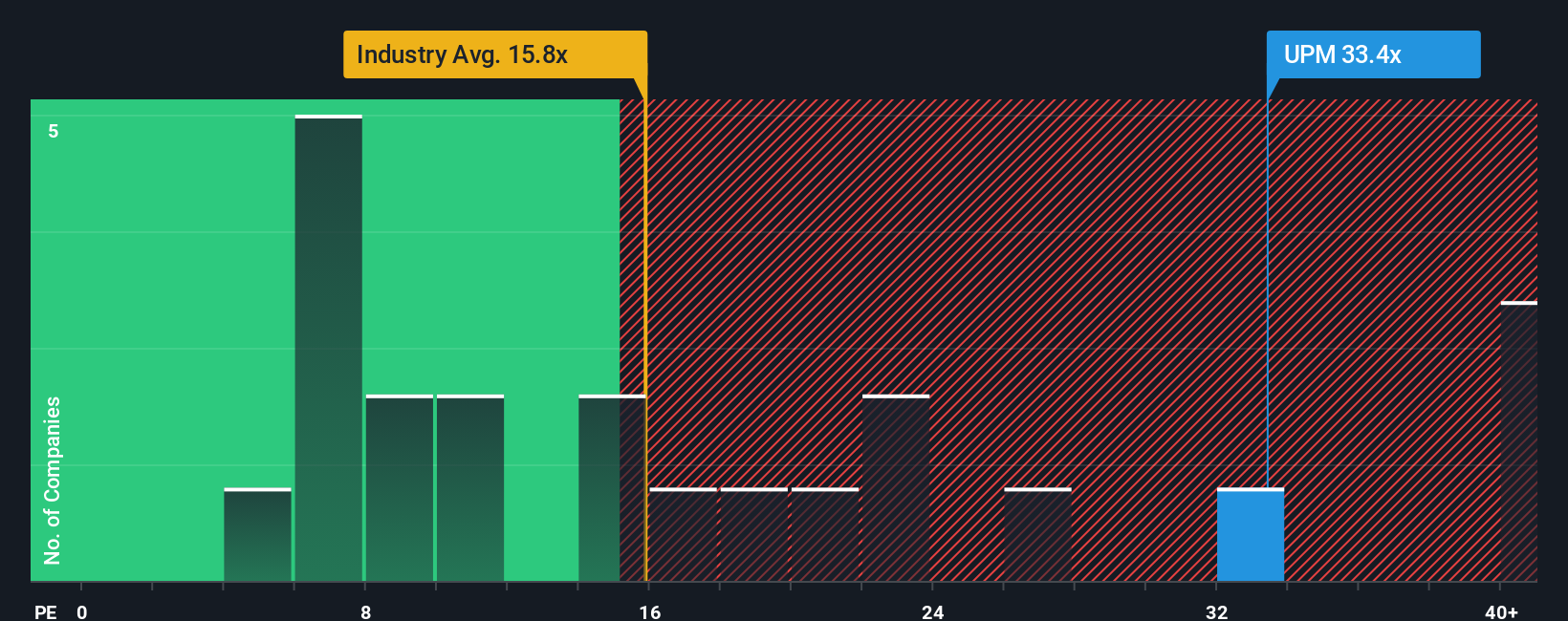

For profitable companies like UPM-Kymmene Oyj, the Price-to-Earnings (PE) ratio is a time-tested metric for assessing valuation. This ratio essentially expresses how much investors are willing to pay for each euro of current earnings. In general, faster-growing, lower-risk, or higher-quality businesses deserve a higher PE ratio, while more cyclical or risky firms tend to trade at lower multiples.

At the moment, UPM-Kymmene’s PE ratio stands at 36.1x, which is noticeably higher than both the industry average of 18.4x and the average for comparable peers at 16.1x. This premium suggests that investors expect better future earnings growth or perceive the business as being higher quality or more resilient than others in the forestry sector.

However, relying exclusively on peer and industry averages can be misleading since these metrics do not consider company-specific factors such as its unique growth trajectory, profit margins, scale, or risk profile. That is where Simply Wall St’s “Fair Ratio” comes in. It blends these elements to determine a valuation multiple that is genuinely tailored to UPM-Kymmene’s circumstances. For this company, the Fair Ratio is estimated at 37.2x.

