Kemira (HLSE:KEMIRA) Earnings Jump 25%, Margin Expansion Reinforces Bullish Narrative

Reviewed by Simply Wall St

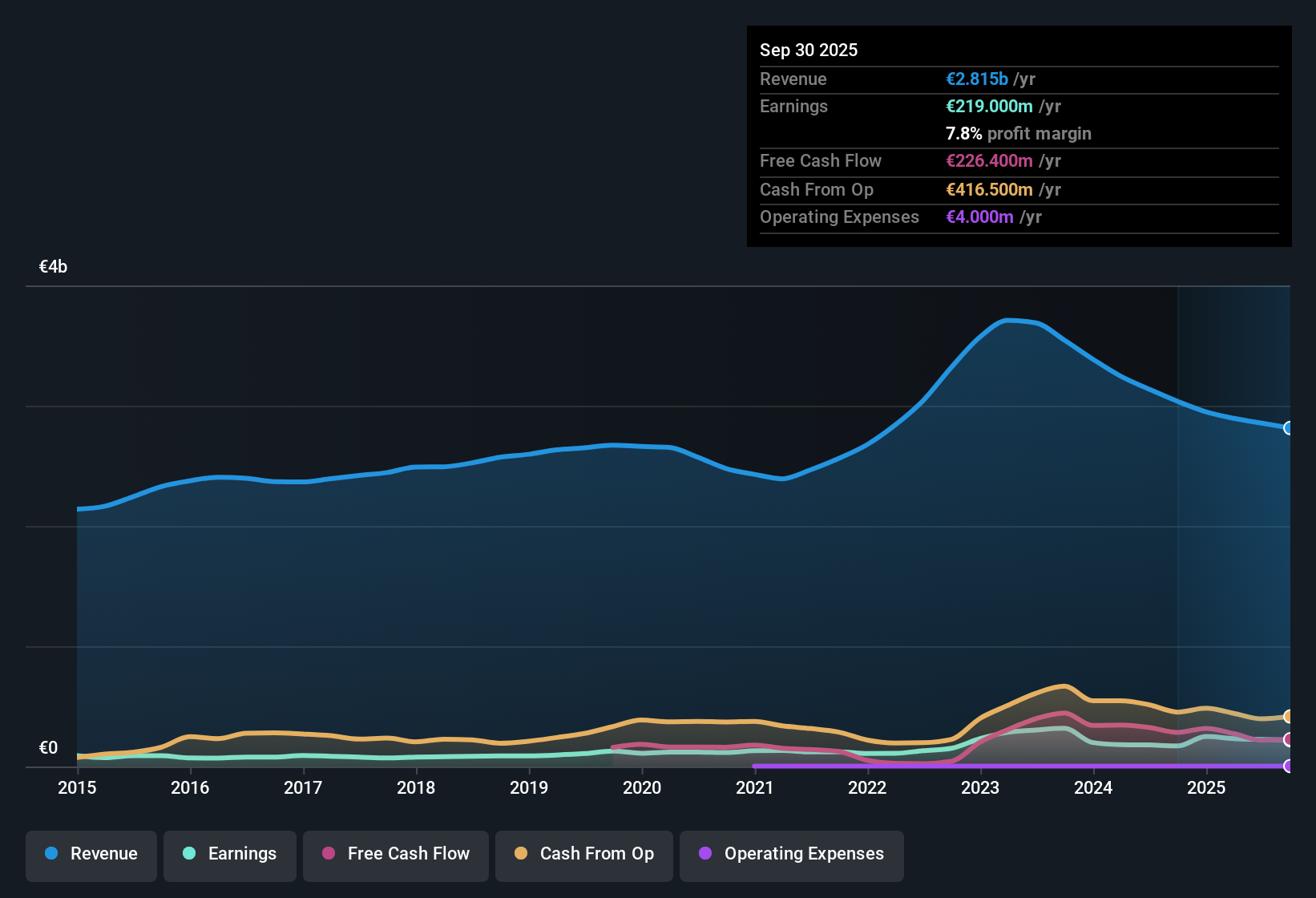

Kemira Oyj (HLSE:KEMIRA) reported a robust 25.2% increase in earnings over the past year, topping its five-year average annual growth of 15.5%. Net profit margins expanded to 7.9% from 5.7%, and the company is maintaining high quality earnings with no significant risks called out by the latest data. Investors are watching as Kemira’s steady margin improvement and attractive valuation could drive sentiment, even as future earnings and revenue growth are forecast to trail wider market averages.

See our full analysis for Kemira Oyj.Now, we will see how these headline results measure up against the market's consensus narrative and what that could mean for investors moving forward.

See what the community is saying about Kemira Oyj

Margin Expansion Outpaces Industry Recovery

- Profit margins reached 7.9%, with forecasts pointing to an increase up to 8.8% in three years, outshining typical recovery rates in mature chemical segments.

- Analysts' consensus view finds ongoing profitability initiatives and cost base reductions are expected to bolster net margin improvement. This is especially notable as Kemira's APAC operations move out of a weak patch and strategic partnerships in water solutions and bio-based materials start to pay off.

- Margin resilience is attributed to active digitalization and capacity expansions targeting regulated, growth regions.

- The consensus narrative contrasts this strength with difficult end-markets and potential headwinds in cash flow if revenue softness continues.

Curious if the margin story can keep getting better? Dig into the full consensus case for Kemira Oyj for all sides of the long-term view. 📊 Read the full Kemira Oyj Consensus Narrative.

DCF Fair Value Sits Far Above Market Price

- Kemira shares trade at €20.44, a substantial 45% discount compared to the DCF fair value of €37.01, and also lower than the analyst price target of €23.16.

- According to the analysts' consensus view, this valuation gap reflects the market's caution over slower forecasted growth rates. Earnings are projected to rise 3.6% annually, which trails broader market averages.

- Valuation multiples like the 13.8x PE further highlight the discount against European peer averages of 17.2x and 19.1x.

- Consensus narrative notes that this creates an attractive entry for investors comfortable with cyclical sectors and focused on steady, not rapid, compounding of earnings.

Revenue Growth and Regulatory Tailwinds

- Revenue is forecast to grow at 2.1% per year, largely driven by demand from water treatment and bio-based packaging, both benefiting from tightening global regulations.

- The analysts' consensus view points out that while regulatory and ESG momentum create tailwinds, especially with R&D partnerships and capacity expansions, mature end markets and greater competition in green water solutions could constrain Kemira's long-term market relevance.

- Strategic investments in North America and emerging regions aim to reinforce this structural revenue floor.

- However, consensus also warns that persistent weak spots, like pulp and Packaging & Hygiene Solutions, pose ongoing revenue and margin risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kemira Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something new in the figures? Take just a few minutes to shape your insights into a personal narrative. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Kemira Oyj.

See What Else Is Out There

Kemira’s long-term growth is constrained by slower revenue expansion, tougher competition in green water solutions, and risks from soft end-markets.

If you want steadier results, try stable growth stocks screener (2099 results) to find companies consistently growing revenue and earnings, even when sector volatility threatens performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kemira Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KEMIRA

Kemira Oyj

Operates as a chemicals company in Finland, rest of Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)