Because UPM-Kymmene’s current PE ratio (36.1x) aligns closely with the Fair Ratio (37.2x), the stock appears to be valued about right given its growth outlook and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UPM-Kymmene Oyj Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are a more powerful tool for making investment decisions because they allow you to capture your perspective of UPM-Kymmene Oyj as a story behind the numbers, connecting your assumptions for future revenue, earnings, and margins to a specific fair value for the stock.

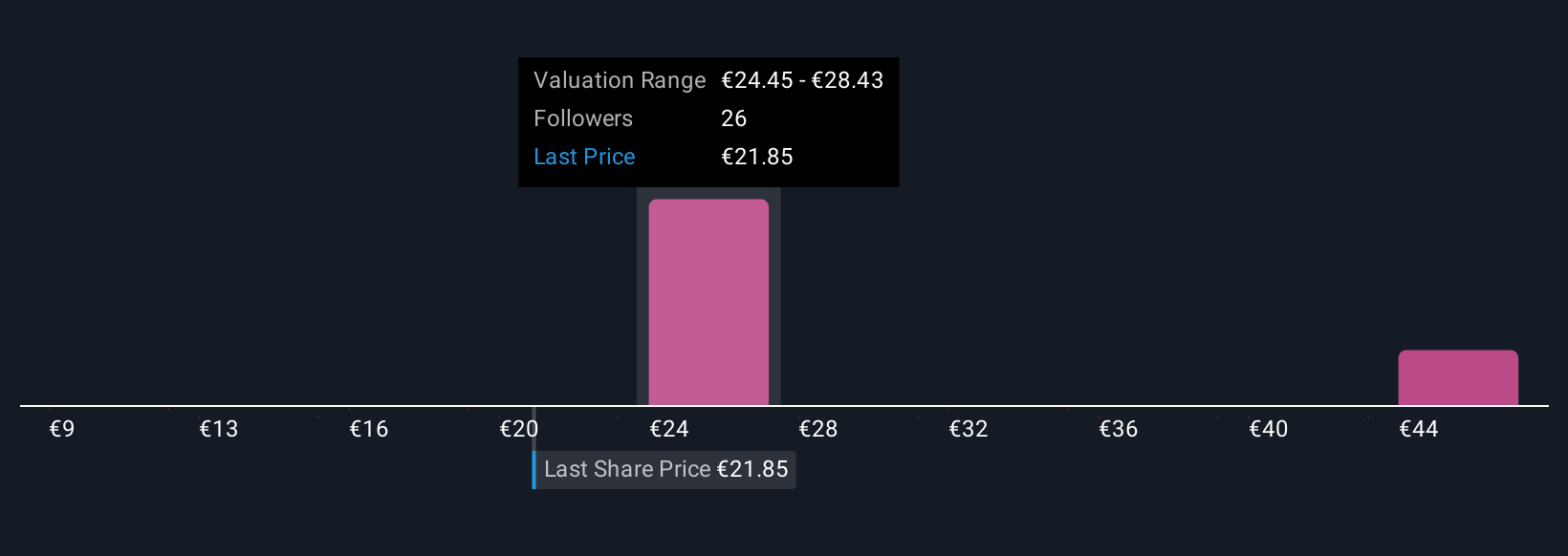

With Narratives, you are not just plugging in data; you are expressing your view about UPM-Kymmene’s business outlook, linking what is happening in the real world to your financial forecasts and, ultimately, to a clear estimated fair value. This approach makes it easy to see if the current price is attractive for your particular view, supporting smarter buy or sell decisions. Narratives are available right now to millions of investors on Simply Wall St’s Community page, and they are automatically refreshed as new financial results, news, or major events arise. For example, one investor’s Narrative could value UPM-Kymmene Oyj as high as €32.0, reflecting confidence in biofuel growth and margin expansion. Another may set it as low as €21.0 in light of industry risks and input costs.

Do you think there's more to the story for UPM-Kymmene Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives